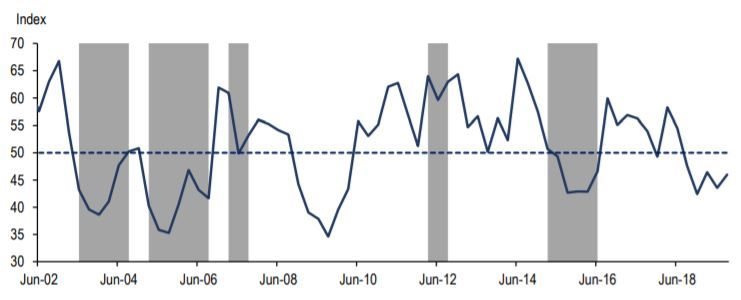

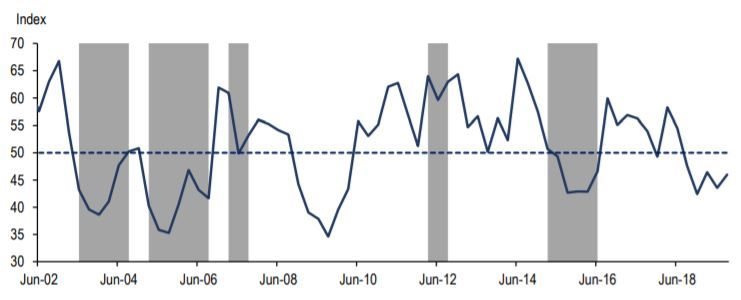

The Agbiz/IDC Agribusiness Confidence Index (ACI) has recorded a 46 point marginal improvement to in the third quarter. The survey, which was conducted between 30 August and 10 September 2019, shows that despite the small uptick, a level below the neutral 50-point mark implies that agribusinesses are still downbeat about business conditions in South Africa, which is precisely the case with third-quarter results.

©Thitiwat Junkasemkullanunt via

123RFThe composite index comprises ten subindices, most of which are still generally subdued compared to the long-term average levels since its inception in 2001.

Agbiz/IDC Agribusiness Confidence Index

Source: Agbiz Research, South African Weather Service(Shaded areas indicate periods when rainfall across South Africa was below the average level of 500 millimetres)

About five out of the ten subindices that make up the composite index underpinned the slight improvement in sentiment in the third quarter.

Subindices that showed an uptick in confidence

The uptick in ACI was primarily underpinned by general agricultural conditions, volume of exports, market share of agribusiness and employment subindices.

• Confidence regarding general agricultural conditions increased by eleven points from the second quarter to 42 points. Aside from the weather conditions in the Western Cape and Northern Cape, nothing has fundamentally changed at farm level compared to the second quarter of 2019. Therefore, it is expected that the forecasts for favourable weather conditions in the 2019/20 summer season have influenced the agribusinesses’ perceptions in this survey.

Also worth noting is that the horticultural firms, financial institutions, and other agricultural services companies were the ones that expressed optimism, rather than the farming businesses.

• Not surprisingly, the sentiment regarding the volume of exports lifted by 14 points from the second quarter to 50. The agricultural firms’ perceptions might have also have been influenced by the 14% quarter-on-quarter uptick in South Africa’s agricultural exports in the second quarter of this year to $2,4bn.

However, it is yet to be seen if the export momentum was carried through to the third quarter when the actual data is made available in the next couple of weeks.

• The market share of agribusinesses subindex was at 58 points in the third quarter of 2019 from 56 in the previous quarter. Although this is a notable improvement, it is still an underperformance by historical standards. The only firms that expressed positive sentiments on this point are the ones operating within the grains industry.

• The improvement in confidence regarding employment from 48 in the second quarter to 58 in the third quarter came as a surprise given that the third quarter is a fairly quiet period in agriculture, especially following a drought season in some parts of the country. The subsectors that expressed optimism about employment conditions were livestock and horticulture.

• The debtor provision for bad debt and financing costs sub-indices are interpreted differently from the above-mentioned indices. A decline is viewed as a welcome development, while an uptick is not a desirable outcome as it shows that agribusinesses are financially constrained. In the third quarter of this year, the sentiment regarding the debtor provision for bad debt fell by five points to 31, a slight improvement.

Subindices that showed a decline in confidence

Sentiments regarding the turnover, net operating income, capital investment, economic growth conditions and financing costs of agribusiness deteriorated in the third quarter of 2019.

• Confidence regarding the turnover subindex dropped from 58 in the second quarter of the year to 56 points. The deterioration in sentiment emanated from agricultural firms that operate in summer grains and oilseeds and also the wool industry. There are two major factors that explain the slight deterioration in confidence in these subsectors and are not different from what dominated in the previous quarter.

Firstly, the poor summer grains and oilseeds harvest has weighed on the finances of agribusinesses. Secondly, while South Africa has made strides in lifting the ban on wool exports to China, there are still some impediments related to Sanitary and Phytosanitary (SPS) measures that are yet to be resolved and have continued to constrain exports over the past couple of months, thus weakening agribusiness and farmers’ financial standing.

• In line with the turnover, confidence in the net operating income subindex softened from 48 points in the second quarter of 2019 to 44.

• The capital investments confidence fell by nine points from the second quarter of the year to 50 points. The deterioration was not broad-based. Some agribusinesses operating within the wine, livestock and grains industries showed an uptick in sentiment, while others were generally pessimistic. And on balance, sentiment fell on this subindex.

The consistent points, however, that we continue to hear from agribusiness leaders is that the lack of clarity regarding land reform and water rights remain an overhang that could constrain the potential expansion in fixed investments. Of late, the concerns about the shipping ports’ infrastructure and biosecurity are also being mentioned as key concerns that could constrain investment and growth of South Africa’s farming sector.

• The perception regarding general economic conditions in the country fell by three points to 24. This goes to show that agribusinesses are not enthused about the economic outlook, although the second quarter numbers brought some positive news.

• As previously noted, the financing costs subindices are interpreted differently from the above-mentioned indices. A decline is viewed as a welcome development, while an uptick is not a desirable outcome as it shows that agribusinesses are financially constrained. In the third quarter of 2019, the sentiment regarding the financing costs lifted by eleven points to 44.

The uptick in financing costs is attributable to a higher balance sheet utilisation, partly driven by the late and poor summer grain harvest.

"Although a positive inch in confidence is always a welcome development, it is important to be mindful that the Agbiz/IDC Agribusiness Index has been hovering at levels below the 50-point mark for the past five quarters. We worry that remaining at these levels for a prolonged period could lead to declining investment in the sector, albeit this is not the case at the present moment,” says Wandile Sihlobo, Agbiz chief economist.

Admittedly, some of the factors that have led to subdued confidence in South Africa’s farming sector are outside of policymakers’ hands, notably the drought. But there are also some factors that are within the policymakers’ reach, such as clarity on land reform policy and water rights, increased investments on strengthing biosecurity and shipping ports’ infrastructure.

These matters should be prioritised in order to see an uptick in sentiments and thereafter investment and agricultural economic fortunes.