Section 12J has been introduced to the South African Income Tax Act in 2009 - in an effort to afford small- and medium-sized entities equal access to funding in South Africa. It is only in recent years, however, that this opportunity has captured the interest of local retail investors.

Dean de Nysschen, research & investment analyst, Glacier by Sanlam

Essentially, the objective of this ruling was to provide a catalyst for equity funding towards SMEs and hopefully to contribute towards the drive for greater economic growth in the future. By investing in these vehicles, investors not only qualify for a full deduction of the total investment amount from their taxable income in the relevant tax year - but these investors will also play an indirect role in supporting the South African economy.

So how does the process work in practice? As a tax-paying entity – this includes trusts and companies - you would approach an accredited VCC (a list of approved venture capital companies can be found on the South African Revenue Service (Sars) website) with your investment. The recipient 12J company then invests this sum of money (in underlying investee companies via a private equity investment vehicle), and in return they would issue investors with a certificate for the full invested amount. This certificate allows the investor to deduct the value of the investment from his/her taxable income in the same tax year – essentially providing the tax payer with a tax-free investment opportunity. For provisional tax payers who submit tax returns at the end of February, the tax benefit can be deducted from the tax liability before provisional payments are made.

Issue of double taxation

The first catch relates to the potential issue of double taxation. When the VCC makes changes within the portfolio during the investment term, or if the investor wishes to sell the investment after the compulsory five year period - there will be capital gains tax (CGT) applicable to the sale, with the entire investment calculated as a gain. In addition, investors will pay applicable taxes when dividends are paid by a Section 12J vehicle. It is very important to note that the base for capital gain will be zero upon maturity of the investment – this is due to the benefit of 100% tax deductibility.

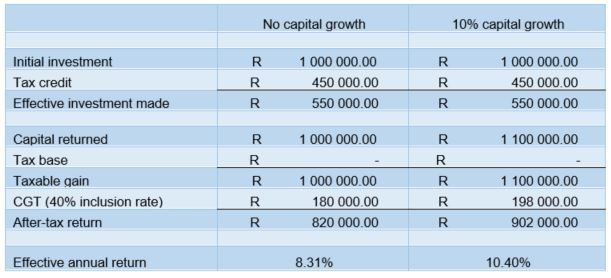

To illustrate this concept, Westbrooke Alternative Asset Management provides the following examples. Investor X has a marginal tax rate of 45%, and makes a R1m investment in a Section 12J fund – the actual net investment from the investor’s point of view will effectively be worth only R 550,000, as Sars will be funding the remaining R450,000 via the tax credit.

Now assume that the 12J fund merely returns the capital amount of R1m to the investor after five years, thus generating no capital growth over that period. This amount will be multiplied with an inclusion rate (40% for individuals and 80% for trusts and companies) and then by the investor’s marginal tax rate. For Investor X that would equate to a CGT liability of R180,000, which means that the investor will receive R820,000 after tax at the end of the five-year period. The result for the investor would be the equivalent of an 8.3% return on the investment per annum (the effective initial investment of R550,000 compounded by 8.3%, for five years, would return R820,000).

This is an attractive return considering zero capital growth, and could be enhanced further by any returns generated by the underlying investee companies (see below table, assuming the fund also generates capital growth of 10% over the five-year period).

Counteracting capital gains tax

Section 12J investments can also be very handy in counteracting present capital gains tax (CGT) events which an investor may have. Let’s consider Investor X as an example once more. Assume he has sold his beach house for R5m, and the base cost was R3m. He is now liable for capital gains tax on R2m of gains. At his marginal tax rate of 45%, and an inclusion rate of 40% - the investor will be due for R360,000. If Investor X uses the opportunity to invest R360,000 in a Section 12J fund, however, his resultant taxable income in that year would be R0, due to the R360,000 tax credit on offer.

