Top stories

AutomotiveHilux Custom Builds offers purpose-built solutions for your business

Toyota South Africa Motors 16 Feb 2026

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

For some brands, that somewhere else means disruptors – inevitable new forces ready to take their customers away by doing what they do, only better. But not WesBank. They’re renowned for producing technological industry-firsts (such as online contract signing, online self-help and WShop) that mitigate potential disruption before it happens. Their current digital ecosystem is no different.

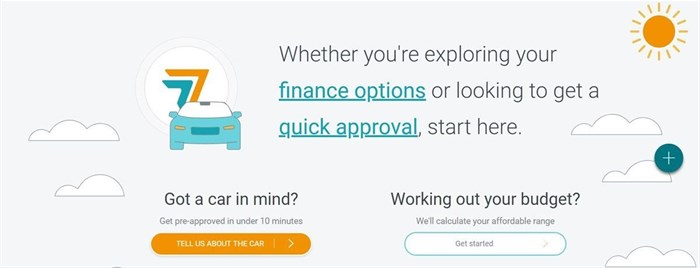

Take their digital application platform, for instance, unrivalled in the industry in terms of its simplicity and transparency. Potential customers can visit the site from desktop or mobile, in their homes or on the dealership floor, and get a quick car finance approval in under 10 minutes. Long, intimidating forms are replaced with a series of short plain-language questions that guide you along your way.

“We wanted the journey of applying for vehicle finance to feel like an online conversation, not an interrogation. Ultimately, we and our applicants want the same thing – so let’s find out if it can happen. Simple. You tell us about yourself, and the car, and we’ll immediately tell you whether you’d be approved for it or not. If not, we will tell you what your options are,” says Dane Reddy, head of digital at WesBank.

That last part is key. Other vehicle finance providers fall flat of the expectations of digital natives by giving them an unhelpful yes/no response. WesBank’s platform is different in that it isn’t just an application; it’s a useful tool that helps you understand yourself as a finance applicant. Instead of just saying “no”, it’ll tell you what your affordability range is so that you know what kind of car will result in a “yes”.

A “yes” isn’t the end of the conversation either. You can choose to pause things and save your quick approval. You can do this for multiple cars and come back to the one you want once you’re ready to go ahead and make things official. In other words, helping you to become an informed, empowered car-shopper.

The result is a digital interaction that serves both customers and business in a symbiotic fashion. For car-buyers, vehicle finance is demystified and in return for being transparent, open and helpful, business has more chance of converting those car-buyers into customers.

This insightful application platform is only one aspect of WesBank’s UX-informed digital ecosystem. As a WesBank customer, you can perform your most critical account actions quickly and securely, at any time, without needing to log in to your account dashboard (think statement downloads, NaTIS copies and payment arrangements). You can also shop for accessories through WShop - a checkout platform that lets you add things like new tyres and service and maintenance plans to your car finance account.

In fact, this digital ecosystem continues to grow, answering more and more questions and making it ever-easier for South Africans and WesBank to do business with each other. This is a refreshing approach and one that proves that it’s not disruptors that service-providers should be talking about, but rather, whether they meet the expectations of digital natives.