Data provider Wealth-X predicts that the world’s ‘ultra-wealthy’ individuals should increase by 40% by the year 2022, and notes that the super-wealthy are acquiring both secondary properties and passports. In fact, the world’s ultra-high-net-worth individuals spend over $2.4bn each year acquiring new citizenship.

“This puts Cape Town’s luxury residential market in a prime position within the investment landscape,” says Knight Frank South Africa managing director Susan Turner. She adds that the Western Cape has seen exceptional house price growth over the last five years, especially in the Atlantic Seaboard and City Bowl, where the limited space to build is driving prices. Adding to this demand is a trend of ‘semigration’ of property buyers from other provinces like Gauteng.

Appetite for international investment solid

The Wealth Report reveals that although clients had increased their exposure to equities over the past year, the second largest rise was in property, with private capital fuelling global property deals worth over $1bn (R11.75bn) in 2017. And the appetite for private investors to buy overseas remains solid, with one-third of respondents planning to invest outside their domestic market in 2018.

For international investors, the floor space in Cape Town is very attractive compared to other popular cities like New York, London, Sydney and Hong Kong. For example, the asking price for a 91m2, two-bedroom flat in London city is £4.1m, whereas £3.9m (R65m) in Cape Town would fetch a five-bedroomed homestead with two guest cottages, staff accommodation and stabling for five horses, totalling a whopping 18,926m2.

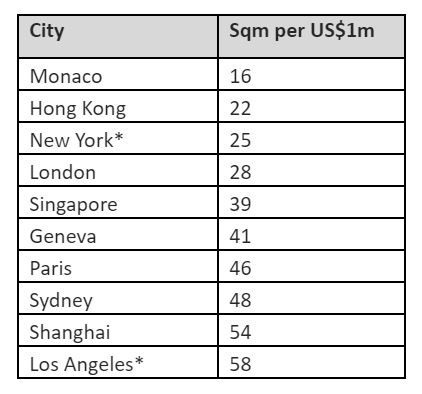

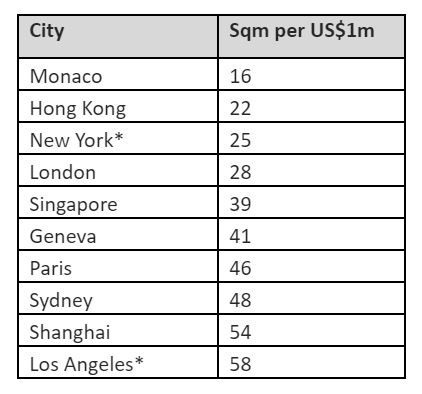

Knight Frank’s analysis of global property markets also explores how much $1m can buy in 20 key cities around the world (the table below highlights the top 10). Monaco is the most expensive city in which to buy luxury residential property, with $1m buying just 16m2 of accommodation.

The square metres of luxury property $1m will buy around the world:

Source: Knight Frank Research, Douglas Elliman, Ken Corporation

* New developments onlyAll data Q4 2017 based on exchange rate on 31 Dec 2017.