Oakbay "sets the record straight"

It's been a tough week for Oakbay Investments. CEO, Nazeem Howa quit, the finance minister virtually thumbed his nose at the company's suggestion that he withdraw his court application for an investigation into financial transactions valued at R6,8bn. Now they have to fend off media speculation that a pre-payment from Eskom was siphoned off to pay for the Optimum Coal Holdings (OCH) acquisitions from Glencore.

The activity forms part of the application made by finance minister, Pravin Gordhan, and is based on a letter by the business rescue practitioners for Optimum Coal Mine (OCM) reporting the transaction to the South African Reserve Bank.

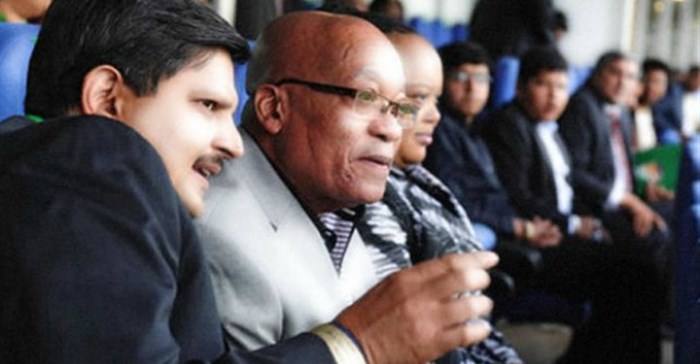

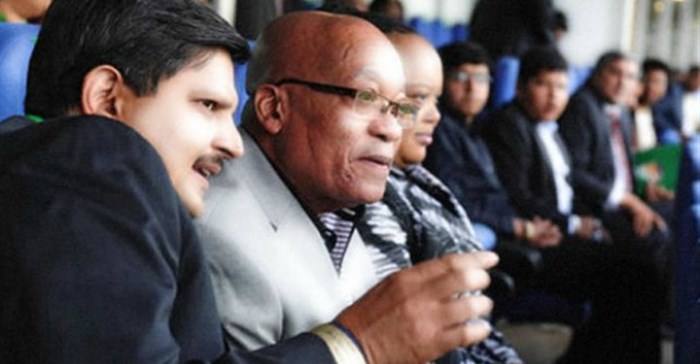

Source: The Presidency/ENCA

Oakbay says: “This is yet another inherently flawed attempt by media to create a sensational story out of nothing.”

A statement issued by the company reads:

- The contents of the queries are wrong and factually incorrect.

- The vehicle that acquired the shares of the seven target companies that previously belonged to OCH was Tegeta Exploration & Resources.

- Tegeta is not – and has never been – in business rescue. As such, the structure of Tegeta’s consideration for the target companies, was no twithin the remit/scope of the business rescue practitioners in any shape or form.

- Tegeta received the pre-payment not Optimum.

- Tegeta had been supplying coal to Eskom since January 2016 on a short-term supply basis, and receiving payments for that supply. By definition, the pre-payment received by Tegeta in April 2016 from Eskom was for continuing supply, In other words, the pre-payment was perfectly legitimate and Tegeta was entitled to do with the proceeds as it saw fit.

- The pre-payment was agreed against onerous provisions including: a 3,5% discount in favour of Eskom, securities in place, due delivery of the required coal and strict quality compliance criteria.

- Tegeta could have obtained finance from any other source or business venture or bank, we utilised the money as we deemed appropriate. This is not in any way, inappropriate.

- There was no need to inform business rescue practitioners as our negotiations with Eskom has no bearing or relevance to them. The coal being supplied by Tegeta was being purchased from Optimum and for which we had separate agreements from time to time and business rescue practitioners, who were in control of the business, were fully aware of this. We took the necessary steps to ensure increase in coal supply and even delivered prior to the deadline date.

- Tegeta completed the acquisition of Optimum in April 2016 with the full approval of the business rescue practitioners and other regulators. Optimum was also released from its ‘business rescue’ status on 30 August 2016.

- Tegeta has not received any notification from any regulatory body that anything untoward has taken place, in respect of the above.

Earlier this year, some of the country’s biggest financial institutions terminated their relationship with Oakbay. The company is owned by the now-notorious Gupta family, against whom there has been numerous allegations of state capture and corruption related to their close relationship with President Jacob Zuma.