Top stories

More news

Logistics & Transport

Uganda plans new rail link to Tanzania for mineral export boost

You have to do your homework, she said, in order to identify the areas of the market that are performing well. You can't base your investment decisions on oversimplified data as the South African property market incorporates a wide range of performances that are driven by a number of factors.

Gordon pointed to three fundamental factors, according to Savills, that are crucial in determining how the property market works: demographics, affluence, and availability of land and housing. Where these three factors are positive, she said, the property market is generally buoyant.

South Africa currently has a bottom-heavy population pyramid with two thirds of the country's population under the age of 34; 34 is also the average age of the first-time property buyer. "If you've got all of those people coming into the market, it pushes everyone else up the property ladder," explained Gordon, and they are already having a huge impact on the market. According to data from Ooba, loans issued to first-time buyers rose from 40% in 2007 to 55% in 2015. While this has dropped a bit since then, due to the economic sensitivity of first-time buyers, it is anticipated in the long term that that percentage will continue to rise. "In terms of sheer numbers," said Gordon, "South Africa has a strong positive for the local housing market."

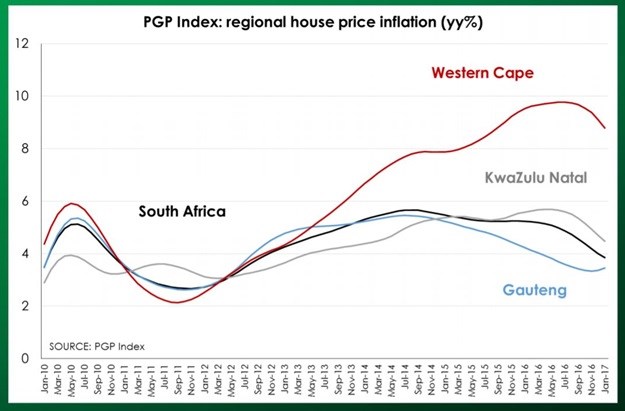

The stand out regional market of late has been the Western Cape, with semigration to the province from the rest of South Africa becoming increasingly popular. According to FNB's data on repeat buyers, 17.4% of all sales in the Western Cape were to people in other provinces, particularly from Gauteng - this is another major source of demand for the Western Cape housing market, said Gordon. Cape Town, apart from its profile as a major tourist destination, also has international appeal based on the lifestyle it offers high net worth individuals and millennials.

While South Africa's declining GDP is not good news for the national property market overall, growth in South Africa's cities remains strong, she said, using Cape Town as an example - over the next five years, there are plans for around R16bn worth of investment in the city's CBD. Other growth nodes she referred to include Kwazulu-Natal's North Coast and Sandton CBD. "Yes, it's disappointing that the overall economy is not growing well and there are repercussions, but in terms of property markets, there are still really vibrant growth nodes and those are the areas in which you want to look for properties as an investment," said Gordon.

Contrasting Cape Town and Joburg, Gordon spoke of expensive cities versus expansive cities - Cape Town's limited land availability due to geographical constraints makes it an expensive market, while Joburg's expansiveness allows for greater room for development and in turn a greater supply and lower average house price.

Once these fundamentals are established, as a potential investor, you need to understand the type of lifestyle people are looking for and what kind of property would be most suitable to them, said Gordon. Things to consider include traffic congestion and access to reliable public transport, transport expenses, and distance from work and schools.

A very strong international trend, which is now picking up in SA as well, is the 'live, work, play' lifestyle which entails giving up the large suburban home and making use of public and/or private facilities. Another lifestyle trend involves self-sufficient estates which provide a range of facilities including schools, hospitals and retailers. Transport corridors are also attractive to property seekers owing to convenient public transport access.

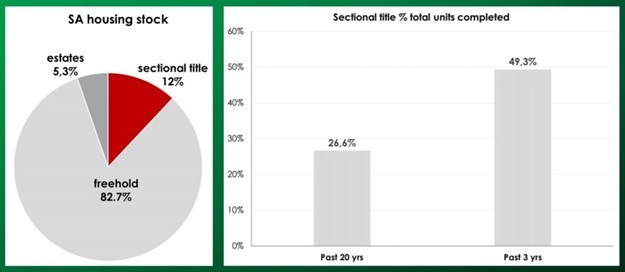

While people usually downscale during economic downturns or are prompted to because of their life stage, it is now also becoming a lifestyle trend, explained Gordon, as smaller homes require less of an ongoing time and monetary investment to maintain. According to data from Absa, nearly 83% of current housing stock in South Africa is freehold homes, 12% is sectional title or apartments, and 5.3% is estates. While freehold homes dominate the market, over the last three years nearly half the units that have been built are apartments. "What that's telling you is that the current stock is old-fashioned," said Gordon. "The future is about apartments, and that's where the demand is and the market is responding to that by producing more apartments, but it's going to take a time before that adjustment is reached."

Whether to Airbnb a property or rent it long-term is something that also needs to be considered when buying an investment property as this impacts how long it would take to pay off that property. With Airbnb, however, beware the potential backlash, warned Gordon: "It is worth investigating what you can generate using Airbnb versus long-term rental. The only difficulty with Airbnb is that you are starting to see major backlash against it across the world because in some cities it is pricing locals out of the market."

The Western Cape leg of the Property Buyer Show took place 8-9 April at the CTICC. For more info, go to www.propertybuyershow.com.