Top stories

Marketing & MediaWarner Bros. was “nice to have” but not at any price, says Netflix

Karabo Ledwaba 2 days

More news

Logistics & Transport

Maersk reroutes sailings around Africa amid Red Sea constraints

However, simultaneously, Mexico introduced a sales tax of about 8% on a wide range of nonessential foods high in sodium, added sugars, or solid fats — "junk food".

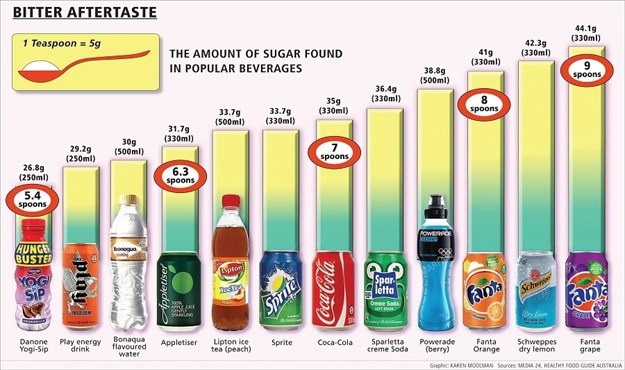

Finance Minister Pravin Gordhan proposed a tax on sugary drinks in SA for next year. He did not state the proposed tax rate, although it has been estimated that a 20% tax would bring in R7m annually to the national coffers.

Such taxes, known as Pigouvian taxes, are reasonably common among governments that perceive that the standard taxes on a market activity (in this case sales of sugary drinks) are not enough to outweigh the negative effects (high rates of obesity). SA’s so-called sin taxes on alcohol and tobacco products, and taxes on polluting industries in other countries, are other examples.

The consumer website Retail Price Watch, which has data on household food prices going back to 2012, looked at the inflation rate on sugary drinks in the 2012–15 period, as well as inflation on three common confectionery products.

With annual food inflation just more than 6%, compounded in the three-year period to about 20%, it appears that inflation on sugary drinks has been kept artificially low by the enormous influence of Coca-Cola. Because Coca-Cola has kept its prices low, presumably to maintain its 60% market share, competing products have had to be priced in the same range. In the case of Oros and Coo-ee, a sugary drink popular in KwaZulu-Natal, the prices have actually decreased since 2012.

It could be argued that a 10% tax will in effect make very little difference to a price that is held artificially low to tempt unwary consumers to suck in a bottle a day. This low price extends to diet colas as they are generally priced similarly to their more sugary rivals. (A sugar tax will at least have the benefit of making diet colas relatively cheaper, which is in line with the aims of a Pigouvian tax).

However, the unintended consequence of Gordhan’s tax may be that Coca-Cola continues to hold prices low, forcing other local players (many of which have already fallen by the wayside even without the added tax burden) out of the market. It would not be the first time that the company has resorted to such practices.

While Gordhan is clearly aware that we all need a 2-litre Coke to watch the soccer on a Saturday afternoon, he has perhaps forgotten that this must be accompanied by a packet of chips, no matter how poor the household.

A further point to ponder is that "local is lekker" when it comes to sugary drinks, but South Africans have an unabated desire for imported confectionery. Brands such as Lindt, Toblerone and Royal Dansk continue to grace our supermarket shelves despite their high prices.

If the Treasury were to spread the burden with a tax on junk foods simultaneously with the one on sugary drinks, there could be a real and measurable benefit to the population in terms of lower levels of obesity, as there was in Mexico.

Another benefit is that imported confectionery might be taxed out of the picture, which would improve our balance of payments and benefit the domestic confectionery industry. In addition, the sugar industry would not be the only one to bear the brunt of the "obesity" tax.

Incidentally, Mexico is using the tax revenue for specific social purposes, a great public relations stunt that has made it more palatable for consumers and sours industry counterattacks.

SA could consider using the money to fund early childhood development, for example, or broadband access for rural areas.

While nobody wants to pay extra taxes, there is at least some point to a Pigouvian tax. Each individual can decide on a case-by-case basis if he or she wants to pay it. Not paying it has a benefit in reduced obesity. This is a win-win situation, but is probably not effective in which one player has such a huge influence on the price of the whole segment.

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za