Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

There are plenty of signs that inflationary pressure is rising as global economies open up. The question is whether these inflationary pressures are structural or a temporary blip.

Longer-term, though, there are 4 Ds that are structurally deflationary forces:

Two or three years out I don’t think inflation is going to be a structural phenomenon. I think the 4 Ds will re-assert themselves, especially disruption and debt.

There's been a major change in government policy (a move to modern monetary theory or MMT, and a concerted effort to inflate away debt) inflation could become a structural issue.

MMTy is also referred to as helicopter money because it involves governments creating money to directly fund public spending or tax cuts, rather than them simply printing money to buy financial assets.

This would be very significant and require capital controls. It may happen but is unlikely in next two to three years.

There’s been a large increase in retail investor participation in stock markets across the world, including in Asia. Historically, this has been a good indicator of a market bubble.

Retail money is flowing heavily into popular themes such as biotech, electric vehicle and internet stocks (Bevi).

I’m getting increasingly worried by the tone of the broker notes, especially on the electric vehicle (EV) side. An EV is essentially a generic good with standard technology that’s relatively easy to use. There are hundreds of EV start ups, and hundreds of existing original engine manufacturing companies.

In fact EVs remind me of LCD TVs in the 1990s. We believe EVs are in a classic bubble and it will burst – rather badly. It’s not a great place for investors.

If the growth areas of the market because it’s bubbly, should investors be looking at the more value-oriented areas of the market?

This is a key debate we’re having at the moment. Relying predominantly on classic value measures like price-to-book and trailing price-to-earnings ratios no longer works.

The key difference between today’s market and the market in which legendary value investors like Benjamin Graham developed the investment philosophy, is that intangible assets have become more important.

Intangible assets are things like research & development, brand building, building a sales network – things that can’t easily be quantified in the same way as the classic value measures can.

Those companies that are investing heavily into intangibles will be the likely winners. You can’t differentiate between stocks simply on traditional value measures like book value because you’re not accounting for the value that lies in the company’s intangible assets.

This is the fun and the challenge for us as investors at the moment. We have to work out which companies are investing well in intangibles and are really building businesses, because we can’t see these investments and potential growth just by looking at the reports and accounts.

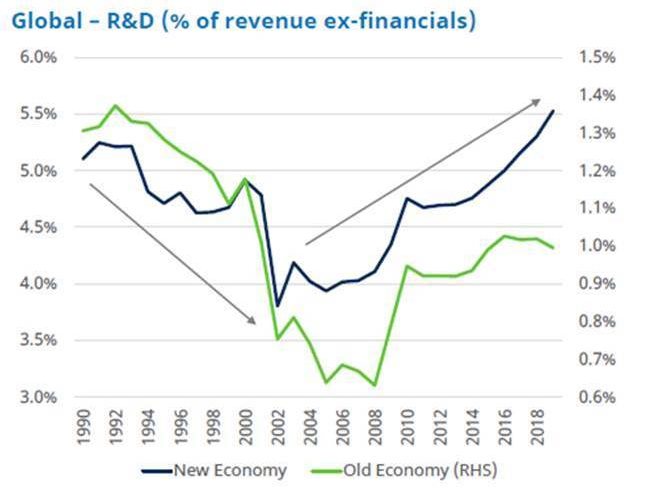

The big difference in intangible/R&D investing between the two based on the chart below.

New economy stocks are investing 5.5% of revenues in R&D while old economy stocks are only investing 1%.

So what you’re seeing is disruption: these new start-up companies are light on physical assets and investing heavily in intangibles and they disrupt incumbents that are often too asset-heavy to adjust their business model.

Value stocks are staging a come-back. I think value stocks in many segments face such challenges that they’re much more like value traps.

The outlook on US, China, Taiwan and Korea stock markets is positiive because these are countries in which companies invest heavily in intrangible assets.

There are several scenarios that could materialise in the long term. My colleague and I sat down at the beginning of the pandemic and put together a list of scenarios that could play out over the next decade. This has helped us position for the long-term in what we believe to be the right secular areas.

These included the ideas that we’ve reached peak oil and total oil consumption will be down by 30% by 2030, global trade volumes as a percentage of GDP could decline to 1970s levels, and leisure travel is likely to recover but business does not.

ESG investing is here to stay. It’s another factor that you have to plug into the investment decision.

On the subject of China dominating Asian and emerging market indices, China will become a separate asset class on its own from both an equity and a bond perspective.

We are moving from the 20th century industrial era to the 21st century information age and it’s a very different and challenging world. It is more important than ever to think long-term and consider what if scenarios as disruption is only going to accelerate, not slow, from here.