Much confusion lies in the measurement of South Africa's online audience...Unique Browsers, Page Impressions, Unique Users... numbers and explanations often bandied around with flair; with little understanding of the difference between the numbers, how they're derived or what they mean.

Hopefully, this month's column will help unpack the jargon and the help you decide what's most important to you.

Just how big is the SA online audience?

Alan Morrissey, Country Managing Director - South Africa, Effective Measure

The South African online audience (which includes mobile and desktop) is around 14 million active users. Effective Measure measures just over 14 million "people" or de-duped browsers online which equates to about 27% of the South African population and that includes both mobile, tablet and desktop traffic. Unfortunately, online media advertising investment has not followed the growth in digital eyeballs yet, but once we have accurate ad spend figures for digital and its ROI, we believe that big brands will start to shift some of their budgets online.

April 2014 Effective Measure data:

That very question plants the seeds of much confusion. It's the right question, but people hear it differently. They confuse online user base with online audience. In other words, they assume that all those who use the internet are equivalent to all those who consume media on the internet. The two are not the same. It's like confusing the ability to read with the activity of buying newspapers. The problem with traditional audience measurement is that while it demands that distinction in the physical world, it "forgets" it in the digital environment. Online access is not the same as online audience. Many people use the internet only for e-mail - the single biggest use of the environment. The online "user base", according to World Wide Worx measures of subscribers and primary research among users, is 13,8 million. The size of the online "audience" is possibly similar, but it is a different number that I leave to the audience measurement specialists.

Ryan Harris, Head of Measurement, IAB South Africa

According to Effective Measure there were 25.7 million Unique Browsers measured in April 2014 on IAB SA member websites. Using this figure and estimates from AMPS derived by Peter Langschmidt from Echo, we estimate that there are around 14 million people who use online in South Africa.

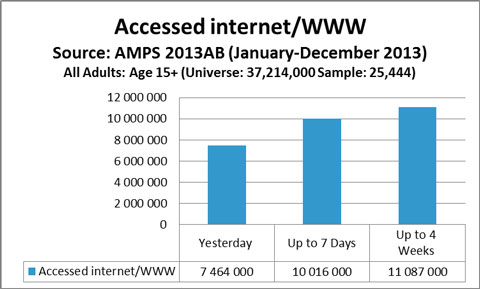

Currently, around 14,5 million people. Take Effective Measure Unique Browsers (around 25 million in April 2014) and multiply by .58 to get back to 14.5 million people. From AMPS, take the past 4-week internet figure and add cellular browsing and online activities from cellular section to get to a more realistic figure. But, also keep in mind that the internet is the fastest growing medium in history, and that the AMPS figure refers to the mid-point of the AMPS 2013 fieldwork cycle, which was June 30th 2013 - some 11 months ago!

Mike van Eck, Digital Business Manager, Ads24

According to numbers released by the DMMA (now IAB SA) and Effective Measure in mid 2013, the unduplicated online audience in South Africa is 14.2 million. If one looks at past week audience on AMPS, the number is just over 11 million. Bearing in mind that AMPS only looks at age 15+ we are missing out on a huge gap in measuring activity among the mobile youth market.

Natasha Fourie, Strategist, SpaceStation

The IAB worked with Peter Langschmidt to calculate the size of the South African online audience. They did this by calibrating Effective Measure data which looks at Unique Browsers back to AMPS' "actual people". The result at the time put the potential online audience at 14 million. This is for people accessing via cellphone and computer.

So, AMPS is being used as the base measurement to get from browsers to people. However, at a respondent level on AMPS what we find is that amongst a small percentage of respondents, there is some confusion as to what constitutes online activity. So when you ask the question "have you accessed the internet in the past 12 months?" you get a result of 12 million people. However, when you ask a "laundry list" of online activities that include email, search, instant messaging, social media, download apps etc, you get a result of 14 million people who have partaken in one or more of these activities. This is not a data anomaly; it is simply a percentage of respondents who are confused as to which activities constitute online access.

