With South Africa’s economy remaining in turmoil, it is no surprise that businesses are under great pressure, with no thanks to the ongoing impact of load shedding and other factors.

Image source: Tim Mossholder from

PexelsThis pressure was evident by Stats SA’s released liquidation statistics for the first quarter of 2023 and has continued up until the end of October when 136 businesses closed their doors in that month alone. 120 closed down voluntarily with 16 being forced to shut their doors.

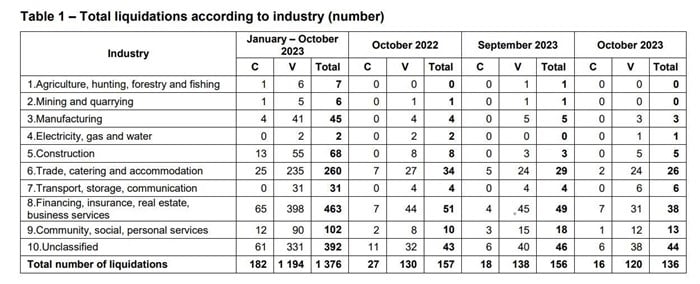

This means that so far this year, over 1376 business have closed down. The seemingly only positive, however, is that the total number of liquidations decreased by 13.0% in the first ten months of 2023 compared with the first ten months of 2022.

Industry breakdown

In October, ‘Unclassified Industry’ saw the most liquidations with 44 and ‘Finance, Insurance, Real Estate and Business Services’ followed with 38 liquidations. This means a total of 463 up until end October making ‘Finance, Insurance, Real Estate and Business Services’ holding the highest number of liquidations in any industry. ‘Trade, Catering and Accommodation’ followed with 26 liquidations in October and ‘Community, Social and Personal Services’ with 13.

Craig Blumenthal 26 May 2023 Impact of load shedding

Ongoing load shedding has meant a loss of revenue and a reduction in production for many businesses that, subsequently, are unable to continue, having used every possible resource to stay afloat. This is particularly troubling as there seems to be no end in sight to our electricity woes.

It is obvious that businesses already harshly affected will be greatly distressed by having no access to electricity for half a day each day, with stage 6 becoming a reality and stage 8 seemingly around the corner.

These and other factors make it clear that confidence amongst business leaders continues to wane due to the challenging economic environment, evidenced with the RMB/BER Business Confidence Index dropping by two points to 31 in Q4 2023.

This means that less than a third of respondents were happy with the overall business conditions. With this, South Africa’s real GDP is unlikely to gain any momentum in Q4 having already been expected to slow in Q3.

All of this, together with our seemingly never-ending load shedding woes, means that optimism for an improvement in December 2023 is low and unexpected.