Customer satisfaction in the motor industry - a different view

“The traditional demographic categories of age, gender and race no longer have the influence on satisfaction that they used to,” states Richard Rice, Client Services Director at Synovate. “Over the last decade, buying power has increased across the market, bringing a new demographic profile to the market. Whilst there were distinct differences between the satisfaction levels of different demographic groups in the past, vehicle owners are now a lot more consistent in their perceptions of service levels.”

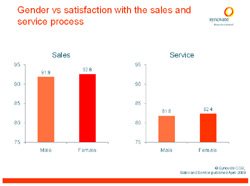

From a purely demographic perspective, there are some small differences that remain. For example, older people tend to give higher scores than their younger counterparts. Men appear to be slightly more critical than women whilst Black and Indian customers return slightly lower scores than White and Coloured vehicle owners. “So while there are some differences between the traditional demographic groupings, these are not nearly as pronounced as they were in the past and we cannot continue to put people into ‘boxes' based on their age, race or gender,” says Rice.

So, does that mean that all automotive consumers the same?

“Absolutely not,” states Rice, “But the real differences are only visible if one takes a different view of the market.”

Synovate has analysed the results of their Sales and Service Satisfaction surveys using their ProfilerTM segmentation tool. Here, customers are grouped according to attitudes about their vehicle and how they behave towards their vehicle rather than on their demographic profile.

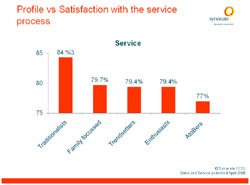

The largest segment of the car market is made up of traditionalists (26.6%). These are ‘average' South Africans and when it comes to choosing a car, they tend towards something that will not stand out in a crowd, a car that reflects their relatively traditional and conservative lifestyle. Their vehicle is very important to them but more because it helps them to ‘fit in' and demonstrates that they are rational and sensible. “From a customer satisfaction perspective, this is a relatively forgiving group,” notes Rice “and they generally return the highest scores for both the sales and service transaction.”

Quite the opposite are the trendsetters (17%). This very image conscious group will always go for the latest and greatest. For them, their car is a badge that they wear and their car is only important to them when other people can see them in it. They are generally the early adopters of new models and are the risk takers of the industry.

“These drivers must stand out in the crowd,” says Rice, “and their car is one of the most important possessions that they use to get recognition. Interestingly, however, they are relatively average when rating dealerships on the service that they receive and for both sales and service, they return very average scores,” states Rice.

Two other groups of owners are also pretty ‘average' when rating the service they get from dealers although these groups are very distinct from one another. The first of these is made up of family focused car owners. These are very rational consumers and take into account the practical needs of their families such as space and functionality when purchasing a vehicle. Safety critical items are also very high on their priority list and this is their key concern when servicing. “Scores for this group are generally in the mid-range but they can be extremely critical if safety items such as brakes are not working as they should,” says Rice.

The second group are the enthusiasts (20.2%) and these are people who just ‘love' their cars and the experience of driving. They are fanatical about the appearance and performance of their vehicles and can be very demanding customers. The pleasure of buying a new car for the enthusiast reflects in the relatively high scores that they give for the sales process. However, they are more critical of the service process and here they return comparatively low scores. “The enthusiast is very critical of the service process simply because of the extremely emotional relationship they have with their car,” notes Rice, “and any slip or lack of attention to detail will be punished.”

And finally, the most critical of all vehicle owners. The A-to-Ber (11.2%) has a purely functional relationship with his or her car and it is simply there to get them from a to b. Any money spent on a car is a grudge and they take no pleasure in the sales experience and even less in the service experience which is seen as a necessary evil. Their budget-driven approach makes them extremely critical and they return significantly lower scores than the other groups for both sales and service and are extremely difficult to please.

“Getting to know your customer is vital to ensure that you deliver the type of service that they expect,” concludes Rice, “and it is definitely not as simple as making assumptions based on their race, gender or age. The enthusiast will want to hear about power, performance and the technical aspects of the car whilst the A-to-Ber will only be concerned about the bottom line of the invoice.”

- Unlocking the value of creativity in advertising: How to bridge the creativity gap15 Apr 13:47

- 4 habits keeping your brand poor26 Mar 16:08

- Understanding consumer mindsets for growth in 202407 Mar 08:52

- South Africa's unemployment nightmare: The burden on its people09 May 10:05

- Global survey shows shrinking trust in internet29 Nov 10:17