Timothy Spira, Chair of Publisher Council, IAB South Africa and General Manager, eNCA Online

Research in July last year conducted by the DMMA (now IAB South Africa) and Echo Consultancy estimated the total internet population in South Africa to be around 14 million users. This represented 39% of the adult population. The research combined AMPS data with census data from Effective Measure, the IAB SA endorsed measurement provider for digital audience data. It's likely that this number has grown significantly in the intervening time. Looking at Effective Measure, growth in Unique Browsers increased by over 30% between April 2013 and April 2014. Of course, this growth rate is inflated by new members joining the IAB and thus being included in the Effective Measure measurement sample, and it also probably reflects an increase in the number of devices per user. But, it is still indicative of an audience that is growing extremely fast. Encouragingly, the Effective Measure data also shows significant year-on-year increases in metrics like Site Visits (up 23%), and a 44% increase in the Average Duration of Site User Sessions. So, not only is the number of users growing, these users are also engaging more with the medium. This is due in part to factors like the growth of social media as well as the proliferation of content such as online video, which is great at holding the audience's attention.

How is the online audience measured in South Africa?

Alan Morrissey: To measure the online audience in South Africa, Effective Measure tags ALL IAB South Africa publisher member sites with our JavaScript and PHP tags which then supplies the usual digital metrics of Reach (Unique Browsers / Unique Visitors), Volume (Page Impressions / Page Views), Frequency (Visits and Number of Visits per Unique Browser) and Engagement (Avg Visit Duration, Avg Page Duration & Avg Pages per Visit).

We have found that both Agencies and Publishers in South Africa tend to focus too much on Page Impressions and Unique Browsers and not enough on "stickiness" metrics, where users are engaged with content. Building a site with millions of Page Impressions is no longer the aim of the game; keeping users engaged is now key. With deeper engagement comes the opportunity to heighten the exposure of ads and further the experience of brand penetration.

Once publishers are tagged, we send HTML pop-up surveys to users on desktop, mobile and tablet. These pop-ups are not incentivised and are indicated as an industry-wide IAB research survey. ESOMAR global standards require us to not incentivise the surveys and ensure we ask that the user is over 15 years of age. The users have the option to "opt-out" to not receive another survey for 90 days, unless they use a different browser, device or flush their cookies.

The users that do proceed with the survey are asked 26 demographic and psychographic questions ranging from gender, age, income and race to if they own a pet. Once the survey is completed, we place a cookie on that user's browser, which enables us to track their usage and associate their demographic to other tagged sites they visit. For example, a user completes a survey on 24.com and then goes to Cosmopolitan.co.za and then Supersport.co.za. We can associate their profile to the site and sections they visit on the other sites. This way, we build up large sample sizes for each site which we then use in the media planning dashboard to allow agencies to plan and run schedules based on what sites match their required demographic profile of audience.

Another way we collect demographic profiles and track non-tagged sites is via an online panel. This is very different to a traditional selected offline panel. We ask the user to install our plug-in once they have completed the generic pop-up. Once the plug-in is installed we track the user traffic and profile on sites like Facebook, Twitter, YouTube, LinkedIn, brand e-commerce sites and basically any untagged sites. In South Africa we have just under 9,000 active "panellists" who we track daily. This traffic is then compared to their tagged site traffic, weighted and extrapolated to the online universe of circa 14 million. Our analysts and data scientists confirm that there is a margin of error of about 5% and a confidence level of about 99% for our panel in South Africa. Therefore, the numbers we report in our panel is pretty accurate. By comparison in the UK, they have a panel of 30,000 for an online market of 55 million "people", therefore ours is pretty sound. We also sanity check our figures against other sources like SocialBakers and the like.

However, unfortunately IAB SA publishers have currently blocked this "full picture" view from the market as they believe it may be helping the foreign-based sites more. Hopefully with the involvement of agencies and brands this "full-picture" will be released to the market in the near future. Overall this system is called a hybrid, which mashes site-centric page tags (actual traffic) with user-centric panel data to achieve the "full picture" of the market.

