Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 1 day

More news

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

It’s been nothing less than a procession: Truworths bought Office Retail Group for R5.5bn; Spar spent R1bn buying 80% of BWG Group, the company which owns the Spar brand in Ireland and England; The Foschini Group spent R2.6bn buying 85% of the UK’s Phase Eight.

And there’s no sign of this abating. Rumours are rife that Foschini — whose brands include Markham, Totalsports and American Swiss — is on the prowl for more retailers in Europe.

Shoprite chairman Christo Wiese, discussing this issue with the Financial Mail recently, said it was not as if local retailers were abandoning ship; it’s just that once you’re a certain size, you run out of options to expand locally.

Yet there does seem to be an almost indecent haste to buy anything offshore.

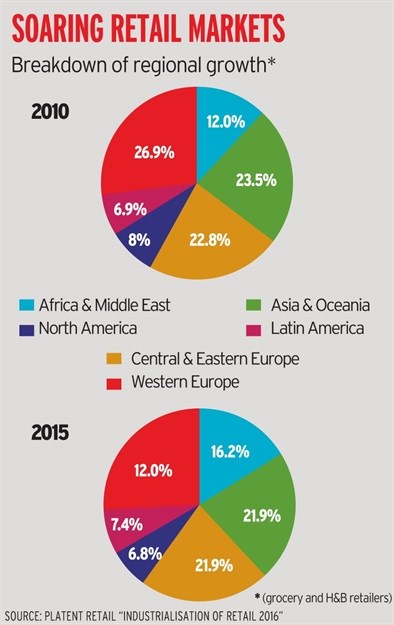

True, some of this expansion has been elsewhere in Africa. A report released last week by Planet Retail, titled “Industrialisation of Retail 2016”, shows that the fastest growth in investment was in Africa and the Middle East over the past five years.

Spar International has been the big pioneer on the continent. It has entered Cameroon, Lebanon and Oman. Spar SA, whose share price has risen over 120% in the past five years, entered Angola in 2014.

So if Africa is going gangbusters, why is Europe such hot property?

Of course, the cliché of “offshore diversification” is always trotted out.

But if it was simply that, surely SA retailers would have done more to crack the Asian market, where growth is set to top 5.3% this year?

The International Monetary Fund reported recently that Asia’s growth will continue, accounting for two-thirds of the global economy, while Europe’s is expected to remain moderate.

Europe, of course, has a sizeable and mature retail market despite the difficulties its economy faces.

That market is also considered transparent and friendly to foreigners.

But this curious bias in SA’s retail landscape dominated much of the discussion at the Consumer Goods Forum in Cape Town, which attracted the equivalent of the global retail industry’s rock stars.

Besides the local brass (Wiese, Pick n Pay CEO Richard Brasher), Walmart CEO Doug McMillon, Alibaba CEO Daniel Zhang and Tesco CEO Dave Lewis vied for the spotlight.

The event produced telling insights into SA’s space in the future shopping landscape.

Perhaps the answer, as Nielsen retail president Steve Matthesen points out, is that some companies seem to think that emerging markets in Asia have run their course and are unwilling to invest in them.

That would be misguided, though.

“China and India will be growing twice as fast as developed markets,” he says. “In India specifically, there is a rise in the number of people who classify as middle-class. This means purchasing power is increasing. These markets are going to be important.”

There are other reasons why companies are reluctant to invest in Asia: red tape, arbitrary regulation and long-term uncertainty.

Alibaba’s Zhang says while China is often seen as something of a holy grail for companies on the expansion trail, the fact is that half the population still live in hard-to-access rural areas.

“This means it’s difficult for retailers to reach customers through the traditional method. It becomes more important to find partners to navigate the economy.”

But as Naspers’s success with Tencent illustrates, once you’re able to access China’s 1.3bn people, there’s big money to be made. (Tencent’s net income has soared from R23.2bn to R65bn in five years, underpinning Naspers’s 485% share price rise over that time.)

China remains the world’s largest e-commerce market, worth about US$603bn last year. To put that in context, China is selling far more goods online every year than SA’s entire gross domestic product of $350bn. And its e-commerce market is set to soar to $892bn by 2018.

“China needs companies that are professional and adventurous. It’s such a unique market that companies need to be innovative if they want to succeed,” says Zhang.

It seems that when it comes to commerce, China may be the new New York (if you can make it there, you can make it anywhere).

Some big names have struggled. Even Walmart has suffered from negative like-for-like sales growth in China over the past 12 months, says the Planet Retail report.

Robert Gregory, Planet Retail global research director, says Asia ought to be of interest to expansion-minded retailers.

“While some Asian markets have fallen somewhat out of favour, others — like Vietnam — have appeared on the international radar of leading players. A combination of strong economic growth, rising incomes for a large and relatively youthful population, a burgeoning modern retail scene combined with recent deregulation has increased the attractiveness of the market,” he says.

Of course, rather like an African expansion strategy, you have to be selective about which Asian markets you enter.

“In some respects it’s the reverse of what we saw a decade ago, when leading players could be accused of planting flags in a number of markets in the assumption that rewards would follow,” he says.

Matthesen says while average incomes might seem low in countries such as India, there is huge money to be made from these economies.

“What companies need are good strategies to unlock the funds. Consumers are willing to pay a premium price for innovative new products. But what’s important is to get involved in these markets,” he says.

Provided you have a long-term view, that is.

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za