Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

In April, a consortium — headed by Golding (formerly executive chairman of empowerment powerhouse Hosken Consolidated Investments) and Roberts — bought up empowerment group Brimstone’s influential shareholdings in Rextru and its pyramid holding firm, African & Overseas (Af&Over) Enterprises.

The deal triggered a mandatory offer to all Rextru and Af&Over shareholders. But a Sens statement showed only scant interest from both Rextru and Af&Over shareholders to sell their scrip to Golding and Roberts.

The consortium received acceptances from Rextru ordinary shareholders holding just 4,315 shares (0.148% of the issued shares) and 185,190 low voting N shares (1%).

A mere 23 Af&Over shares were offered to the consortium with 240,557 N shares being surrendered (representing almost 2.4% of this class of shares).

The disclosure confirms the Shub family, which has held artificial control at Rextru for generations via the N share and pyramid holding company structure, retains its influence despite holding a far smaller economic stake than the consortium of Golding and Roberts.

The consortium now holds a 31.2% economic stake in Rextru, and a 78% economic stake in Af&Over.

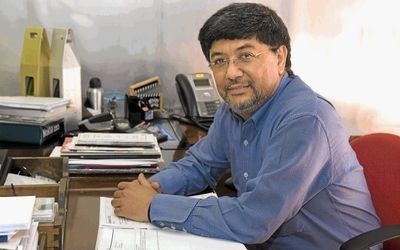

Golding said the consortium was never sure what might transpire in the mandatory offer.

Asked whether it was problematic holding such a large economic stake when power effectively rested in the hands of a minority shareholder, Golding said it was still early days and that the consortium would need to discuss the next stage of the investment plan.

"It was never hostile … we saw value in participating in the company."

Brimstone’s travails as a significant shareholder at Rextru have been well documented, including open confrontation at annual general meetings in recent years.

Brimstone believed that Rextru’s main assets — the Queenspark fashion chain and its properties in the increasingly hip Cape Town precinct of Salt River — held much potential.

But the empowerment company sold out after being consistently frustrated in its efforts to accelerate the unlocking of value from these assets.

Independent analyst Syd Vianello said the Golding-Roberts consortium found itself in the same situation as Brimstone.

"Possibly, they believe that somewhere down the line the control structure can be cracked?

"Or that the Shub family might sell out at some stage?"

But Vianello believed that the biggest opportunity for the consortium could come if Rextru ever ran out of money.

Any issue of new shares for cash could considerably strengthen the position of the biggest economic shareholder.

At this point, though, the conservatively managed Rextru has a stout balance sheet.

Vianello, however, believed Rextru could still prove a rewarding investment for the Golding-Roberts consortium if an international retailer was looking for a foothold in SA.

"Queenspark is just the right size to be sold to a foreign retailer looking for a presence locally.

"It is not about the profitability of Queenspark, but rather that the stores are in great locations in prime shopping malls."

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za