Arthur Goldstuck: The online user base (as opposed to audience) is measured by World Wide Worx through getting subscriber numbers directly from internet and mobile service providers, and conducting primary research on a nationally representative basis among the population and among the user base. A key to understanding the numbers, though, is to distinguish between internet users and what the mobile operators call data users. In the past, SMS was included among data use, but that was easy to filter out. Not as easy was the operators' definition of data use as "accessing the WAP gateway", which meant using a mobile phone service that accessed the internet layer of the mobile network - even if you didn't know you were doing it. In most cases, this was not internet access by any reasonable person's definition, but it was thrown into the mix - and still is. The inflated numbers for mobile internet users in the past were a result of not making these distinctions.

Ryan Harris: Currently there are multiple ways of measuring the total online audience in South Africa. The IAB SA uses Effective Measure to tag up all member websites and based on these tags we are able to measure metrics like Unique Browsers and Page Views. Through this tag and the use of surveys we are able to estimate in-depth demographics for IAB SA member sites.

Effective Measure also tracks a panel of users and monitors their internet traffic in order to estimate the size of the South African internet audience outside of IAB SA member websites. AMPS also has questions relating to online (web- and mobile-based internet access) that are also used to estimate the total size of the online audience in South Africa. Combining all of this digital and traditional research we are able to estimate reliable figures relating to the online Audience in South Africa.

Peter Langschmidt: AMPS is South Africa's media bible and has the largest 25K random probability sample. It can hence be grossed up to represent the universe, unlike many studies like World Wide Worx, which are not random samples. Questions are asked about browsing and other online activities. The problem here is that there is respondent confusion as AMPS under-reads mobile access, due to respondents thinking of the internet as via a computer. This can then also be compared to the penetration of TV radio, print and other media included in AMPS.

Effective Measure is used to measure the traffic and profile of individual sites. It is very accurate in terms of browsers as it is all done via cookie tracking. The problem is that advertisers are interested in reaching people, not devices and browsers and Effective Measure measures browsers, so if I visit a site on my iPhone, my iPad and my PC via internet Explorer and Google Chrome, I am counted as 4 UB's. Also, Effective Measure only works on tagged sites, and 9 of the top 10 sites in SA are not tagged.

We are using the internet to measure the internet, which creates bias. The pop-up questionnaire is completed more often by regular browsers and is skewed towards bigger sites. IAB SA is working at including questions to reduce this bias considerably.

Mike van Eck: The South African digital landscape is in a fortunate position, where the IAB SA have worked extremely hard to ensure that we have one single currency in terms of online measurement. Effective Measure is the official measurement currency in South Africa, where media strategists are able to compare and plan digital media campaigns across various publishers and online brands in using one measurement technology - comparing apples with apples as the placement of tags is the same across all sites. Added to this, a recent win for digital media was the recent inclusion of the Effective Measure data into the Telmar dashboard, allowing digital media to be a part of strategic planning from the onset.

Natasha Fourie: Effective Measure is currently the IAB endorsed gold standard of measurement in South Africa.

Is Google Analytics sufficient for a publisher to measure their traffic? If no, why not?

Alan Morrissey: Google Analytics is great for day-to-day "real-time" analysis of traffic for which pages are busiest, where traffic comes from, heat mapping etc. However, it does have its limitations and reasons for being a "free" service. There is also a difference between Online Audience Measurement that Effective Measure offers, and web analytics that is what Google Analytics and numerous other vendors like Adobe SiteCatalyst (ex Omniture), Webtrends, Coremetrics, AT internet, comScore DAX and others offer.

Effective Measure's core remit is to provide a digital media planning dashboard or online trading currency where sites can be compared on an apples vs apples basis. All publisher sites are on one system that agencies can trust and plan based on demographics and target audiences. We provide a "birds-eye" view of the market and most importantly, the "who" has been to the websites, which other vendors cannot provide.

