Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

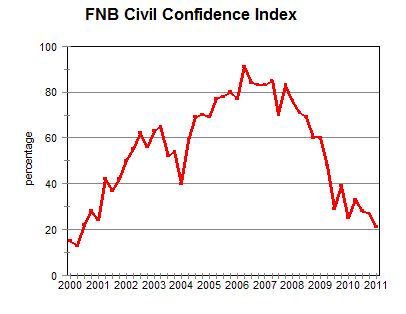

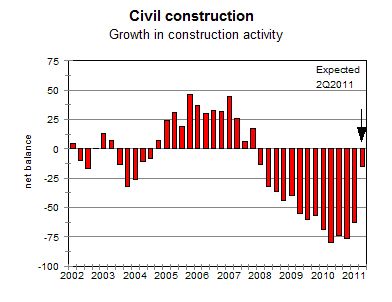

"A positive development is that construction activity was slightly better in 1Q2011 compared to previous quarters," says Cees Bruggemans, chief economist of FNB. This extends the trend that started in 2Q2010.

The 1Q2011 up-tick in activity appears to stem mainly from new work commissioned by the provinces. Little new work comes from the private sector (mainly infrastructure for housing projects and capital spending in the mining sector) and the work from the public corporations either went ahead at the same pace (such as the power stations for Eskom) or declined as projects are completed (such as the roads for SANRAL and the Gautrain).

In 1Q2011 mainly larger companies (those that operate on a provincial level) benefited from the new work contracted by the provinces, as the size and complexity of the projects were too big for the smaller firms (those that operate at a local level).

Hopefully the increase in work turns out to be lasting and part of a sustained turnaround and not a temporary flicker caused by provincial officials trying to achieve budget spending targets before the end of the fiscal year in March 2011.

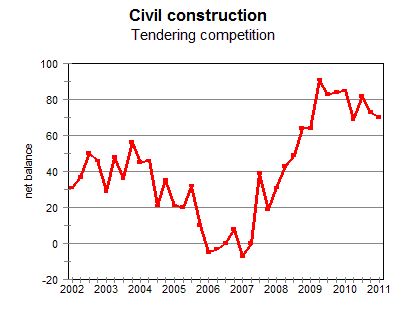

Notwithstanding the likely bottoming out of construction activity, conditions remained extremely tough and unsatisfactory in the civil construction sector in 1Q2011. Insufficient demand for work remained a huge constraint. As a result, tendering competition remained extremely fierce. This, in turn, suppressed profits and left firms with no other option than to continue retrenching staff to curtail costs.

In contrast to the residential and non-residential building sector that suffers from weak demand, the need for civil work remains high. The availability of earmarked funds (such as the regional and municipal infrastructure grants) and intense pressure on government officials to deliver may see the dire need for infrastructure maintenance and expansion (such as water supply and treatment plants) translate into effective new work for civil contractors.

The short-term outlook for the civil construction sector, therefore, looks brighter than that for the building sector. Historically the building sector recovered ahead of the civil construction sector, but this time the civil construction sector may be the first one to rebound.