Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

This study reflects many of the changes that will ultimately define this era. For the first time, the retailing of digital downloads and personal telecommunications devices by non-traditional retailers are included.

Technology companies such as Dell, Apple and its iTunes Store are represented, as are wireless communications providers and handset sellers AT&T and Verizon.

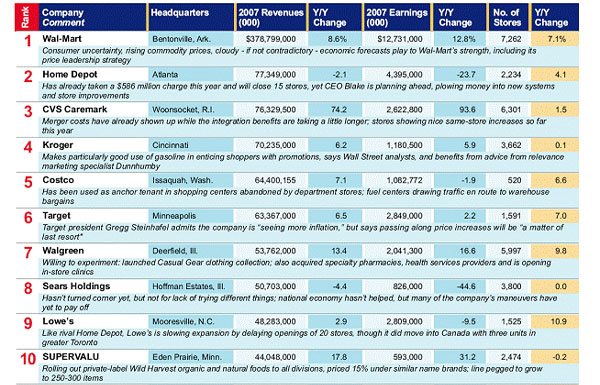

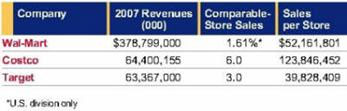

Wal-Mart remains the No. 1 retailer by sales — a position it isn't likely to lose soon, as it alone accounts for 22% of aggregate Top 100 sales. Change is afoot, however, as pharmacy chain CVS. has vaulted into the No. 3 spot as a result of its acquisition of Caremark.

This reflects the growth and evolution of the health and wellness industry as served by “drug”/pharmacy stores. Home Depot managed to hold on to the No. 2 spot despite the poor state of the US house market, while Kroger, the supermarket leader, slipped one place to No. 4.

Mass merchants are well represented in the Top 10, with warehouse club operator Costco Wholesale ranking fifth, Target sixth and Sears Holdings — parent of Sears, Kmart and several chains of hardware and home furnishings stores — in the eighth position.

No. 7 Walgreen has been overtaken as the volume leader among pharmacy chains, even, though it has been beefing up via acquisitions. Rounding out the Top 10 is SUPERVALU, which this year has its wholesale and distribution business included in total revenues.

Here follows a closer look at how the rankings panned out in the different retail categories:

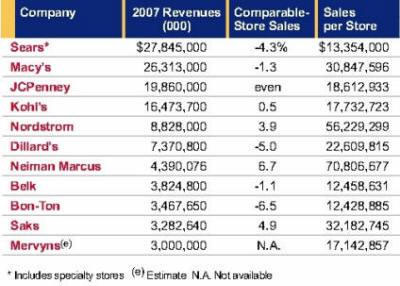

2008 has not been kind to apparel retailers, who had high hopes coming off a 2007 in which the different categories of clothing sales increased across the board. Total clothing sales rose 3% last year to just under $200 billion, led by children's clothing (up 6%) and menswear (4%). Dresses for women and girls and dress-up looks for men (suits, tailored clothing) were the big sellers.

Fashion retailers began marking down spring and summer items as early as March, and fall merchandise began showing up in stores prior to Memorial Day weekend.

This drop in consumer demand has been a boon for off-pricers like Ross Stores, which operates the Dress for Less chain. Middle-of-the-road retailers like Gap have found the going pretty rough. Gap sales fell 4.8% in the first quarter as same-store sales dropped 11% across Gap, Old Navy and Banana Republic units. .

Macy's has been relooking parts of its approach to homogenisation; JCPenney has been playing up its national identity, and; Sears Holdings has continued to struggle with finding a permanent cure for it's numerous merchandising and operational ailments

Macy's CEO Terry Lundgren, wants 15% of the product in each of the chain's stores to reflect local tastes. This, even as the company has instructed that each store should have a toy department operated by category specialist: F.A.O. Schwarz.

With $2 billion in cash and manageable debt, JC Penney is finally in good shape to weather any economic storms. According their CEO, Myron E Ullman, the department stores to worry about are the regional operators lacking a broad-based cost structure to ride out a downturn. Thirty years ago, there were 65 department store companies, he says. “Now, we have a couple of solid competitors that we respect.”

Sears continues to flounder amid quarterly losses, management changes and sagging sales. Investors are getting impatient. Dillard's is battling too, having admitted to entering some markets it shouldn't have and announcing plans to rein in costs. The company will continue closing stores; with six earmarked for this year.

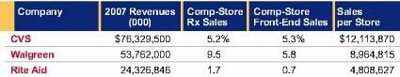

Cheap prescription drugs from the likes of Wal-Mart (which claims to have saved consumers more than $1 billion since rolling back medicine prices in September 2006), Target and major supermarket chains aren't worrying the large pharmacy chains. CVS, Walgreen and Rite Aid have ignored the bargain-basement approach to pharmacy pricing, absorbed the punch from the competition and moved on.