Effective Measure is also audited by ABC UK and accredited to global standards set by JICWEBS. What that means is our measurement has been rigorously audited to ensure we filter out all the required "bad traffic" from our data that includes Robots and Spiders, internal traffic, pushed traffic, click-farm traffic etc. It also ensures our cookie regime (the way we deploy cookies) is correct and to a global standard that ensure a proper de-duplication of Unique Browsers on sites and when sites are merging traffic from one domain with another. It's key to ensure any web analytics vendor used is audited either by ABC UK or the MRC in the USA to ensure the data can be fully trusted

Ryan Harris: The short answer is no. Google Analytics is great at measuring the technical aspects of a website but it is not as good at measuring details about that website's audience. It is tag-based measurement that tracks users based on their cookies. If a user has more than one device or uses more than one browser they will be counted multiple times. Google Analytics reports on a metric called Unique Visitors, which is actually their estimate of Unique Browsers. Often this figure is cited as the number of people who actually go to a website and this is not correct. Globally the trend is that aggregated Unique Browsers are massively over inflated and Google Analytics is not very strict on this metric, especially over longer time periods such as months or quarters. Hence the concern when using total traffic figures based only on Google Analytics. These figures can also be inaccurate if the tag has not been implemented correctly across a website.

Peter Langschmidt: Google Analytics is great to measure and track one's own traffic and customise your site. However, it is not sufficient if you want to sell advertising, as advertisers need to know the profile of people and how long they stay on the site and how often they visit. To get a ROI on their advertising investment, advertisers need to know the Ratings (reach and frequency) of people in their target market (profile), and this is why we need a cookie tracking system like Effective Measure, which gives the first part of the measurements that advertisers want.

Mike van Eck: This is an ongoing debate in the industry. Google Analytics is a free service and offers top-line analytics in terms of pages accessed and user engagement. However, to truly understand your audience, you need real-time data and an analytics solution that offers a tailored dashboard where you are able to view (in real time) online activity to both breaking news and media campaigns. This in turn allows you the option to both optimise news in accordance to how your audience is responding, and adjust media campaigns to deliver the best conversion. This does come at a hefty price as most analytics solutions are quite costly and in a tight economy you need to evaluate cost and potential return.

Natasha Fourie: I think Google Analytics is useful as an indication for internal use if you don't have access to anything else. However, it is always better to base your business decisions on audited figures that have been 3rd party ratified - which is why Effective Measure is recommended by IAB SA. For clients and planners Effective Measure audited figures are important as it ensures that they a) Know the figures are trustworthy and legitimate; and b) Standardised measurement allows you to compare apples with apples so the best purchase decision can be made.

Timothy Spira: Google Analytics is wonderful tool and it's an added bonus that it's free. While it does have certain limitations compared to its paid competitors - such as the number of transactions it measures and the ability [to] set custom variables - the vast majority of publishers will not be affected by these constraints. But there are many aspects of analytics for which other tools are needed. For example, tools like Chartbeat provide an arguably more comprehensive real-time analytics dashboard for publishers. Google Analytics also doesn't handle the metrics around video and audio all that well, so publishers using streaming media need additional tools - often the native analytics tools for their preferred media player - to measure things like plays, drop-off and completion rates, engagement rates and the like. Furthermore, like most site-centric analytics tools, Google is good at measuring the performance of pages or features on your site, but not as good at measuring user behaviour. In contrast, tools like Mixpanel and Kissmetrics assist in tracking users across devices as they allow publishers with registration and login functionality to identify multiple browsers across several devices as belonging to the same person.

But there is a downside to Google Analytics which many publishers probably don't fully appreciate...

As with many free web-based software tools, the software provider owns the data it collects from tagged sites and can use this data for its own purposes. In Google's case such purposes may include utilising the data to target users of specific websites within in its own advertising network, thereby competing more aggressively for advertising spend with the very publishers who use Google's analytics services.

Can we track unique users? If not, why not, and what is the closest measurement we can get to understanding how many PEOPLE use the internet in SA?

