Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

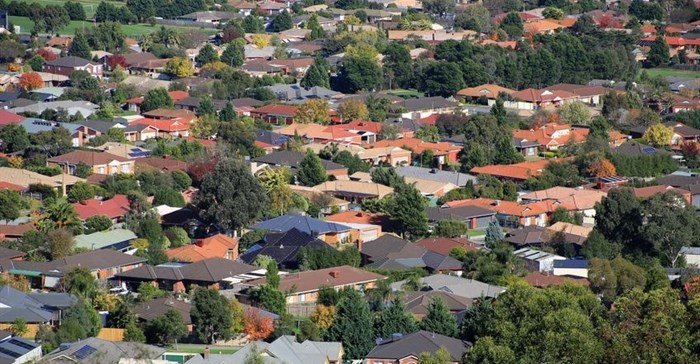

Data provided by Statistics South Africa from the 2010 census indicates that around 15% of South African families (almost two million families) don't qualify for government-provided housing, but also don't earn enough to be able to buy a house in the affordable housing market. When poor credit records and over indebtedness are taken into account, the proportion of households unable to pursue home ownership is substantially higher.

Basil Manuel, the president of the National Professional Teachers' Organisation of South Africa (Naptosa), recently summarised this conundrum when he told the media that teachers in the R10,000 to R20,000 income bracket earn too much to apply for housing subsidies, but too little to afford a bond on a house.

Where people in this income bracket receive housing allowances, they are often not designated for housing, but are simply provided as an extension of salaries and as a result are redirected by the beneficiaries into paying off other debt or day-to-day expenses.

Over the past 20 years, government has remained dedicated to its housing projects and has delivered 3.5 million homes. However, around 50% of those houses haven't been transferred into their owners' names because of bureaucratic inefficiency, and when these unregistered houses are sold on, these transactions are informal and do not register a transfer of ownership.

In the same 20 years, another 1.5 to 2 million houses have been built by individuals in rural and semi-rural areas. In most cases, these dwellings don't have registered title deeds and were built without access to financial support.

This shows that the emerging middle class has a significant propensity and appetite to invest in their own homes. However, evidence shows that these households generally have limited access to housing expertise, experience and housing finance supporting the acquisition of houses.

Employers in industries such as mining, agriculture and forestry have traditionally been involved with their employees' housing as a result of their often remote operating locations. Housing solutions have included providing basic houses and hostels which were of inferior quality and which bred a multitude of social challenges. These companies are now under pressure to provide better housing projects for their employees.

Research by Finmark Trust into the township residential property market in 2003 showed that houses in this market are viewed more as social assets than as economic assets. This means that when someone buys a new home, they often don't sell their old township home, but rather pass it on to another family member.

People's ability to access home loans and acquire a home of their own is also often hampered by a lack of affordability, over indebtedness, bad credit records, over expenditure and a lack of creditworthiness.

The burden of overcoming the challenges facing South Africa's low and middle-income housing market cannot be left solely on the shoulders of government, and the private sector has significant potential to assist in tackling the task.

Corporate institutions need the assistance of specialised companies to ensure their housing projects are successful. Many companies' projects fail because they don't have the skills, time and resources to manage them properly, and their projects are often simply reduced to providing company housing or some form of financial support for housing.

Housing financial support can be an extension of an employee's salary, get paid directly into a loan, form a grant or lump sum to pay off capital amounts to purchase or build a house, or reduced rental rates for employees in company-owned housing. The failing of all these mechanisms is that the employees are given financial input or respite without being given support and guidance on how to use it to the best advantage for their families' long-term financial and social well-being.

This shows that financial support alone is not enough. Lower to middle-income employees also need access to expertise and support to enable them to transact in this market on a price competitive and risk managed basis.

Private sector partnerships can invest in ensuring that employees are informed and enabled to take the lead in meeting their housing priorities. This has the benefit of moving employees from passive recipients of employers' generic housing solutions to empowering them to pursue their own pathway to home ownership and strengthen their expertise, ownership and accountability for the outcome and the responsibilities of home ownership.

Owning a home has a fundamental impact on people's financial viability, which contributes positively to social development and stability. But equally, acquiring a home where the financial obligations are not sustainable and often results in foreclosure can destroy a person's financial viability.

A recent case study provided by PPC shows how the private sector is providing services to employers and individuals to reduce the housing burden on government and create lasting financially viable home ownership for employees.

PPC and the SAHC established the PPC Homeownership Support Programme on the premise that home ownership is an excellent lever for financial wellness. The project aims to give financing to employees while also addressing negative credit worthiness issues, levels of indebtedness and budget re-alignment so that they can access finance for housing and transact in the market.

The three-year programme is currently providing support to 246 employees and its key principles are that employees are responsible for their housing decisions and that their housing transactions should enhance and not undermine or threaten their financial sustainability.

With the strong appetite for home ownership amongst low to middle-income earners, and despite a history of government-supplied housing and bad debt, new support approaches by the private sector have the potential to help stabilise and mature what was previously a stunted and underperforming sector.