According to Rhys Dyer, CEO of Ooba Home Loans, affordability in the local residential property market remains of crucial concern to homebuyers.

Rhys Dyer, CEO of Ooba Home Loans

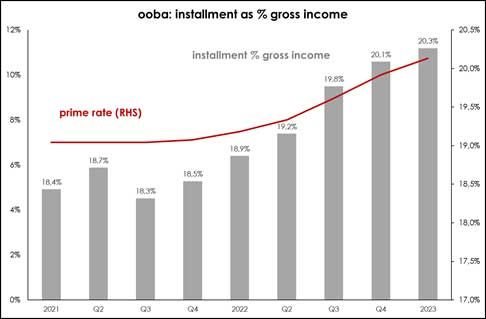

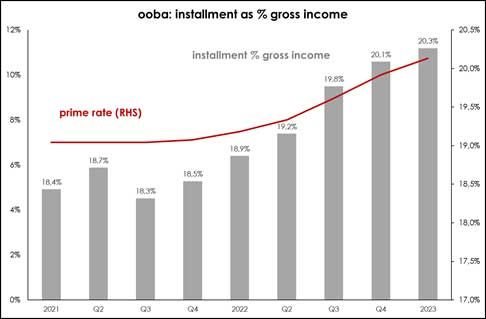

“Affordability, in this context, is determined by how comfortably a homebuyer can afford their monthly repayments relative to their gross monthly income (income before tax and monthly expenses),” explains Dyer.

He adds that while many South African households are under financial pressure, debt levels among Ooba’s homebuyers have yet to reach unsustainable levels. “Home loan instalments as a percentage of gross income increased to only 20.3% in Q1 2023, comfortably below the industry benchmark of 30% of gross income.”

Source: Ooba Home Loans

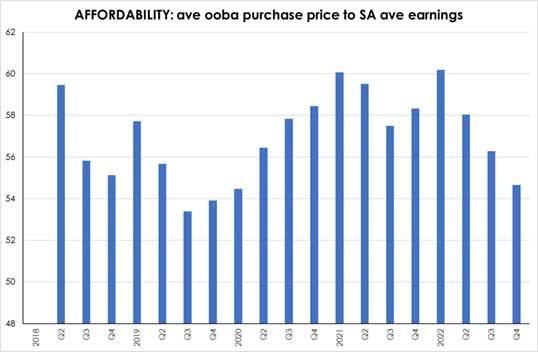

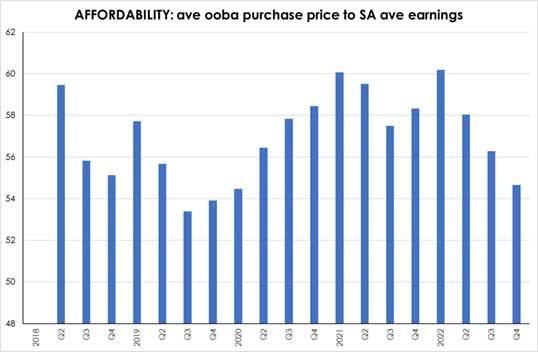

Looking back, affordability levels deteriorated significantly during the first two quarters of 2020, coinciding with the onset of the Covid-19 pandemic and the initial "hard lockdown" measures implemented by the government. The hard lockdown resulted in the closure of various industries, including travel, transportation, hospitality, and events, which negatively impacted the income of many South Africans.

Note: The vertical axis on the graph below represents the ratio of average national purchase price to average national earnings. The higher the ratio, the more expensive homes are relative to earnings.

Source: Ooba Home Loans

"Affordability continued to deteriorate, reaching a peak in Q1 2022 before beginning to gradually improve due to the growth in national average incomes and slow house price inflation (HPI), which is a result of the oversupply of property in certain regions and a sluggish economy," says Dyer.

“Our latest data illustrates that house prices rose by 17.4% between Q1 2019 and Q4 2022, while average earnings, as measured by Statistics SA, increased by 22.6% for the same period. This resulted in a net improvement in housing affordability, despite the ongoing market volatility over the four-year period," he adds.