Alan Morrissey: Unique Users was a term used in the early days of the internet and was removed from digital terminology as it inferred "people". JICWEBS changed this about six years ago to "Unique Browsers", which was a more accurate definition of the number of "browsers" (so the likes of IE, Firefox, Chrome, Safari etc) accessing a site rather than people. With device and browser proliferation "people" are becoming multiple Unique Browsers.

I have four devices and use three different browsers on each device and delete cookies every few weeks so I could represent as many as 20-plus Unique Browsers a month to a website. However, on the flip-side you do have non-tech people sharing a PC or device and using one browser so there are swings and roundabouts. This was called the "cookie churn" debate that led to Effective Measure and other Audience Measurement vendors to look at applying "browser factors" to the Unique Browser figure to determine a "Unique Audience" figure for each site and each region (In SA it's about 1.7 for desktop & 1.2 for mobile).

One of my biggest education battles in South Africa was making it clear Unique Browsers does not equal "people". In the USA and Europe they have moved away from monthly Unique Browsers to Daily Average Unique Browsers as the key metric to get away from the cookie churn debate. Users are unlikely to delete cookies daily, hence this stopped the argument about user duplication over a long period, like a month. There was even talk of moving towards Hourly Average Unique Browsers but time-zone differences stopped that for a while. The future really lies away from browser-side measurement in what vendors call "device fingerprinting" measurement. Each device has its own unique code or fingerprint which can be identified. What we are planning to do is measure the number of "Unique Devices" accessing a website in the future. This will also help with App Measurement and move us closer to a "people" metric. However, I think until we all have an imbedded microchip in our arms and scan it for every bit of media we consume, I don't think we will ever get to a proper "people" metric.

Arthur Goldstuck: It depends whether you want to measure the user base or the online media audience. In a fragmented market, you can only measure the use base through a combination of subscriber numbers and primary research. Once our market matures, and measurement and reporting systems mature, it will be possible to collate the numbers from just a few sources. Unique users can be tracked - per software platform. In other words, you can track unique Android phone users, or unique Android tablet users, or unique iOS phone users, or unique iOS tablet users, or unique Firefox users, or unique Chrome users, or unique internet Explorer users. However, it's not possible to track automatically across platforms, and anyone saying they do so is being creative in their terminology. The most heavyweight users have to be tracked across 5 to 10 platforms, and no current system used locally can do that with any level of accuracy. However, if you combine user tracking with valid primary research, you can get a closer approximation.

Ryan Harris: The term Unique User is often used without context. It is regularly used incorrectly to describe Unique Browsers or the number of logins registered on a website. A Unique User is a person and by using standard measurement tags it is not possible to directly measure the number people who use a website. This is because tags are only able to measure down to a browser or a device level while people often have multiple browsers and devices. All tagged solutions that offer a people metric have to convert their Unique Browser figures back to people. This is done by supplementing the tagged data with other research from software installed on user's devices and traditional research. The IAB SA works very closely with Effective Measure, SAARF and Telmar to supply granular level data regarding how many people use the internet in South Africa. The process is under constant refinement and the efforts of Peter Langschmidt to help with this cannot be understated. A joint industry committee, DiMTeC (Digital Measurement Technical Committee) is also being assembled to push the technical standards needed to measure online audiences in South Africa more accurately.

Peter Langschmidt: Effective Measure tracks both Unique Browsers and Unique Audience. Audience is tracked via a panel of 8,000 people. This panel's behaviour across all sites including non-tagged sites like Google, Yahoo, Amazon, and Gumtree is included. It is from this panel and an AMPS multiple device count that we are able to convert Unique Browsers to people.

Mike van Eck: In order to get an understanding of the number of PEOPLE, we need to evaluate the number of devices that we all engage with. Unique browsers are not people but de-duplicated or unique cookies. Most of us engage with multiple devices on a daily basis. According to the April Effective Measure stats, there are 25.3 million Unique Browsers across the publications which carry an Effective Measure tag. To find the absolute Unique User across devices you can divide the Unique Browsers by the device factor, which according to Effective Measure is 1.46 in South Africa.

