Top stories

More news

According to Insight Survey's latest Fast Food Industry Landscape Report 2015, which provides a dynamic synthesis of primary and secondary research, the impact of banting has in fact been minimal to non-existent.

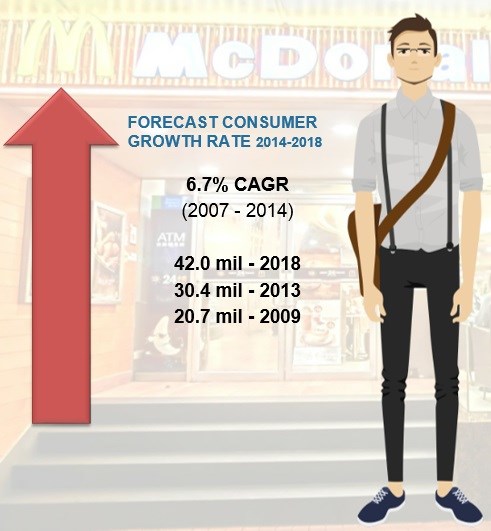

The industry is currently under siege from far more ominous foes in the form of rising commodity prices, market saturation, myriad hygiene scandals and omnipresent load-shedding. Yet despite this, fast food is experiencing exponential growth with local consumers (16+ years old) increasing from 66% in 2009 to 80% in 2014. Within this statistic we see that individuals who have purchased fast food over a four-week period has risen by close to 10 million within the last five years.

Source: AMPS: Graphics by Insight Survey

But why, given the aforementioned challenges, is the industry experiencing such phenomenal growth? According to Insight Survey, the multifaceted answer requires a nuanced understanding of the industry environment and market dynamics, and encompasses an array of competitive strategies underpinned by progressive business acumen and consumer-centricity.

Firstly, what we are seeing is the aggressive penetration of chained global players such as Burger King and Domino's into the local market, as part of their systematic continental expansion plans. This, coupled with the rapid growth of resident global and local franchise stores i.e. a net growth of 134 in 2014 with the top 10 franchises having a national footprint of 3643 outlets (as of April 2015), is in turn significantly aiding positive market performance. The annual turnover of the fast food industry in 2014 was estimated at a staggering R302bn.

Source: Business Tech: Graphics by Insight Survey

Furthermore, what we are seeing is the insertion of fast food services into previously disadvantaged parts of South Africa. Peri-urban and rural communities constitute a new market for the franchise industry, and this new market has been unlocked by the development of retail centres in townships and rural areas.

It is the low LSMS's which represent the greatest potential for growth, driven by the same salient factors applicable to higher LSM's: such as affordability, convenience, and value-for money. This was ratified during one of our primary interviews with Natalie Ruwers (Marketing Manager for King Pie) who stated that low LSM consumers ''are price sensitive, but they don't mind spending money on value''.

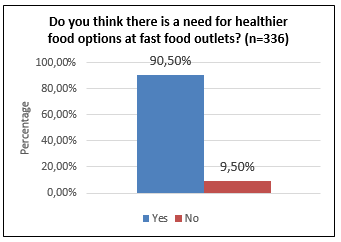

We are also seeing reactive product differentiation strategies manifesting in menu alterations to cater for the burgeoning health trend (see graph below). This hypothesis was confirmed during our many interviews with key industry stakeholders and leading academics who claimed that health trends in higher LSM markets were forcing the crafting of competitive product responses e.g. McDonalds' recent partnership with Weight Watchers.

Source Gopaul: Graphics by Insight Survey

Given the aforementioned examples, coupled with drivers such as ICT's, product innovation, and IPO's and Private Equity Involvement, it is easy to see that within the context of local market dynamics, Noakes' prophecies are having little impact.

Where they may have had some affect, although it would certainly be a tentative correlation to draw, is in the higher LSM's where the proportion of LSM 9 and 10 has dipped by 2% between 2009 and 2014. However, this 2% needs to be understood in a context in which the local fast food industry is experiencing exponential growth.

As such, the reverberations of banting hype are by no means sounding the death knell for South Africa's fast food industry. Furthermore, this may just be the start of an explosive upward trend, as additional growth is forecast, with CAGR numbers expected to rise to 42mil by 2018.

Whether this projected growth materialises however, will largely be dependent on the efficacy of future competitive strategies.

Source: Euromonitor: Graphics by Insight Survey

The Fast Food Industry Landscape Report (120 pages) provides a dynamic synthesis of primary and secondary research, including extensive interviews with relevant stakeholders and industry experts across the value chain: from retail franchises, to independent outlets, street food traders, consumers, and leading academics.

Some key questions the report will help you to answer:

Please note that the 120-page PowerPoint report is available for purchase for R25,000 (excluding VAT). Alternatively, individual sections can be purchased for R7,500 (excluding VAT). For additional information simply contact us at az.oc.yevrusthgisni@ofni or directly on (0)21 045-0202.

For a full brochure please go to: http://www.insightsurvey.co.za/2015-fast-food-industry-landscape-report

Insight Survey is a South African B2B market research company with almost 10 years of heritage, focusing on business-to business (B2B) market research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B market research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business's competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.