Top stories

ESG & Sustainability#BudgetSpeech2026: SRD grant unchanged, other Sassa social grants see hike

3 hours

More news

ESG & Sustainability

South Africa’s carbon tax should stay: climate scientists explain why

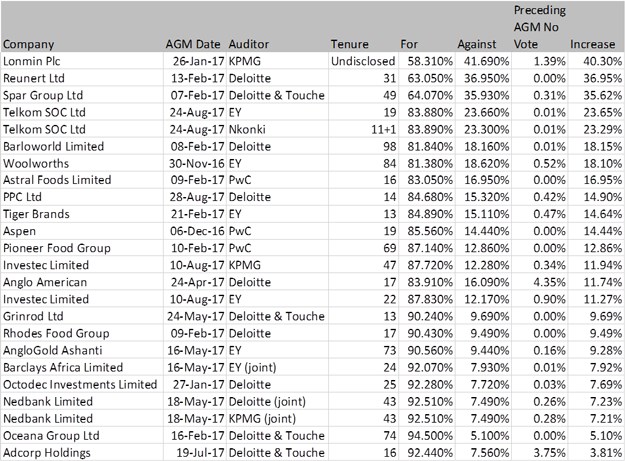

What is interesting is that shareholders are starting to take notice judging by the increased percentage voting against reappointing auditors, particularly those with a long tenure.

“The most recent AGMs to be subject to this increased shareholder opposition were Telkom and PPC Ltd, which reflected 23% and 14% increases in the no vote. While such an increase may seem insignificant in some instances, it indicates to us that even minority shareholders are finding their voice.”

Reading between lines, the Telkom and PPC votes took place after the KPMG story broke, and although neither corporate employed the audit firm, the media reports have no doubt shaken shareholder confidence in industry as a whole. It will be interesting to see if forthcoming AGM votes show the same trend.

Irba has been tracking the results of shareholder voting at annual general meetings (AGMs) since the MAFR announcement. There has been a visible movement towards voting against the reappointment of auditors, with 27% of the surveyed ordinary resolutions increasing the opposing votes by up to 40%, says Bernard Agulhas, CEO of Irba.

In December 2015, IRBA issued a regulation requiring audit firms to disclose their tenure in the independent auditor’s report to shareholders. This was to ensure that shareholders were aware of the length of the relationship between the auditor and their client, which should have also been considered by the audit committee when the auditors were up for reappointment.

“What is clear is that the shareholders are beginning to make their voice heard at AGMs regarding the necessity for firm rotation to end excessively long relationships. Where audit committees may feel a 20-year, 50-year or longer relationship might not impair auditor independence, shareholders are saying otherwise,” he says.

“Of the 102 auditor appointment resolutions tabled at annual general meetings since November 2016, 51 recorded an increase in opposition; of these 24 resulted in significant shareholder opposition to the auditor’s reappointment. The most significant opposition recorded an increase of up to 40% year on year in the votes against the reappointment of auditors.

Of those 24 resolutions that recorded an increase in the vote against the reappointment of auditors, only three had previously recorded an opposing vote above 1% (but less than 10%); the remainder had seen shareholders almost unanimously adopt the recommendation of the audit committee at the preceding AGM.

“The reality is that even with some shareholders opposing the reappointment of auditors, the vote is not binding without a majority. This is not in the best interest of minority shareholders.

“As a first step, we are satisfied that the rule to disclose tenure of audit has served the purpose of highlighting excessively long relationships between companies and their auditors. However, there is still more shareholder education to be done, as it is the shareholder – and not the management of the company - who is the auditor’s real client,” Agulhas says.