Natasha Fourie: To get to people you can use AMPS for a broad indication, but probably more interesting is that IAB SA is working with Telmar in launching an internet planning tool, which uses Effective Measure data and weights it back to the AMPS numbers so when you buy impressions on any IAB SA member sites, it will calculate how many people in your target market you are reaching with an average frequency - which will be a game changer for planners. This has been completed and [is] currently in testing so [is] an imminent solution.

Why is it so difficult to track mobile users?

Alan Morrissey: Smartphones or smart devices are easy as they can handle cookies/JavaScript without any problems. The issues come up with "feature" phones, where they are not very good at handling cookies at all or very randomly. Due to this we offer a PHP tag that measures them slightly more accurately but again not a perfect measurement.

All web analytics vendors have this headache which is caused by platform limitations and not the measurement software. We use the best possible solution to measure this traffic so all sites are still being compared on an apples vs apples basis. Another key issue about 'feature' phones is profiling users on these devices. We are working on potential USSD methods to profile these users on platforms like Mxit or 2go, however we won't be able to associate cookie profiles by site as we do for desktop. With the onset of cheaper smart devices and hopefully under R500 smart phones and cheaper data we are hoping this issue will gradually fade within the next five years. However, we are aware this is Africa and that this could take a great deal longer. Feature phones are the most prolific device in SA and other large African economies like Nigeria, Kenya, Ghana and Egypt.

Arthur Goldstuck: It was easier when most mobile internet users only had a basic feature phone with a basic browser but, ironically, at the time when it was easier, the measuring tools were not yet adequate. Smartphones typically run several browsers as well as media apps. When you install your own choice of browser, chances are you are going to use that browser as well as the default browser that came with the phone - partly because many links will default to that browser even when you don't want to use it. Then you are also going to use proprietary apps to access specific sites, or aggregation apps that pull together content from a variety of sites.

None of these apps - including the browsers - talk directly to each other, so unless you are identifying people by their phone identifier, the IMSEI (International Mobile Station Equipment Identity) number that is unique to every phone, you don't know how many "users" are in reality being represented by one "person". In a market like Nigeria, many people actively use two or three phones, hence an inflated picture of the size of that market. Media and marketing love the big numbers, and become almost religious about defending them. But at some stage, realism must set in if you want to serve your market honestly and productively.

Ryan Harris: The heavy reliance on tag- and cookie-based measurement that is ubiquitous on desktop devices often does not work well on mobile devices. This is because mobile devices often cannot run the code in these tags or don't store the cookies correctly. There are also issues where large volumes of mobile traffic are channelled through proxy servers before actually going to the website and this also strips out useful information. BlackBerry and the Opera Mini browsers are notorious with their implementation of this. Another limitation is that the smaller screen size often limits the use of traditional online surveys to these users that would help in understanding them better. As smart phone penetration increases these issues become less of problem because they are able to handle more complex scripts. Traditional research is also very slow and because of the growth in mobile these figures are often a year or two behind the current situation.

Peter Langschmidt: We can track Unique Browsers. The hard part up to now is the pop-up profile questionnaire - which did not work on a mobile device and also the screen was too small to complete the survey. So the Effective Measure profile from the pop-up questionnaire was completely skewed towards the PC (read older, white, urban) universe and excluded the mobile audience.

Mike van Eck: As far as I understand, this is as a result of type of phone and nothing more. We currently use JavaScript tags for measuring mobile users, however these tags have limitations with regards to feature phones, which still forms a large part of the mobile audience landscape in South Africa. The best measurement tag is apparently a PHP tag and IAB SA will be driving accuracy on mobile measurement in the coming year.

Natasha Fourie: Yes mobile has been tricky and needs a bit more work. The good news is that Nicolle Harding, Vice Chair of Mobile Marketing Association of South has recently joined the IAB SA board, so Mobile measurement is up front and centre. RSA and the continent are really leaders in this space so it is up to us to develop international best practice.

In terms of where we are at the moment, we know IAB SA has recommended looking at international figures when looking at mobile as the IP address often does not correlate to your geographic location so filtering by country could be misleading.