Despite the fact that there are significant portfolio benefits on offer for investors, it is important to note that there remains the risk of capital loss. As a result it is critical to ensure that there is sufficient expertise and private equity experience within the team managing such a vehicle. As a result, much of the due diligence onus now falls on the shoulders of the intermediary, who needs a clear understanding of the fund structure, the underlying holdings and the nature of leverage being used within such a fund or by the investee companies. In addition he/she needs to be comfortable that the management team has a demonstrable VC track record - as there are sure to be many new players looking to capitalise on the Section 12J ruling.

Prospective investors should also scrutinise the fee structure applicable to these vehicles. Private equity vehicles are often synonymous with high upfront fees and high annual management fees. In addition there may be significant performance fees applicable to the investment. These fees should not necessarily be seen as a deal breaker, as long-term returns could be commensurate - but full awareness of the structure is required for effective client communication and to ensure investment transparency.

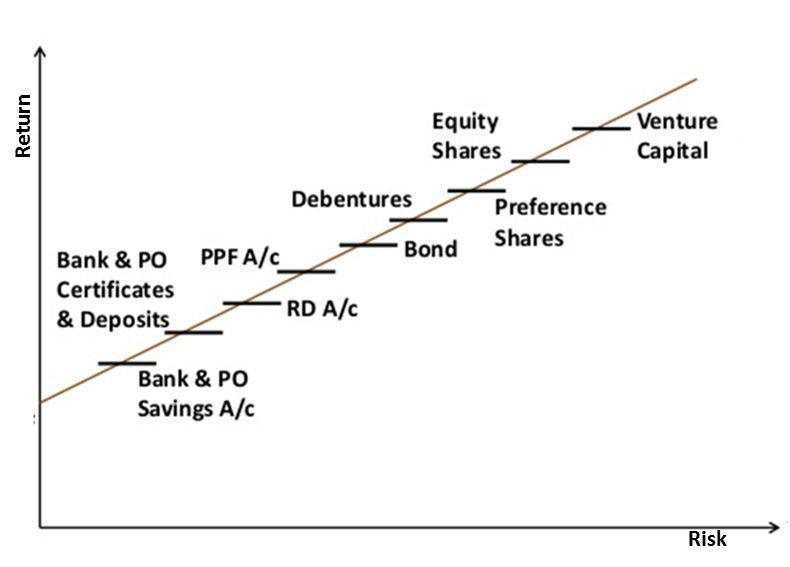

Next, consideration needs to be given to the asset class in question. Private equity – and VC is just a form of this asset class - sits on the highest end of the risk-return spectrum (see below risk return indicator), and as a result both the client and the intermediary should be fully aware of the applicable lock-in period as well the resultant longer time horizon required when making an investment.

What of the question of the applicable risk? Other than the considerations mentioned above, there are two major areas of risk for investors to be cognisant of. Invest12J broadly classifies these as investment risk and liquidity risk. The investment risk portion deals with the fact that venture capital investments are made into investee businesses which are generally unestablished and often in their infancy.

Naturally, there is a greater risk of failure with these businesses, as opposed to investing in more traditional companies, with a demonstrable track record of generating profit. The liquidity risk factor speaks to the lock-in period applicable to these investments - Sars requires Section 12J investors to be invested for a minimum of five years, in order to reap the tax benefit on offer. And even once this five-year period has elapsed, the investment return may well take further time to materialise - as another buyer needs to be found before the investment can be exited. In addition, it often takes a long time for these companies to mature to the extent that investors receive the benefit thereof. As is always the case with greater levels of risk however, the potential for larger than usual returns remains.

Despite the various challenges and risks highlighted above, we believe that the examples discussed clearly demonstrate the potential value that such a vehicle could add to an investor’s portfolio - when managed appropriately of course. Selective and strategic investments in Section 12J approved vehicles can definitely be beneficial for well-suited and informed investors. These investors will generally have surplus wealth and will often be in high tax brackets. Importantly the investor needs to have both the ability and the willingness to be strategically invested, without material time horizon and drawdown constraints. For these investors, Section 12J investing will certainly provide significant income tax relief, and could provide valuable investment diversification opportunities via the introduction of uncorrelated and alternative asset classes.