Top stories

Marketing & MediaAds are coming to AI. Does that really have to be such a bad thing?

Ilayaraja Subramanian 5 hours

More news

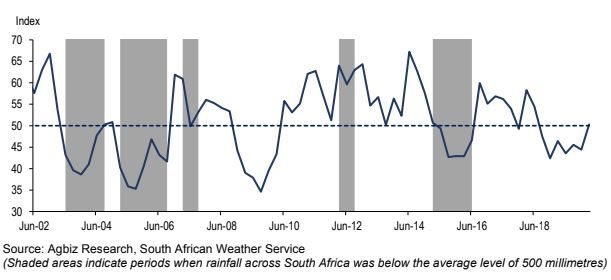

A reading at the neutral 50-point mark or above implies that agribusinesses were relatively optimistic about business conditions.

The ACI comprises of 10 subindices, of which seven underpinned the improvement in sentiment in the first quarter of 2020, albeit remaining below the long-term average levels since the index’s inception in 2001.

The Agbiz/IDC Agribusiness Confidence Index reflects the perceptions of at least 25 agribusiness decision-makers on the 10 most important aspects influencing a business in the agricultural sector (i.e. turnover, net operating income, market share, employment, capital investment, export volumes, economic growth, general agricultural conditions, debtor provision for bad debt and financing cost). It is used by agribusiness executives, policymakers and economists to understand the perceptions of the agribusiness sector, and also serves as a leading indicator of the value of the agricultural output while providing a basis for agribusinesses to support their business decisions.

Subindices that underpinned improvement in confidence

The uptick in the ACI was mainly underpinned by net operating income, the market share of agribusinesses, the volume of exports, economic conditions, general agricultural conditions, financing costs and debtor provision for bad debt subindices.

• Confidence regarding net operating income of agribusiness jumped by 17 points from the fourth quarter of 2019 to 61 in the first quarter of 2020. This optimism was shared by firms across various subsectors of agriculture, except those operating in summer grains related businesses, agricultural machinery and livestock. In the case of summer grains related businesses, the subdued sentiment is caused by anticipated late grain deliveries as the season started later than normal because of delayed summer rains.

The downbeat net operating income sentiment in the agricultural machinery industries corroborates poor sales over the past few months. In the livestock sector, the foot-and-mouth disease outbreak has led to a partial ban on exports, which continues to weigh on the profitability of firms and farms and thereafter sentiment.

• The market share of agribusinesses subindex was at 67 points in the first quarter of 2020 from 62 in the fourth quarter of 2019. The optimism was across the board, with grains related businesses (summer and winter grains) maintaining an unchanged view from the last quarter of 2019.

• The subindex measuring the volume of exports improved by 5 points from the last quarter of 2019 to 44 in the first quarter of 2020. Several firms expressed optimism because of expected large production volumes of summer grains, oilseeds, and horticulture. But this is likely to change as COVID-19 threatens to disrupt supply chains and weaken demand, as consumers continue to go into isolation and governments, put measures in place to contain the spread of the virus.

• The perception regarding general economic conditions in the country improved from 9 points to 28 in the first quarter of this year. Nonetheless, this is still below the long-term average since the inception of the ACI, which is 36. Moreover, the spreading COVID- 19 and ongoing domestic power outages remain key risks to economic growth.

Therefore, the improved optimism regarding economic conditions could reverse in the coming quarters.

• After falling to 31 points in the last quarter of 2019 when there was still prospects of drought, confidence regarding general agricultural conditions jumped to 78 in the first quarter of 2020. This is mainly because of the drastic change in the weather conditions in the country, with favourable rainfall since the start of January 2020. This has led to prospects of bigger summer grains, oilseeds harvest, and horticulture harvest.

• The debtor provision for bad debt and financing costs subindices are interpreted differently from the above-mentioned indices. A decline is viewed as a favourable development, while an uptick is not a desirable outcome as it shows that agribusinesses are financially constrained. In the first quarter of 2020, the sentiment regarding the financing costs declined by 11 points to 24. At the same time, the debtor provision for bad debt sentiment fell by 9 points to 35.

This could be underpinned by the 25 basis points reduction in the repo rate by the South African Reserve Bank (SARB) in January and expectations of further reductions over the remainder of the year.

Subindices that showed a deterioration in confidence

Sentiments regarding the turnover , employment and capital investment of agribusiness weakened somewhat in the first quarter of 2020.

• The turnover subindex confidence fell by 11 points to 64 in the first quarter of 2020, which is still well above the long-term average levels. The input suppliers, agricultural machinery firms, financial institutions and also winter grains-focused firms that are part of the survey were the ones that expressed pessimism in this particular subindex.

• The employment subindex was at 47 points in the first quarter of 2020 from 53 in the previous quarter. This would have been a temporary blip, with the aforementioned expected large summer grains and horticulture harvest set to improve employment conditions in agriculture, albeit seasonally. However, the risks associated with COVID-19 could lead to reduced employment in agriculture in the near term as workers might self-isolate as a precautionary measure to reduce the spread of the virus, but also because of the anticipated decline in demand for agricultural commodities, specifically exports.

• The capital investments confidence subindex fell by 6 points from the fourth quarter of 2019 to 44 in the first quarter of this year. Similar to the previous quarters, the consistent view that we continue to hear from agribusiness leaders is that the lack of clarity regarding land reform remains an overhang that could constrain the potential expansion in fixed investments and thereafter growth in South Africa’s agriculture sector. The focus at the moment is on the Ad Hoc Committee on Section 25 of the Constitution which finalises its work and reports to the National Assembly by end of March 2020. This will be an important determinant of the direction that South Africa’s agricultural sector will be taking.

While we are pleased with the improvement in South Africa’s agribusinesses sentiment in the first quarter of this year, we doubt if it will be sustained. The fundamental driver of the optimism in the sector is the improved weather conditions, with expectations that there will subsequently be higher agricultural output. The challenge the sector faces, however, is a potential decline in demand from several traditional export markets and by extension lower agricultural

commodities prices following the spread of COVID-19. This, in turn, will weigh on farmers and agribusinesses’ finances and possibly reverse the optimism we’ve seen in the first quarter of 2020.

Moreover, the outcome of the land reform policy discussions about Section 25 of the Constitution later this month is another important event to look out for as it will have fundamental implications on agribusinesses and the agricultural sector going forward. Overall, it is hard to celebrate the news of the ACI reaching the neutral 50-mark, as risks which threaten to reverse much of the positive gains have increased since the time of the survey.