Top stories

Energy & MiningGlencore's Astron Energy gears up with new tanker amidst Sars dispute

Wendell Roelf 16 hours

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

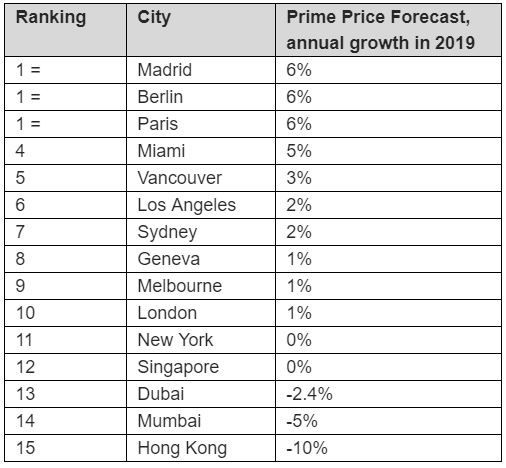

The proliferation of property market regulations, the rising cost of finance, uncertainty surrounding Brexit and, in some markets, a high volume of new prime supply, is weighing on prime prices. However, key European cities are bucking the trend for lower growth, and are leading the rankings with prices expected to rise by 6% in Madrid, Berlin and Paris over the year.

Kate Everett-Allen, partner, international residential research at Knight Frank commented, “Of the 15 cities monitored, the key European cities of Madrid, Berlin and Paris, lead our forecast for 2019 with growth of 6%. Still positive, but marginally down on 2018, the normalisation of monetary policy, weaker economic growth and a fragile political landscape post-Brexit will influence demand, but the relative value of these cities remains a key driver.”

Taking account of the latest economic indicators, supply, demand and sales trends, Knight Frank predicts price performance in 15 cities worldwide:

A number of key events in 2019 are likely to impact prime residential markets: