Ready meal and jam manufacturer Rhodes Food Group (RFG) announced its intention to list on the JSE's main board, joining companies like Pioneer Foods and Tiger Brands, owner of the popular Koo canned food range.

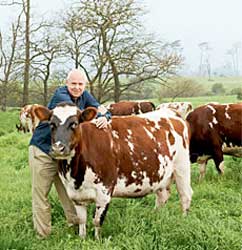

Rhodes' Bob Henderson, with RFG's Ayrshire herd says the listing will allow the company to accelerate its expansion plans. Image:

Taste MagWestern Cape-based RFG plans to raise R600m through the issue of new shares which will be used to fund growth and settle debt and shareholder funding that arose from a management buyout of a 29% equity stake in 2012.

The balance of the 100-year-old group is owned by private equity firm Capitalworks and Morgan Stanley Alternative Investment Partners.

Chief Executive Bruce Henderson said the proceeds of the primary offer would further strengthen the company's balance sheet and fund investment to accelerate its expansion.

The initial public offering (IPO), which will not be open to the public, will see it sell new stock equal to about 25% of the existing shares.

The company's regional division, which accounts for around 65% of revenue, covers SA and other sub-Saharan countries, including Kenya, Mozambique and Zambia.

Vunani Securities Analyst Anthony Clark said a listing should be well received.

Sizeable export markets

Avior Research Equity Analyst Jiten Bechoo says the listing will allow RFG to expand, particularly in sub-Saharan Africa while saving it about R76m a year. Image: Google Plus

"RFG, with its sizable export market and a growing demand for fruit globally is well-placed to continue its niche growth. With debt repaid after the IPO, an incentivised management and equity to raise future capital for deals, pending the rating, RFG as a mid-cap food counter, potentially, looks as juicy as its canned peaches," Clark said.

The company also exports canned fruit and fruit juice purees and concentrates to Europe, the Far East, the US, Canada, Australasia, Russia and the Middle East.

RFG, whose brands include Portobello and Bull Brand, also has an arrangement with Woolworths to provide ready-made meals like Lasagne Al Forna and to supply Ayrshire dairy products in the Cape.

Avior Research Equity Analyst Jiten Bechoo said the firm needed capital to grow in sub-Saharan Africa, and to improve its image and recognition. "From this perspective, listing would be good for Rhodes. Moreover, the change in capital structures does provide a cost saving to company of around R76m per year, which is no bad thing."

RFG recorded sales of R1.8bn last year.

"However, their ambitions signal management's view that private label brand penetration is increasing and that volume growth could be disproportionately high compared with the sector," Bechoo said.

Source: Business Day via I-Net Bridge