A snapshot of the industry shows that pharmacy stores accounted for 40.4% of the $260 billion in domestic prescription sales last year, with supermarkets ringing up 11% and mass merchants 9.9%. Mail order houses handled 20.5% of the script business; independent druggists, 18.2%.

This is a new category this year, replacing the more narrowly-focused booksellers category. Though it might, at first glance, appear to be a mixture of diverse specialty stores, there is more overlap and convergence than the companies' traditional realms would indicate.

This is best demonstrated by national bookseller Borders. Their current concept stores, bring together digital and Internet options with the hands-on approach to books, CDs and DVDs. Borders is opening 14 of these prototype stores this year, combining 170,000 book, music and movie titles on the shelves with digital centers where customers can download e-books, mix and match songs on CDs, and create electronic photo albums and family histories.

Apple's iTunes Store is now the largest seller of music, surpassing Wal-Mart, Amazon.com, Best Buy and Target. In May iTunes broke the news that it would sell movie downloads, beginning the same day the titles are released on DVD.

Blockbuster, once viewed as a dinosaur lumbering toward extinction, has reinvented itself to the point where rentals constitute only half its revenues. Blockbuster's Total Access program enables it to compete with Netflix and other electronic retailers, while video games constitute a growth area for store merchandise. With the release of the highly-anticipated “Grand Theft Auto IV” earlier this year, for example, Blockbuster enjoyed a 4.5% share of the sales, compared with the 1% to 1.5% share it usually captures in game sales.

Store preferences and loyalties are being severely tested this year as home improvement retailers battle through another depressed Summer within the housing market. Home Depot and Lowe's have commenced with retrenchments. Home Depot is closing 15 underperforming stores and reducing the number of new-store openings by more than half.

Lowe's has postponed openings for 20 stores — primarily in Florida and California, where housing woes are particularly acute.

Still, a couple of smaller chains are showing that the entire home improvement segment hasn't fallen into disrepair. Menards is a Top 100 retailer that is employing a novel strategy in its site selection process by buying plenty of land around new stores. The company then puts in utilities and engages local home builders to develop the real estate with the understanding that materials will be purchased from Menards.

For example in Yorkville, Illinois. Menards purchased enough real estate for more than 160 single-family homes and 69 townhouse condominiums. Once these units are occupied, Menards has a ready-made core group of consumers in the immediate vicinity.

Lumber Liquidators has carved out a specialty niche in this segment by selling flooring at deep discounts, whether it's 80c per square foot for down-scale laminate or 10 times as much for tropical hardwoods. The 130-store retailer, generated just over $400 million in sales last year and plans to open stores at a rate of 30 to 40 annually until it reaches a minimum of 300 locations and its goal of becoming a billion-dollar company.

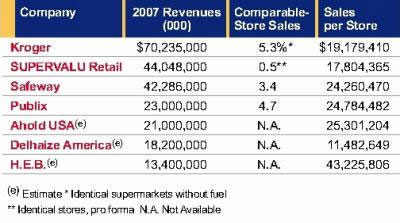

Among supermarkets, the “Big Thing” is all about getting small.

British supermarket chain Tesco, the world's third-largest retailer, took the USA by storm last year when it began opening 10,000-sq.-ft. Fresh & Easy convenience grocery stores in western cities like Los Angeles, San Diego and Las Vegas.

Filled with prepared foods and private-label products, these stores were widely seen as being the catalyst in transforming the US supermarket industry from big or medium-sized box operations to community food stores.

After an initial burst of energy, Tesco has slowed done its store opening programme. Wal-Mart has seized the opportunity to the launch its response in the form of Marketside, a community grocery store of about 15,000 sq. ft. These stores have kitchens and eat-in food counters. These stores will also debut in Western cities.

To date the only traditional supermarket players to open a smaller format store, has been the Safeway Group with its Market by Vons, a 15,000-sq.-ft. store in Long Beach, California.

Kroger already operates 780 convenience stores, under several banners, including Kwik Stop, Loaf & Jug and Tom Thumb Food Stores. Instead of entering the neighbourhood store battleground, the company appears to prefer concentrating resources on larger concepts like its Marketplace supercenter and more traditional Fresh Market stores.

SUPERVALU had opened a smaller-format store called Sunflower, but pulled the plug in the aftermath of its acquisition of a multitude of Albertsons locations.

McDonalds continues to have to rebut the ongoing activists and their allegations regarding the source and content its food. It is using TV, print advertising and its corporate website to respond to some of the more radical and fanciful allegations.

“We're engaging in a conversation with our guests because we feel it's important for them to know the truth about our food,” says Molly Starmann, head of domestic marketing for McDonald's.

