Related

Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 2 days

More news

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

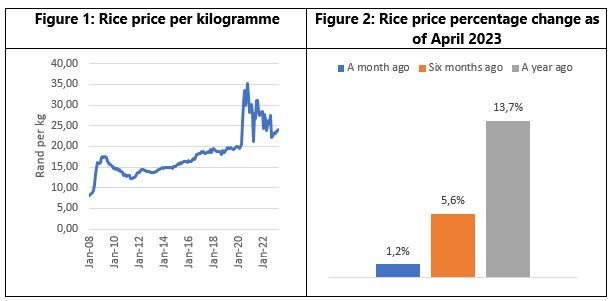

Figure 1 below, shows the evolution of domestic rice prices between January 2008 to April 2023.

As shown in Figure 1 below, domestic rice prices were fairly constant until 2020 at the height of the Covid-19 pandemic. Prices have ever since moderated but still remain higher than the pre-pandemic levels. The rice price per kilogramme (kg) was R27.47 in April 2023. As shown in Figure 2 below, the rice price per kg in April 2023 was 1.2%, 5.6% and 13.7% higher compared to a month ago, six months ago and a year ago, respectively.

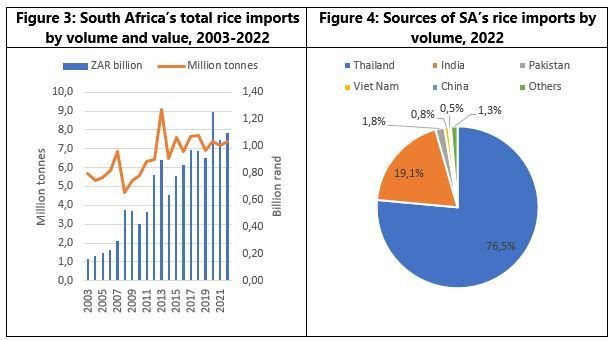

According to data from TradeMap ITC, South Africa imported approximately 1.1 million tonnes of rice to the value of R7.8 billion in 2022. Figure 2 below, shows the trends in South Africa’s rice imports by volume and by value from 2003 to 2022. During this period, South Africa’s rice imports by volume increased at a compounded annual growth rate of 1.3% compared to a CAGR of 10.3% by value. Figure 4 below, shows that South Africa’s leading sources of rice imports in 2022 were Thailand (76.5%), India (19.1%), Pakistan (1.8%), Viet Nam, (0.8%) and China (0.5%), amongst others.

Rice is a summer crop mostly grown in paddy conditions. Small quantities of rice are currently grown in South Africa. Data from the United States Department of Agriculture’s Rice Explorer shows that rice production in South Africa is mostly in KwaZulu-Natal (43%), the Free State (34%) and Limpopo (19%). The long-held view has been that rice is a water-intensive crop and it cannot be grown commercially because of water scarcity in South Africa. However, there is scientific evidence that suggests that there are dryland rice varieties that give good yields that can be grown commercially in South Africa.

Here lies the potential for upscaling the existing and new rice farmers through technical support, finance and the development of a domestic rice value chain. This has the potential to create employment along the rice value chain from the farm to the retail. Importantly, this import substitution strategy is likely to reduce unemployment, poverty and inequality. In addition, consumers are likely to be insulated from the fluctuations in global trade policies and consequently the resultant high prices.