Top stories

More news

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

For the first half of 2021, we have Woolworths leading on recommendation, followed by Takealot and Mr Price. This supports brand consideration, with Woolworths and Mr Price strongly leading the market, translating to a cross-over of these two brands from mid-July 2021 with regards to purchase intent. On the other hand, while Edgars places 10th on recommendation, the brand ranks 6th on consideration noting the brands legacy strength in the market.

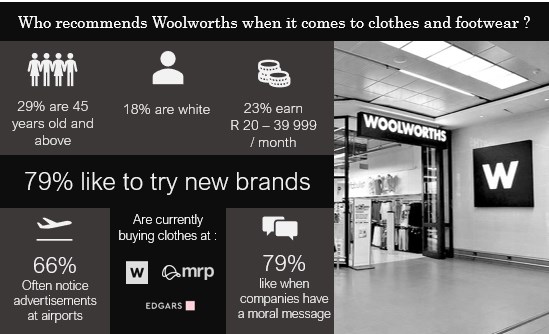

Those recommending Woolworths constitute a slightly older age group, with 4 f in 5 f customers supporting brands that have a moral message. This is encouraged by Woolworths’ business journey promoting sustainability of the environment, its people, and communities.

When delving deeper to further understand those recommending Takealot, we note that 9 in 10 customers are looking to purchase good quality products, with 42% noticing advertisements on the internet. In encouraging customers to utilise Takealot, it is also vital that customers are given the opportunity to subscribe to a loyalty programme that demonstrates value in their purchase.

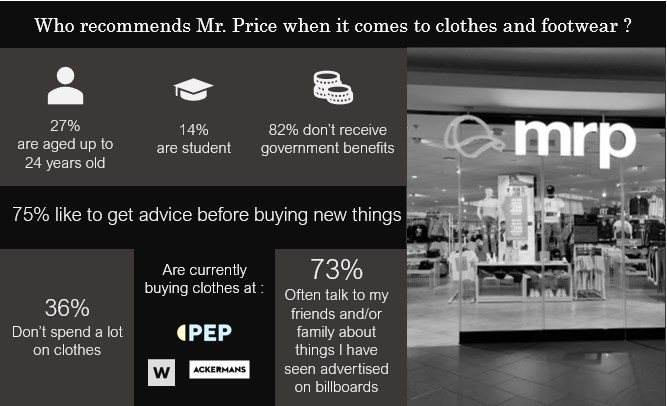

Lastly, Mr Price accommodates for a younger age group of customers, with 27% aged up to 24 years old. Value is a key aspect for Mr Price customers, with almost 4 in 10 customers stating that they do not spend a lot on clothing, speaking to the fast fashion industry gaining traction in the South African market in recent years. This is reiterated by the brand earning 2nd place on value on the BrandIndex measurement tool. 7 in 10 customers recommending Mr Price also often talk about brand advertising they have seen, driving a need for billboard advertising that supports top of mind awareness for the brand.

Overall, while each brand speaks to different customer bases, it is vital that brands keep abreast of the shifting customer needs, over and above changing fashion trends, in order to remain relevant and drive brand recommendation and consideration.

* All data mentioned in the above infographics is significantly higher compared to the South African National Population

BrandIndex: the real-time & continuous monitoring tool for brands and all the speeches dedicated to them. In South Africa, more than 100 brands are assessed on a daily basis via our panel of approximately 28,700 respondents.

Recommendation: Which of the following retailers would you RECOMMEND to a friend or colleague?

And which of the following retailers would you tell a friend or colleague to avoid?

Population: South African adults with access to the internet

Period: from 1 January 2021 to 31 July 2021

N ~ 4 141

Profiles: segmentation and media planning YouGov tool. Data is collected daily, and YouGov Profiles makes it simple to find and understand the audience that matters most to you. It gives you the power to build and customize a portrait of your consumers' entire world with unrivaled granularity. More than 9,000 variables are available in South Africa.

Dataset: 2021-08-08

Population: South African adults with access to the internet who recommend Woolworths within the fashion sector

N ~ 1 596

Population: South African adults with access to the internet who recommend Takealot.com within the fashion sector

N ~ 1 151

Population: South African adults with access to the internet who recommend Mr. Price within the fashion sector

N ~ 1 160