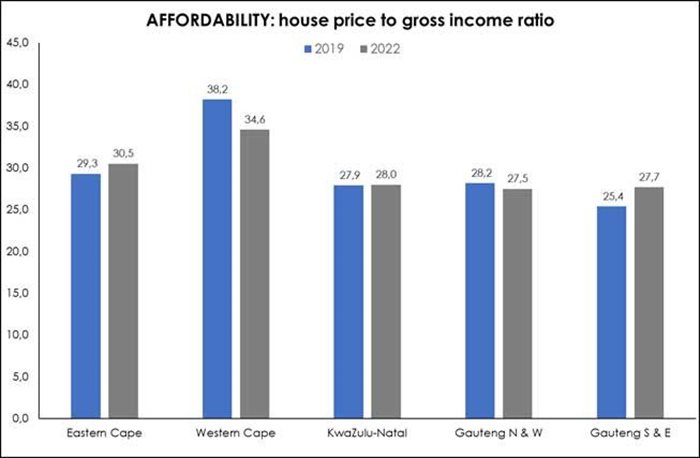

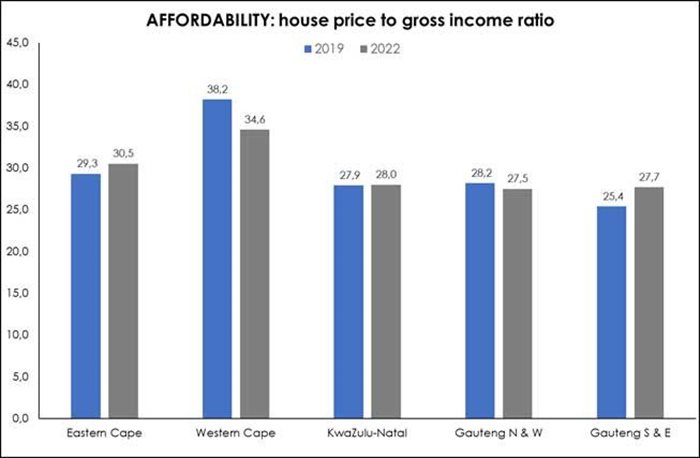

Good news for all five major regions

All five of South Africa’s major regions showed improved affordability when comparing the first four months of 2019 to the same period in 2023, with Ooba Home Loans applicants in KwaZulu-Natal second only to the Western Cape for the highest growth in gross income (+32.4%) relative to the prices of homes that were bought by these applicants (+17.8%).

“The Eastern Cape registered the strongest growth in the prices of houses by applicants in 2023, relative to 2019 (+23.4%) but one of the slower increases in applicant income (+30.7%), thus registering only a modest improvement in affordability between January to April 2019 and the same period in 2023,” says Dyer.

Western Cape shows the greatest improvement in income and affordability

Source: Ooba Home Loans

While the Western Cape is well known for having some of the most expensive property in the country – particularly in sought-after areas such as the Atlantic Seaboard and Winelands – it is also the region that has seen the greatest improvement in affordability levels.

"The reason for this notable improvement becomes clear when considering that the average purchase price of properties purchased by Ooba Home Loans customers in the Western Cape has only risen by a mere 1.9% in 2023, versus those purchased in 2019, while the average income of applicants has increased by a staggering 44.5% over the same period," comments Dyer.

“The low growth in average value of properties purchased in the region is closely linked to the growth in demand for buy-to-let properties in Cape Town, as investors generally buy in the lower to mid purchase price segments.”

“While it’s difficult to pinpoint the exact cause of this significant increase in income in the Western Cape, we believe that some of it can be attributed to semigration and international investors.”

Source: Ooba Home Loans

The combination of increased income levels and a relatively low growth rate in the price of properties purchased by applicants throughout the country has had a significant impact on the purchasing power of homebuyers, indicating that there is still scope for affordability at the current level of interest rates.

Sixty percent of Ooba Home Loan’s customers granted bonds in the first quarter of 2023 were for homes priced above R1.5m – compared to just 47% of customers in the first quarter of 2019.

“Whilst this statistic suggests that a significant number of buyers are opting for more expensive properties, we are also seeing a substantial growth in the size of average deposits buyers are putting down. This indicates that buyers are prioritising deposits to off-set the higher cost of financing in the current high-interest-rate cycle,” says Dyer.

“While a higher interest rate environment is not without its challenges, the slower growth in property prices coupled with relatively strong consumer affordability and good availability of financing means that there are still plenty of good investment opportunities to be found in South Africa’s residential property market” concludes Dyer.