Related

Align policy and investment to power southern Africa’s poultry transformation

Dr Jean Jacques Mbonigaba Muhinda 31 Dec 2025

Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

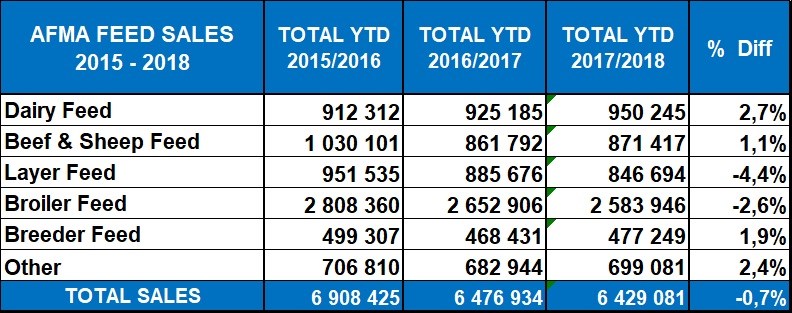

The dramatic feed sales loss experienced in 2016/17 was the direct consequence of the challenges the livestock and poultry industries had to face and overcome.

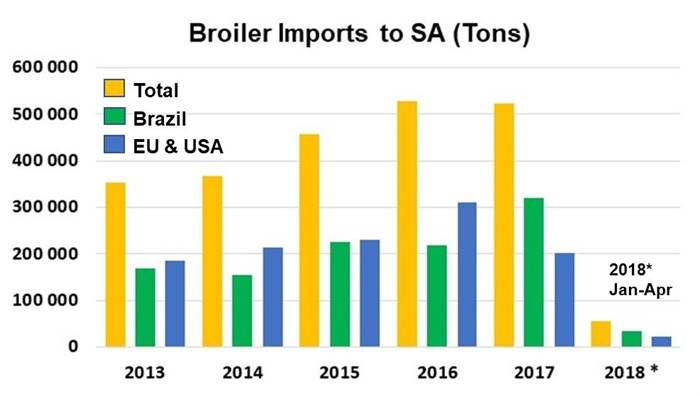

"Initially, the focus was on the poultry industry having to deal with the dumping of cheap imports from the EU (within the EPA free trade agreement), the duty-free quota allowed under the AGOA agreement from the US in 2016/17, which was followed by cheap dumped product from Brazil in the latter half of 2017 that continued into 2018," said Boshoff.

The poultry industry was further struck by the deadly Avian Influenza (AI) and vast numbers of birds had to be culled during 2016/17 to stop the spreading of the outbreaks.

The culling had the largest influence specifically on broilers and layers, with the Western Cape being hit the hardest by the AI outbreaks. According to the World Organisation for Animal Health (OIE), about 2.5 million birds died or had to be culled to stop the spreading.

The direct effect of these actions on animal feed sales is displayed by Table 1.

Following the 2017 winter season and after vigorous biosecurity measures applied by poultry and related industries brought an end to AI outbreaks, matters eventually started to settle and industry began their recovery process.

While South Africa dealt with its AI outbreaks in 2016, imports however continued. During 2017, outbreaks of AI in the EU and US resulted in a slowdown in imports from these regions, allowing Brazil a field day in filling this gap, keeping imports at the same levels as in 2016.

While the focus was directed towards the poultry sector, feed sales experienced a double blow according to Boshoff, with the worst drought in South African history having devastating effects on other livestock species, specifically beef and sheep due to the lack of absence of grazing. This left producers with no option other than reducing their herds dramatically and retaining only their breeding stock, so as to rebuild their herds again after the drought.

Table 1 contains a short summary of AFMA feed sales for the last three statistical years.

The impact of the drought on beef and sheep saw feed sales dropping by 16.3% (±170,000 tonnes of feed). It is encouraging to see that this category has already started recovering in the last year, although it will take three to four years to fully recover to previous levels.

"One hundred per cent of the drop-in layer feed sales was due to AI and we expect a full recovery of these lost volumes by the end of the next financial year if we are able to remain AI-free during this period. The drop in both broiler and breeder feed was due to AI and poultry imports. While we do expect a full recovery from the impact of AI, the negative effect of poultry imports will remain," says Boshoff.

Boshoff concludes by saying that the animal feed sector is positively but anxiously awaiting outstanding outcomes of the special Poultry Task Force initiated by the government under the co-leadership of the Department of Trade and Industry (DTI) and the poultry industry in late 2016.

"These outcomes still need to be agreed upon and implemented. Should these outcomes materialise, it will not only benefit the feed sector, but the entire grains and oilseeds value chain of South Africa. This would lead to policy certainty, paving the way for investment and growth coupled with the potential of vast job creation in these sectors. This will put the industry on the road towards achieving the main outcomes of the National Development Plan (NDP)."