Yum! Brands, operator of KFC, Pizza Hut and Taco Bell, is one to watch, particularly as it turns itself into an international juggernaut, with roughly half of its operations and profits coming from outside US in countries such as China, Thailand, France, South Africa and the UK.

All eyes seem focused on Starbucks to see if founder Howard Shultz can give the coffee giant a caffeinated jolt of renewed growth in espresso time; this after the company recently announced that is would be closing down 600 stores in the next year or so.

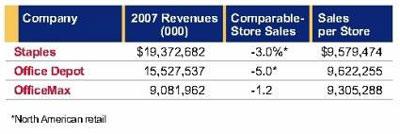

The category killers making up this retail segment, which includes the likes of: Office Depot, OfficeMax and Staples, only have approximately 10% of the office supply superstore share of market.

Contract specialists have a 21%, specialty stores 20% and mass merchants 18%. The Federal Trade Commission doesn't read the statistics this way, however, and has adamantly opposed any alliance, union, merger, marriage or other combination of domestic office superstore retailers - even though each of these companies' market share is in the low single digits: Staples (4%), Office Depot (3.4%), OfficeMax (2.3 %).

Nipping at their heels is FedExKinkos, which has the copying, printing and other services found at a typical office supply superstore.

As a result, all the companies have had to find unique solutions to achieve the size necessary to remain competitive in the US market. Staples and Office Depot have looked overseas for partners, while OfficeMax is still coming to terms with its acquisition by timber company Boise Cascade.

Staples already have extensive overseas operations. This includes a foothold in China (where it has partnered with UPS) and the 2007 opening of its first store in India. Last month, Staples announced it had reached an agreement to acquire Corporate Express, a Netherlands-based contract dealer in office supplies.

The four-month negotiation resulted a $2.7 billion deal that Staples executives hope will put further distance between the retailer and its rivals. Faced with sluggish sales in its North American division, Office Depot is entering India by partnering with Reliance Retail. The joint venture has acquired eOfficePlanet, which uses a direct sales force to peddle office products and services to businesses.

"The bigger they come, the harder they fall” is an axiom that has been ascribed to everything from trees to celebrities. Large-format value retailer power players are working hard to prevent it from being applied to them any time soon. In addition to keeping their finances in order, they all are polishing their altruistic credentials in order to show a beneficent side to the public, whether it is championing environmentalism, cutting prescription prices or espousing other forms of good corporate citizenship.

Dollar stores were all the rage just a few years ago, touted as the perfect weapon to counter the big-box mass merchants' march across the landscape. Things have changed. Today these small-format value retailers are struggling to get their share of the dollars consumers are trying to stretch in a tough economy.

Dollar General has scaled back expansion plans from recent historical levels. Its current CEO was appointed a year ago by its new owners private equity firm - Kohlberg Kravis Roberts & Co. Drug store and supermarket veteran Rick Dreiling was brought in to get costs under control.

He is doing so by weeding out underperforming stores and combing through the inventory to eliminate underproductive SKUs. He has also reshuffled his senior management team in order to get the right combination to implement his strategies.

Family Dollar, which reinvented itself a few years ago, has made a number of positive moves, pursuing an urban strategy that has largely kept many of its new store locations from bumping into the Wal-Mart juggernaut.

Inside the stores, Family Dollar has been using general merchandise — particularly home goods and apparel — to create a “treasure hunt” ambience while expanding supermarket merchandise to drive traffic. Larger grocery sections were installed in about 2,800 of the chain's 6,500 locations during the current fiscal year.

Amazon is the standard-bearer for retailers without stores, but there is nothing standard about what the Seattle-based company has accomplished as it has grown into a $15 billion entity while operating in the black. Amazon is more about the future than last year's results or this year's performance, and it has blazed the e-commerce trail with operations so sophisticated that some observers view it as a technology company that happens to sell goods. Its potential is seen as larger that its accomplishments.

It's so cocksure and confident that it lets other merchants piggyback on its capabilities through its web services operation. On its own, Amazon sells jewellery, watches, housewares, consumer electronics, home goods and all kinds of general merchandise, although books, music and movies account for half the revenues.

QVC and IACI/HSN have e-commerce operations, but their main selling vehicle remains television. But just as online retailing has made a dent in the sales of bricks-and-mortar merchants, so has it impacted TV-reliant home shopping retailers. A recent Nielsen survey indicated that, worldwide, 85% of people with Internet access have used the Net to make a purchase.

HSN.com has been transformed into a dynamic stand-alone storefront with more than 40,000 products. The site provides shoppers with a wide range of unique features, including When-To-Watch e-mail reminders, an interactive Program Guide and Weekly Product Reviews. At QVC.com, improvements included a wish list, the ability to print pre-paid return labels and improved auto-delivery management.