#EntrepreneurMonth: No hidden agenda with Naked Insurance

We chat to Sumarie Greybe, one of the co-founders of Naked Insurance, who was the overall winner at the 2019 MTN Business App of the Year...

Can you tell us a bit about Naked Insurance?

Naked insurance is the new way to insure your stuff. We offer a fully digital, artificial intelligence (AI)-driven car insurance platform that gives customers a faster, fairer and more flexible insurance experience. We called the business Naked Insurance because we want to bring new levels of transparency to insurance – no hidden fees, no hidden agendas.

Unlike conventional insurers, Naked takes a fixed portion of premiums to run the business, with the balance going into a pool to cover claims. At the end of each year, money left over in the claims pool goes to charities nominated by customers rather than towards company profits, meaning our income doesn’t depend on whether claims are paid or not.

When, how and why did you get started?

Naked was founded by three experienced actuaries: Alex Thomson, Ernest North and I. We all worked for leading insurance companies in South Africa before breaking away to start Naked. As consulting actuaries, we saw first-hand how existing insurers are struggling to meet the needs of the modern digital consumer.

In addition to the high costs of straddling traditional and digital channels, the industry has an inconsistent (at best) reputation for fairness and transparency. To fix these problems we needed to do two things: build processes and systems from scratch, using a modern technology stack with digital at its core, and change how we make money to make it fairer and more transparent.

In 2016 we raised seed funding to start building Naked and officially launched to the public in April 2018.

What is the core function of Naked Insurance?

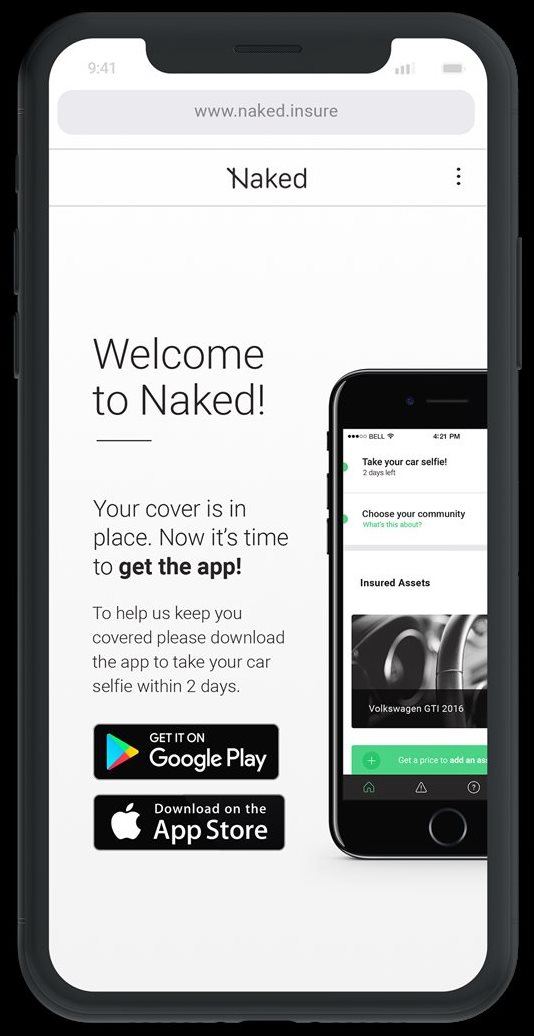

Our goal is to change insurance for the better by providing instant, honest insurance at game-changing prices. From quoting to claiming to generating a proof of insurance letter, the Naked insurance app empowers consumers to control their car insurance policy without needing to speak to a contact centre agent.

Users can get a final quote in 90 seconds and sign up for cover in less than three minutes on the app, guided by the friendly chatbot, Rose. With the CoverPause feature, customers can pause their accident cover with one tap if the car won’t be used for a day or more – instantly reducing the premium for that time.

When something bad happens, Naked customers can also claim on the app. The AI system approves some claims within seconds. If a customer is stuck at the side of the road or needs a tow, they simply click on the emergency assist icon to be connected directly to the Naked Assist line.

What are some of the obstacles you've had to overcome since starting out?

Some of the obstacles included:

- Persuading a cynical market (who are used to extreme volumes of advertising from old-school insurance companies) that we are truly different. Consumers have low trust in the insurance industry, particularly when it comes to transparency and fairness, and we’ve found that happy customers spreading the word is the best way to cut through the normal advertising which old school insurers do.

- Also, people are used to the ‘old’ way of doing things – it takes time to get them used to a truly digital-only process.

- Another challenge is breaking the perceptions that people have about the need for insurance – as many of 70% of cars on the road remain uninsured. We are trying to increase penetration of insurance across socio-economic classes by making our product affordable to the entry-level market (especially through our automated processes) and through Naked’s reputation of settling claims without hassle.

What advice would you give to other aspiring entrepreneurs?

Always start with a big problem that you have. Other people probably also have the same problem and would also like a solution to it. If you come up with a solution you know actually works, it will give you the conviction to keep going despite the difficulties and rejection you will experience along the way.

Just as important as your idea is the people you choose to be your fellow partners or early employees. Make sure you invest enough time and energy into this part of your journey. Many startups fail due to a break-down of founder relationships. You want to spend all your energy on building the business and making it successful, not managing conflict.

What has been your proudest achievement thus far?

A definite high point was when we launched Naked to the public in April 2018.

I am also incredibly proud of the Naked team for exceeding our growth targets and expectations, while delivering a great customer experience. What we are most proud of is that over 80% of our customers refer at least one other person to Naked based on the online self-service experience, convenience and prices we offer. It shows that customers are embracing what we do, that we are doing enough things right for them to refer friends and family to us, and we that have achieved a product-market fit with a sustainable business model.

I was also humbled when we recently won the 2019 MTN Business App of the Year Award.

What does the future of entrepreneurship look like to you?

Africa’s existing employment landscape will not be able to provide jobs for everyone that needs it. In my view, entrepreneurship is the best solution to this problem and we can already see that Africa is rising to the challenge. A recent study by the African Development Bank showed that 22% of Africa’s working population are starting new businesses, which is the highest percentage in the world.

What do you think is the importance of startup accelerator/incubator programmes?

One of the biggest advantages is that they give young entrepreneurs access to experienced mentors that can guide them, improving chances of success. It also allows these young entrepreneurs to focus on the product and not the admin around it e.g. accounting, office space etc. because such programmes will help out with the day-to-day stuff. They also help entrepreneurs meet other entrepreneurs to start building that all-important network that will help and support them in the future.

What would you like to see changed in the South African startup landscape?

More access to early-stage seed funding and a bigger startup “community”. We have seen an increase in both seed funding as well as things like co-working spaces where you can mix with and learn from other startups, but there is much more support needed for early-stage startups.

What do you believe are the traits an entrepreneur needs in order to succeed?

Self-confidence because self-doubt is often the biggest stumbling block we must overcome.

A great piece of advice I once received was to never disappoint yourself. If you say you are going to do something, always make sure that you do it. The more you do this, the more your confidence and belief in yourself and your abilities grow, and the more things you will be willing to tackle and succeed at.

Why would you encourage someone to become an entrepreneur?

If you are the kind of person who has a strong need to succeed and control your own destiny being an entrepreneur might just be the right option for you.

Where would you like to see Naked Insurance in the next five years?

This is just the start for us. We’re not only growing our car insurance business at a rapid pace but will soon launch exciting new products in other categories of the short-term insurance market.

Into the future, we hope to continue leading the charge in this new category of insurance.