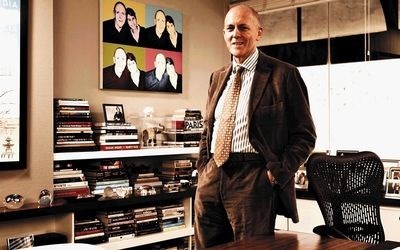

Former MD of retail at Woolworths Andrew Jennings, has been tipped as a possible contender to head the new Edcon board, which will have the near-impossible task of growing profit in one of the most hostile trading environments in the group's 86-year history.

Jennings, who left Woolworths in 2006, worked as a special adviser to Australian-based retailer Myer, whose former CEO, Bernie Brookes, was appointed head of Edcon a year ago.

Asked for comment, Brookes said consultancy Spencer Stuart had been engaged to conduct a search and was gathering names.

The appointment of Jennings or someone with experience of nonfood retailing, will be critical to overcome concern that a committee of bondholders is set to oversee Edcon.

"Corporate bondholders know nothing about running a clothing retailer. If they try they will fail just like Bain [Edcon’s previous owner] has failed; Edcon will not survive another failure," said an industry insider who did not want to be named.

A low-to-no-growth environment and rising bad debt combined with a regulatory clampdown on unsecured lending and tough competition are just some of the challenges facing the country’s largest non-food retailer.

Adding a few of its own problems is a relatively new management team and the prospect of a committee of bankers driving the process.

The debt-to-equity restructuring, which has been in the planning phase for the past three months, was inevitable, according to most analysts.

Jean Pierre Verster said each set of quarterly results highlighted the steady deterioration in the group’s performance. "The jury is still out on whether Edcon will trade out of its problems, it’s a big uncertainty."

Sasfin analyst Alec Abraham said the capital restructuring would be a big help, but the crucial issue was whether management would be able to address the fundamental problems and trade better.

Given that many of the group’s fundamental problems were self-imposed — including abandoning many of its core products, buying in inappropriately expensive brands and selling its debtors’ book to Absa — few commentators were concerned about the clean-out of top management.

Brookes said the retailer now intended offloading some of its international brands and focusing on home-grown brands such as Kelso and Stone Harbour.

Escaping from the clampdown on lending imposed by Absa will be more challenging. The 2012 sale of the R10bn debtors’ book was intended to ease the group’s debt burden, but the tougher lending criteria imposed by Absa created a different set of bigger problems.

"Edcon needs to get the credit lever back under its control," Verster said. "But these are tough times."

The Absa transaction was reminiscent of a much-regretted decision taken by Edgars in the early 1990s to sell its book to Nedbank. That deal was unwound after a few years.

While there is much scepticism, there is cause for some optimism.

"If they can correct themselves and focus on the right things, they could take advantage of the current weaknesses at Mr Price and Foschini …. They still have 3-million to 4-million core credit card holders," the industry insider said.