Top stories

ESG & Sustainability#BudgetSpeech2026: SRD grant unchanged, other Sassa social grants see hike

6 hours

More news

ESG & Sustainability

South Africa’s carbon tax should stay: climate scientists explain why

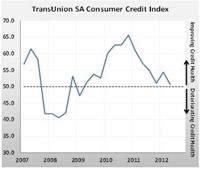

This indicates a marginal improvement in consumer credit health for the second quarter and the first half of the year compared to 2014. In addition, new account defaults and distressed borrowing levels have seen improvement. However, while the report shows a number of positive aspects, on-going economic challenges indicate that consumers are still under strain and will continue to feel the pressure in the second half of the year.

The CCI is a unique indicator of consumer credit health measuring the ability of consumers to service existing credit obligations within the constraints of their monthly household budget. It is based on a 100-point scale, where 50.0 is the break-even level between improvement and deterioration of credit health.

"Any number above 50 in the context of the CCI means that consumer credit health has improved over the past year. However, a number under 55 is considered only a moderate improvement. Given that the Q2 CCI is the same as Q1, we can ascertain that credit health has stabilised for the time being," explains Owen Sorour, senior vice president of Analytic and Decisioning Solutions at TransUnion.

"The improvement can be attributed in large part to more conservative lending from credit providers. We have seen a drop in the number of credit applications and an increase in the rate of declined applications, and these more prudent lending requirements by providers are paying off. However, despite this promising trend, the future for consumers is not optimistic. In the past few months the exchange rate and instability of the Rand have resulted in price increases, and a recent interest rate hike will further contribute to decreased cash flow," he adds.

According to the TransUnion payment profile database, the rate of new consumer loan defaults (accounts three months in arrears) declined by 8.3% year-on-year in Q2, compared with an 8.5% year-on-year decline in the first quarter. The rate of this decline has slowed since late 2014, which indicates that the best phase of improvement in repayment records may now be in the past.

Distressed borrowing shows the amount of revolving credit such as credit cards and store cards used by consumers as a percentage of their overall credit limit. Currently, households are using just over 50% of their credit limits, up from around 40% in 2007. However, while the numbers have increased over the past eight years, for the first time since Q3 2010 the CCI shows the level of distressed borrowing declining on a year on year basis.

Consumers are currently experiencing worsened cash flow levels as a result of a number of factors. The household cash flow measure shows growth in household cash flow fell from 2.6% year on year in the first quarter to 1.6% year on year in the second quarter. Price increases on non-discretionary items such as food, accommodation, petrol and other basic necessities have placed strain on consumers, particularly those from lower income groups. In addition, disposable income growth has slowed.

Rand depreciation poses a significant risk, as a stronger US dollar and slow domestic economic growth are placing the rand under renewed pressure. A weaker rand raises inflation and interest rate risks, which in turn impacts household budgets and can place strain on credit markets. Ultimately, what the CCI indicates is that the South African economy is struggling to recover from the downturn. In the short to medium term, we can expect pressure on consumers to remain as a result of rising interest rates and constrained cash flow.

"For credit providers, the key message of the CCI currently is to continue with cautious and conservative lending measures. It is vital to continue to assess risk accurately and predict the lower risk income earners, in order to keep default levels and distressed borrowing as low as possible. The new affordability assessment requirements mandated by the NCR will ensure more sharing of information around affordability, which will in turn assist credit providers in making improved decisions around lending," Sorour concludes.

Read the full CCI Report