Top stories

More news

Marketing & Media

Warner Bros. was “nice to have” but not at any price, says Netflix

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

This is according to Andrew Flavell, wealth manager at AlphaWealth, who tracked the US dollar and the rand exchange rates since January 1997 when it was R4.39. The current exchange rate (at the time of writing) is R11.78 to the dollar which means the annual exchange rate depreciation has averaged 5.3% per year.

There are many aspects which influence the strength of the rand but the rand's depreciation has been consistent with two economic theories: the interest rate differential and the inflation rate differential.

Since 1997 South Africa's inflation has averaged 6%. US inflation has been 2.25% which makes the average differential over the period 3.78%. According to this theory, the rand should depreciate at 3.78% annually.

According to the interest rate differential, using the ten year bond yield, South Africa has on average been borrowing at 10.1% and the US has been borrowing at 4.05%, which means the rand should have depreciated around 6% to the US dollar each year. So the value of the rand should at R9.27 based on the inflation differential and at R13.74 according to the interest rate differential.

When we combine the two, the average differential of inflation and the interest rate, the average annual depreciation should be 4.9%. So the rand should currently be R11.50 but it is currently trading around R11.78 which is only a 2.4% discount.

Flavell suggests that this discount exists for five main reasons.

1. Capital flows: A big driver is when rates normalise in developed economies, the flow of capital from emerging markets is significant and money managers are able to achieve real returns in hard currency and not have to take on the liquidity and sovereign risk that comes with emerging markets.

Foreigners were buying South African bonds and equities since 2003. This peaked in 2011 and since then, foreigners have been net sellers of South African equities and bonds.

2. Market sentiment: Business confidence is low due to power, labour and policy uncertainty.

3. Poor fundamentals in the local economy: South Africa's GDP growth has lagged behind its peers. When real GDP growth is compared in key emerging markets such as Brazil, India, Mexico, Morocco, Thailand and Turkey, South Africa has come in well below par.

4. Low productivity: To remain globally competitive as a manufacturer, either the South African work force needs to become more efficient, or the currency needs to depreciate to compensate for the lack of productivity. In reviewing the productivity chart below, it is clear that we are going through a period of inefficiency and to combat this, the rand has depreciated. Ideally a country's output should be 50% or above.

South Africa is currently around 45% which indicates weakness in output production - this may be on account of slow growth, lower demand, higher wages, strikes, an inconsistent power supply and variable input costs for importers.

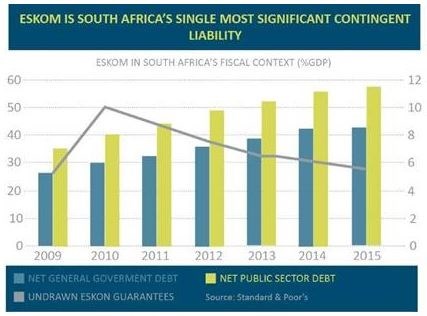

5. Credit outlook: In general, a credit rating is used by sovereign wealth funds, pension funds and other investors to gauge the credit worthiness of South Africa thus having a big impact on the country's borrowing costs. Standard & Poor's credit rating for South Africa stands at BBB. Moody's rating for South Africa's sovereign debt is Baa1. Fitch's credit rating for South Africa is BBB+. The ratings agencies have indicated that GDP growth is the main driver for a potential downgrade.

With an unreliable power supply, the imminent 'strike season' and widespread corruption, the GDP growth rate may continue to come under pressure. On the back of a repeat of low GDP figures and a contingent liability due to Eskom, another downgrade would see the rand once more sell off against hard currencies.

So what to do? Keep your rands in South Africa, or take them offshore?

In the light of SA's slow growth, 2.4% is not a bad discount, given the potential headwinds. So taking money offshore should be considered. Flavell advises taking money offshore as strategic geographic diversification, rather than allocating offshore as a rand trading position. After all South Africa makes up less than 3% of global capital markets and therefore other capital markets should be considered.

Whilst the rand is currently trading at 2.4% discount, factor in the five reasons for the decline of the currency. If you believe that these issues will be resolved or turned around, then it may not make sense for you to transfer your investments offshore.

If, on the other hand, you believe that capital flows are more likely to exit rather than enter the country, that market sentiment will remain depressed, that GDP growth is unlikely, that productivity will remain low - now would be a good time to discuss these issues with your wealth manager and to evaluate offshore investment opportunities.