The other challenge has been getting stable and representative demographic data for mobile. To get a true demographic read, the entire internet-enabled mobile devices have to be represented. There have been some technical issues in issuing surveys on some devices which has disrupted this process. However, Effective Measure is making headway in this space and we expect to see some richer data becoming available in the near future.

Some marketers have really taken to online marketing to achieve their business objectives, whilst others are still hesitant, often citing that the audience is too small. How would you respond to these individuals?

Alan Morrissey: With 27% of the SA population online in some form, digital must be part of the media mix, especially for future generations on mobile devices. These marketers could be missing a huge chunk of the market by not having a digital budget or strategy. Mobile is the most "targetable" device and ads can be tailored to the individual. This is far more measureable and direct than any other medium. TV, Radio, Print and Outdoor all seem "grape-shot" type media now compared to digital, which uses cookies and retargeting to send the right ads at the right time. Yes, traditional media will remain strong for the near future, but once all the other media become "digitised", marketers will need to know how to reach their target audiences digitally. Digital is not the future it's the present, get on board or get left behind.

In the UK, USA, Europe and Australasia, the more developed First World, digital Ad spend is nearing 40% of total ad spend, larger than Print, TV, Cinema etc. South Africa probably realistically sits at around 8% to 10%. Watch it grow exponentially in the next decade.

Arthur Goldstuck: It's laughable to suggest the market or audience is too small. However, where they do often have a point is that specific platforms or destinations remain too small for mass market campaigns. You cannot cite the size of the entire user base to argue for placement on specific sites based on the potential that the entire base may come to that site. Inflated estimates of market size are not good for anyone. The good news, however, is that the user base is growing fast, and eventually catches up to some of our most unlikely expectations. Who would have thought back in 2009, when we had around two-and-a-half million smartphones being used in this country, that one in three South Africans would have a smartphone within five years? That's huge, but it doesn't automatically mean it's an addressable market.

Ryan Harris: It would obviously depend on the business's needs where it chooses to advertise but the online audience is definitely not too small. 14 million people is not a small number in a country where 18.7 million people voted recently. This audience also has incredible spending power that is often neglected when making such statements. The caveat is that this audience is fragmented because of the incredible amount of choice that exists online. It means there needs to be shift in the approach to online marketing versus traditional channels like TV, radio and print. Online also offers incredible flexibility in achieving marketing objectives. The recent example of political parties whose advertisements were banned from public broadcast yet still reached large audiences by going online, is a perfect example of this. It is still possible to run large awareness campaigns online and it is also possible to run very targeted campaigns. The power and flexibility of this medium are incredible and the audience size continues to grow. It would be very naive to exclude online from the marketing mix based on this preconception.

Peter Langschmidt: Marketers have to look beyond the basic numbers, and market research figures have to be adapted and changed. This does not only apply to online. For example, AMPS shows that 50% of people read newspapers, which given the circulations is mathematically impossible with over seven readers per copy and only 3.2 adults per household; and 89% of copies being bought by household member. Do you see half of all cars stopping for the paper, or half of all adults reading in a taxi or at the office? The penetration of newspapers is actually around 35% for the household.

The digital audience overtook the printed audience last year, but one cannot see this from AMPS, as it under-reads online (due to respondent confusion in terms of mobile access) and over-reads print due to human nature and the 'recency' method.

Marketers and their agencies need to understand the limitations of measurement research and not blindly accept the figures of any medium. It cannot be summed up better than in the words of the great media researcher Jean Michel Agostini, "One needs to interrogate the data until you tame it, and then manipulate it".

Mike van Eck: Can 14 million potential consumers be ignored?

Natasha Fourie: There is no one-size-fits-all solution. As with all media channel decisions the question that needs to be answered is not "should I be in digital?", it is "what are my objectives and does digital answer this better than any other opportunity?"

