We've all had those moments of looking at our bank balance and wonder where all your money has gone, well FNB has launched a new app that keeps track of your spending at any time or place.

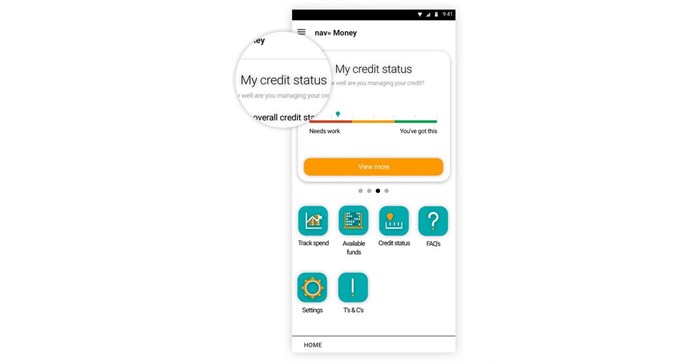

Called nav» Money, the tool is part of trilogy alongside nav» Home and nav» Car, and is designed to help build financial awareness.

Jolandé Duvenage, nav» chief imagineer (CEO), says the bank has embraced fintech as a disruptive platform by using data and offering customers multichannel access to their money. “Whether spending or saving, we need to be on top of the money management game. Building financially suitable fintech solutions has largely been influenced by our customers’ needs and wants.”

The nav» Money tool will provide an updated view of the customers financial health; based on three simple views:

- Track my spend

This feature lets consumers know whether they are spending more than they are earning and provides spend tips to manage their cash flow better.- My available funds

Lets consumers know what's left to save and spend after all known upcoming payments. All the scheduled payments and debit orders are taken into consideration and if you are experiencing a shortfall, you can access other funds available like eBucks, savings, and credit – all in one useful place.- My credit status

FNB assesses various data, including internal information and credit bureau info, to rate a customer’s credit fitness across seven helpful drivers of behaviour. Know exactly what you’re doing right, and where you could improve, with personalised tips on late payments, credit limit usage, your proven track record and more.

Highly competitive

The bank first launched nav» Home in 2016 which has seen one-million visitors to the platform, with R3.1bn in pay-outs made. This was followed by nav» car which also has 203,000 vehicles were loaded and 10,500 licence renewals since launch in 2017.

“We are in a highly competitive environment that is challenging the way banking is done. Given this context and the pressures that customers face; we need to ensure that we provide customer-centric solutions that only add to the betterment of our customers lives. Helping our customers navigate their financial journey remains a core focus for the bank.” concludes Duvenage.