Top stories

More news

The top three categories of interest to consumers this Black Friday are:

Clothing and groceries were the most popular categories in 2020 during Black Friday. This year, however, electronics have overtaken these categories. Despite the tough economic times, 34% of consumers said they plan on spending between R2001 and R5000, while another 27% plan on spending even more (between R5001 and R10 000). Not surprisingly, consumers with higher household incomes are willing to spend more than those with lower incomes.

Consumers search for Black Friday deals by searching online (73%) or social media (47%). It goes without saying that if retailers want consumers to see their deals, they need to ensure they have both an online and social media presence.

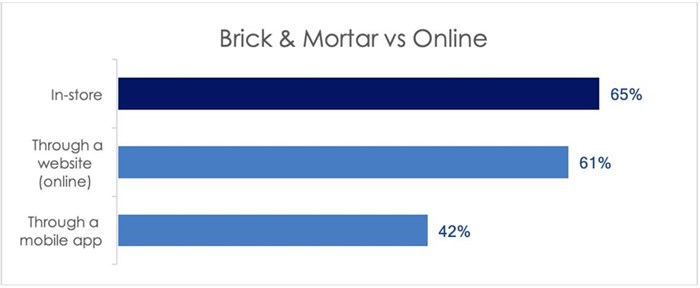

The majority of consumers are planning to shop in-store on Black Friday. Online shopping, however, does not lag far behind which means that preparation for both channels will be key.

Due to the pandemic, consumers are also willing to buy almost anything online, with no category out of bounds. The most popular categories for online purchases are clothing (63%), electronics (61%) and household appliances (50%).

This year consumers are looking for bargains when it comes to Black Friday deals. A bargain means the product needs to be on offer at a significant decrease from the original price (62%) or as specials which they would not usually find (51%). They are also searching for deals online, prior to purchase, so they need to be able to see each retailer’s price points, and what a significant decrease in price entails.

How consumers will truly behave during Black Friday in comparison to their predictions will be interesting to see. This year Ask Afrika will be running another study on Black Friday, to check in with consumers and unpack what was bought and how much money they spent. Look out for the next instalment!

1Source: A Powerpanel Study conducted by Ask Afrika

You can tap into Ask Afrika’s Power Panel which amplifies citizen and consumer voices on topics such as products, services, government and social issues, to name a few.

The Power Panel is customisable to any type of research study, budget and business question. Just ask us!

Ask Afrika is a decisioneering company. We support our clients’ decisions through facts. Typically, our clients’ require information around social research and philanthropy, experience measures and consulting, and brand dynamics.

Social research decisions are required around HIV/Aids and more recently, Covid-19. Educational and early childhood development, fair-trade shopping, media and financial research are some of the areas we love to work in. NGO’s, public- and private sector clients choose to work with us to get the pulse of the nation.

Besides being decisioneers in brand and customer experience research, Ask Afrika is well known for creating some of the most useful, go-to industry benchmarks, including the Ask Afrika Orange Index®, the Ask Afrika Icon Brands®, the Ask Afrika Kasi Star Brands and the Target Group Index (TGI). Ask Afrika’s knowledge of brands is extensive. The Target Group Index (TGI) survey, which measures psychographics, service, products, media and brands, has been used by the majority of the top 50 advertisers and media owners in South Africa for nearly two decades.

Our clients operate across various industries, including retail, telecoms, finance, and the public sector. We offer tailor-made and ready-to-use offerings for all our clients regardless of the size of project.

In addition to being brave, agile, vibrant and experimental, we apply deep thinking to every research project. Our aim is to be great at everything we do and to make a meaningful impact.

Partner with Ask Afrika in order to confidently make game-changing business decisions that grow your business.