Unchanged interest rates is the right decision

The widely expected decision by the monetary policy committee (MPC) to again leave interest rates unchanged is the right one, given continued policy and economic uncertainty in SA. Although now a more benign inflation outlook and weaker growth prospects in 2017 might have justified a small rate cut at this stage, recent political developments make it inevitable that such a decision now needs to be postponed. It is striking the extent to which the MPC narrative was permeated by references to political uncertainty and its impact on SA's economic outlook.

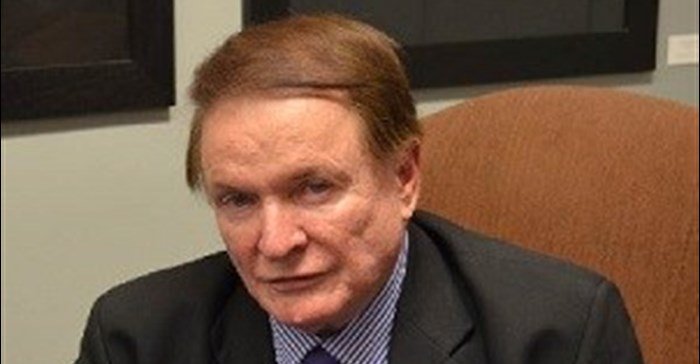

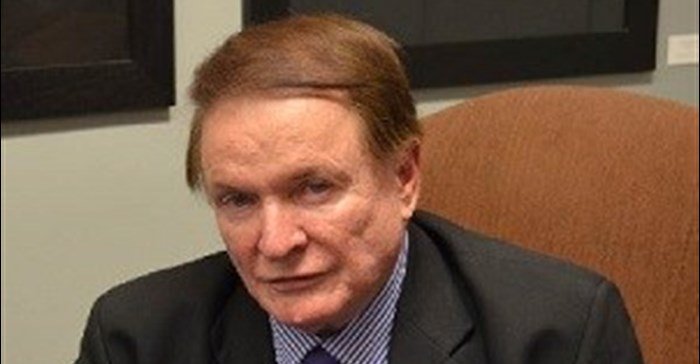

Professor Raymond Parsons, UWC School of Business and Governance

Therefore domestic factors such as the recent changes at the National Treasury and the investment downgrades which followed - as well as a volatile global environment - confirm that the risks of a rate cut at present would outweigh any benefits. In the meantime the MPC is understandably remaining cautious until more evidence has emerged about the balance of risks in economic outlook, and what unpredictable strains might yet still be imposed in the economy.

By the time the MPC meets again at the end of July there should be more clarity about Moody's anticipated decision on SA's domestic currency downgrade, the ANC policy conference will have taken place, and there may be a less volatile element in global sentiment about emerging markets. The MPC will then be in a better position to make a judgement call on future interest rates and confirm that SA is indeed at the end of the interest rate tightening cycle.

The fact that the MPC has now reduced its growth forecast for 2017, having inexplicably and in retrospect unwisely raised it at its previous meeting, merely confirms the view of many economists that recent political developments have increased the downside risks to economic growth. The MPC reference to the continued weakness in private fixed capital investment again emphasises why strengthening investor confidence remains essential to SA's future economic performance.

About Professor Raymond Parsons

Professor Raymond Parsons is an economist at the NWU School of Business and Governance.