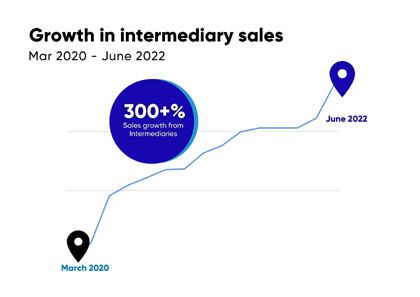

Disruptive digital life company Simply Financial Services has experienced sales growth of >300% p.a. in their intermediated sales channel since the beginning of Covid in 2020, highlighting the value of technology for brokers.

According to CEO and co-founder, Ant Miller, Covid has increased awareness of mortality and demand for life insurance products. It also highlighted the need for flexible, customisable products and multi-channel distribution.

"Covid accelerated digital, remote broker solutions by at least three years," said Miller. "It also accentuated the need for flexibility as individuals sought to cover relatives who were no longer earning and able to pay their own premiums. The death of one-size-fits-all products is now a case of when, rather than if."

He added, "We were fortunate to be in the right place at the right time. Our user-friendly online platform helped advisors sell policies and service their clients' needs seamlessly and in a simple and secure way. Our end-to-end sales and service functionality, which includes paperless Persal integration, enables our broker partners to focus on their advice and relationships while we take care of the back-end heavy lifting," he added.

Established in 2016, Simply initially launched an online, direct-to-consumer product, bundling funeral insurance, alongside life and disability, which was undersold in this market. "By 2019, we developed an online Advisor Platform selling similar products via intermediaries and Covid was a game changer," said Miller.

Since the humble beginnings of the Simply Advisor Portal in 2019, launched first with iMas (previously IEMAS) Insurance Brokers, Simply has onboarded over 1,000 advisors to the platform, predominantly in the mass market. Many advisors simply prefer the digital option because it makes their lives easier. Simply has seen 300+% growth in intermediary-sold monthly premium since May 2020. With an average premium of R403pm and an average of 2.3 benefits per policy (life, disability, funeral and extended family funeral), Simply is hitting the sweet spot for mass market intermediaries.

Through the use of technology, Simply has enabled brokers to sell to their clients while on the road, without going back to the office, filling out a whole lot of paperwork and coming back days or weeks later with even more paperwork. It's a win-win, where brokers get to focus on the customer relationship and do more business, and leave the tiresome admin to the technology that's built to make their lives easier. The customer doesn't have to wait long, or chase a paper trail, to get the insurance they want.

Simply offers three products - all of which are sold via intermediaries, and direct - the customer can choose how they would like to purchase:

- For Brokers www.simply.co.za/simply-brokers

- Simply Family Cover (for individuals and families)

- Simply Staff Cover (for employers and employees of small to medium-sized businesses)

- Simply Domestic Cover (for domestic employees)