Top stories

More news

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

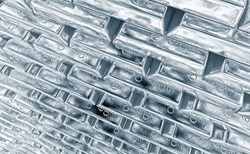

Matching Russia's 800‚000-ounce-a-year platinum production would require about a $5.3bn investment‚ according to a report released by the Chamber of Mines of Zimbabwe on Monday, 21 October 2013.

Zimbabwe's miners - which include JSE-listed Anglo American Platinum‚ Impala Platinum and Aquarius Platinum - are forecast to produce a combined 365‚000oz of platinum this year.

Mining policy experts told Business Day on Monday that Zimbabwe's investment climate would be determined by the final mines and minerals development policy the government is working on. They said the restoration of certainty to the mining policy framework would pave the way for investment inflows into industries such as platinum mining.

"We need policy certainty. It improves foreign direct investment and as long as we have a policy that's not going to change tomorrow‚ investors will come and the mining sector and industries such as platinum extraction can grow‚" said Harare-based mining policy expert Ted Muzoroza.

The investment climate for mining industries in Zimbabwe has been regarded as hostile.

Under the contentious indigenisation policy‚ Amplats‚ Impala and Aquarius Platinum have been forced to vendor finance the acquisition of the shares in local projects by black groups.

The Chamber of Mines said in its report on platinum mining that the industry had vast potential for growth through ramping up production. "This growth projection‚ however‚ requires significant investment‚" it said.

The chamber has projected that from about 2017‚ "Zimbabwe's production of platinum will be approaching that of Russia".

New mines to be operated by Ruschrome Mining and Amari Resources are expected to increase Zimbabwe's production capacity. These would be in addition to South Africa-run platinum mines such as Zimplats‚ Unki and Mimosa mines.

Although industry insiders say companies have generally frozen expansion projects‚ there are indications from mining executives that further investment and a more certain environment could motivate investors to dig deeper into their pockets to fund new operations and to expand existing ones.

"We are hopeful that the days of uncertainty are behind us and that policies that guarantee returns will be put in place by the new government"‚ said a Zimbabwean mining executive.

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za