Audience size is important, but so is reaching the right people and limiting wastage. Also, when looking at reach most people don't factor in that with digital, you are a lot closer to a guaranteed view vs many other media channels which can only offer an opportunity to see. Another factor to consider when looking at reach figures is how your audience is consuming the media and the value of the view. Passive consumption is great for achieving a warm and fuzzy brand feel and bonding, but active consumption (like digital) is better for generating action, or for highlighting brand USPs.

Beyond pure audience numbers, there are many marketing considerations where digital can play a role. Some examples include:

• Launch: Generate a big brand feel by utilising a home page take-over on some high-reaching publisher sites; showcase trial via interactive and shareable video tutorials; harness the power of brand ambassadors and key influencers.

• Media Synergy: Millward Brown which tracks noting and recall of TV adverts tells us that noting levels are declining, and increasingly higher media pressure is required to achieve breakthrough. Do you spend increasing levels of budget to achieve the same result (thereby adding to the clutter and contributing to the decreasing noting and brand confusion) or do you relook the plan? By applying media synergy and utilising complementary mediums you can counter this spiral.

Another consideration is TV as a passive medium is fantastic for building a brand but there is often a big drop off with any additional main message take-out. A solution is to include a digital component, as an active medium it is a great way to re-enforce the key brand benefit.

• Association with key environments: Digital offers a lot of premium content by the best publishers in the country. You can sponsor or own relevant sections for ongoing key brand association and reaching a highly engaged target market. I think all marketers intuitively understand the benefit of appearing in complementary premium environments - the rub off with the brand and the heightened benefit of focusing on people who are interested in your category.

• Tactical Association: Immediacy is one of digitals key attributes. This can be as broad as taking advantage of your typical calendar events such as Mothers' Day, Valentines, back to school etc; to real-time promotion of stock that needs to move, to time-of-day targeting for fast-food around meal times, to promoting your event. Lead times are shorter than most traditional media and material is cheaper to change.

• Amplification: You have invested in a sponsorship/event/initiative/PR stunt which was fantastic on the ground but only 100 people saw it. To maximise this investment you need to ensure that this is packaged and promoted to a broader audience. Branded and shareable videos online, digitorials, adverts with links to your website or ceding social media via key opinion leaders are all possible via publishing partners.

Timothy Spira: The notion that South Africa has a small online audience is a myth. It is now virtually uncontested that there are a minimum of 14 million South Africans online - a significant market in anyone's language.

While it is true that fixed-line broadband penetration in South Africa has lagged many other parts of the world (due largely to a legacy of blinkered telecommunication policy), mobile internet access is far more prevalent than previously reported in surveys like AMPS. This under-reporting of the online market size has, understandably, contributed to the reluctance of some marketers to dedicate a significant portion of their spend to the medium. However, these historical anomalies are quickly being ironed out by SAARF and will be comprehensively addressed in the new establishment survey that is currently user development.

Another factor that has held back online adspend is that this spend has itself historically been underestimated. Most online publishers do not submit their revenue numbers to Nielsen's AdDynamix survey, and as such AdDynamix still reflects online spend to be around 3% of total adspend. Unfortunately, this number in turn influences the portion of online spend that marketers and media agencies dedicate to the medium. So as an industry we need a more accurate way of measuring spend, and the IAB South Africa is currently working with PWC to achieve this, using the same measurement methodology that has become a benchmark in more developed online media markets like the US and the UK.

Addressing these historical errors in measurement of market size and media spend will no doubt go a long way towards compelling marketers and media agencies to take the online medium a lot more seriously.

Conclusion:

As is evident, determining the exact size of the South Africa online audience is no simple feat. Advertisers should not use the size of the audience as a benchmark however when planning their investment in online advertising. Regardless of the size of the audience, it's crucial to keep in mind that online advertising offers the unique ability to reach a target market with fine precision thanks to the likes of Effective Measure's demographic and psychographic surveys, but also the ability to track ROI (right down to concluded sale) through other measurement tools. Every media channel has its purpose and can achieve varying objectives, but when it comes to the ability to precision target and track ROI, online advertising is a tough one to beat.