Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

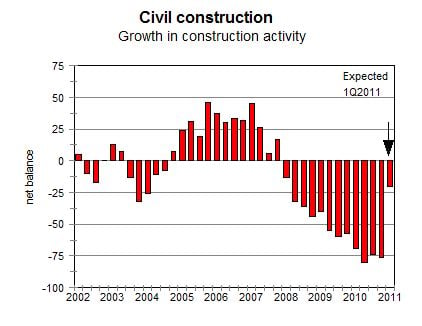

During 4Q2010, construction work contracted at the same high rate compared to the third quarter. The percentage of respondents indicating that an insufficient demand for work placed a serious constraint on their businesses increased from 84% to 90%.

What causes this lack of construction work? "Despite a dire need and the availability of funds, the awarding of government contracts to maintain and expand infrastructure have so far not compensated for the dramatic fall in private sector work since 2008," said Cees Bruggemans, chief economist of First National Bank.

The construction industry had to expand capacity sharply over the period 2005 to 2007 to handle the increased work from the private sector (mainly infrastructure for housing projects and capital spending in the mining sector), the public corporations (for example, the roads for SANRAL, the pipeline for Transnet, dams for TCTA, the airports for ACSA and the power stations for Eskom) and certain once-off mega government projects (such as the Gautrain and soccer stadiums).

The fall in construction work already hit the small firms (operating in only a particular province or local area) in 2008, but only started to affect the large firms (operating across the country and abroad) more seriously since about the middle of 2010 due to the different types of work they can take on.

The work of small operators dried up in 2008, as the private sector wound down nearly all housing and accompanying infrastructure projects. So far, increased work has not been forthcoming from the government despite the dire need for infrastructure maintenance and expansion (such as water supply and treatment plants) and the availability of earmarked funds (such as the regional and municipal infrastructure grants).

Large firms continued to have sufficient work until about the middle of 2010, as new work (such as the building of the soccer stadiums and new power stations) and the continuation of some existing work (such as the Gautrain) largely compensated for the loss of other work (such as the cut-back in investment in the mining sector). However, large firms - like their smaller counterparts - faced falling workloads since about the middle of 2010 as no new mega projects were started and some existing projects neared their end.

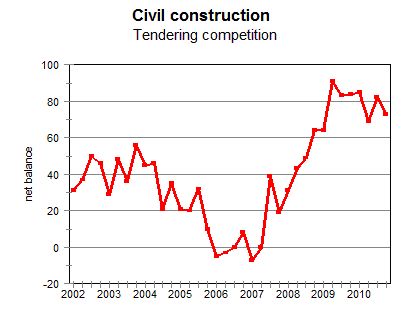

In this environment of little work, tendering competition is extremely fierce. Many firms put in low tenders to get at least some work, which hurts profitability. To remain financially viable and reduce capacity, firms continue to reduce staff. Employment in this sector is expected to fall further.

Respondents continue to expect business conditions to improve and the volume of work to recover noticeably during the upcoming quarter. This expectation is logical given the visible need for and repeated pronouncement of increased government spending on infrastructure.

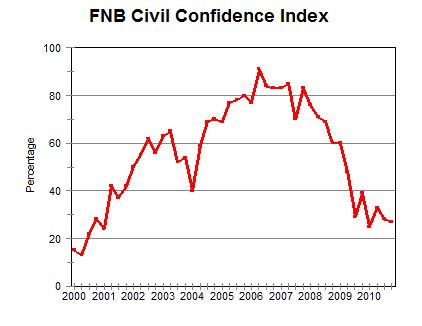

However, if structural reasons are causing the absence of government work and the problem persists, then construction work will only pick up when private sector spending increases in 2012 and beyond. In this case, the FNB/BER construction confidence index will most likely continue to move sideways at low levels in 2011.