Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

As IR grows in popularity, companies are coming under increasing pressure to demonstrate that they are attempting to prepare integrated reports which meet stakeholders’ expectations. To promote financial stability and sustainable development, IR cannot be treated as a compliance-driven exercise or a tool for managing impressions. There is a clear need for integrated reports to be subject to some form of external verification. This position is supported by some of the latest research which shows that an increase in the number of elements of an integrated report being subject to external assurance is associated with higher quality reporting. External assurance can be used to enhance the accuracy, completeness and reliability of integrated and sustainability reporting and promote better quality disclosure. For brevity, external assurance provided on different environmental, social and governance (ESG) information found in integrated reports is referred to as “ESG assurance”.

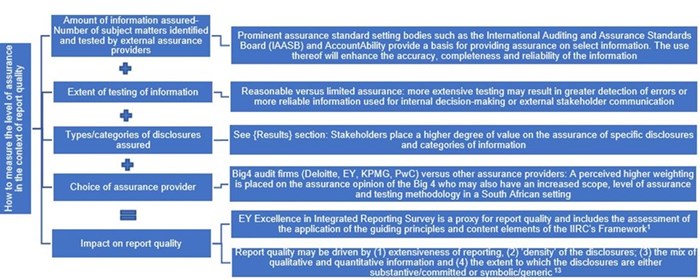

South Africa offers a unique and mature environment for studying ESG assurance. It has played a leading role in the development of codes on corporate governance and different types of non-financial reporting, including IR. A comprehensive scoring system for integrated reporting quality in South Africa is available. The scores/ratings are issued by Ernst & Young (EY) and are based specifically on the quality of reports. The EY scores provide a consistent and accurate measure of integrated report quality ranging from “top 10” to “progress to be made”. In contrast, there is no publicly available scoring system for the amount and quality of ESG assurance. The features which are used to gauge the levels and quality of ESG assurance in the academic research vary. Figure 1 summarises some commonly used ESG assurance indicators.

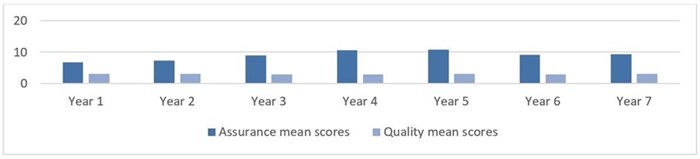

The number of companies making use of some form of ESG assurance increased from 38% to 54% over a seven-year period. Results of academic research in measuring assurance and quality mean scores of top listed JSE entities are presented below.

When assessing the inputs in Figure 1, the academic research finds that the use of an assurance provider enhances the stakeholder’s confidence in the quality of a report. Moreover, the use of a Big 4 firm is associated with an increase in both the ESG assurance and IR quality mean scores. Interestingly, the impact of reasonable versus limited assurance had a negligible effect on assurance and quality mean scores. This is likely due to the perspective of non-experts who may interpret these opinions in a similar manner.

The categories of information assured are also related to the overall quality of the report. Researchers have assessed the key disclosures assured and aggregated these into five simplified categories that account for the variance in assurance mean scores. These are:

1. General sustainability disclosures: This includes items such as water consumption, energy usage, health and safety statistics and compliance with internal sustainability policies.

2. Accountability principles (materiality, inclusivity, and responsiveness) and financial statistics not included in the financial statements.

3. Data, systems and processes: Materiality determination and stakeholder engagement.

4. Environmental impact and employee relations: This includes pollution statistics and the number of environmental incidents as well as the assurance of employee relations measures.

5. Employee development: This includes employee training and development, and statistics on anti-corruption measures, such as whistle-blowing, by employees.

Category 1 and the type of assurance provider report the strongest correlation with quality suggesting that higher-quality reporting is associated with having general sustainability disclosures assured by one of the Big 4.

External assurance can positively contribute to the quality of the integrated reporting environment. In South Africa, an increase in the number of ESG disclosures/elements being externally assured by the Big 4 is associated with higher quality reporting. This is the case when assurance is evaluated in total and when considering the number of subject matters tested to provide reasonable or limited assurance. Higher quality reporting is also associated with assurance of ESG disclosures, codes of best practice and the principles of materiality, inclusivity, and responsiveness.

The benefits of having parts of an IR externally assured are summarised in Figure 3.

Additional guidance should be provided on making an integrated or a sustainability report the subject matter of an assurance engagement in its entirety. The assurance of only some parts of these reports is already contributing positively to their quality. A broader approach to assurance which covers more categories of information, the controls used to safeguard the reliability of data and the methods used to compile a report will be of even greater value to stakeholders.

Article references can be obtained by request from az.ca.stiw@mice.nasuD.