Top stories

HR & ManagementNike under investigation for allegedly discriminating against White employees

6 Feb 2026

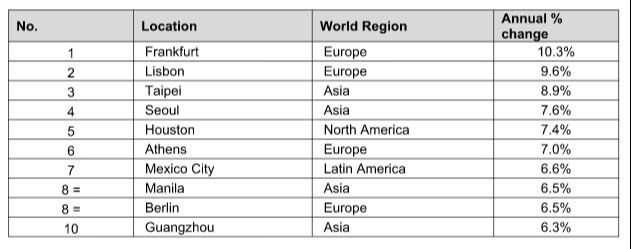

Highlights from the index include:

“Despite wealth growth and interest rates in most advanced economies remaining at record lows, the slowing global economy, rising property taxes and, in some cases, a surplus of luxury homes for sale, weighed on price growth.

“The results of our Prime International Residential Index reflect this slowdown. While growth ranged from double-digit hikes in some markets to significant falls in others, we saw a shift in the trend of moderating growth that has prevailed since 2013. In 2019, the 100 locations covered by PIRI recorded average price rises of almost 2% - up from 1.3% in 2018, but still some way off the 2.8% recorded in 2013,” says Kate Everett-Allen, head of international residential research at Knight Frank.

Hong Kong prime price increases ended 2019 at 2.9%, with a mortgage cap reduction and three interest rate reductions mitigating some of the impact of the political volatility. Singapore (1.2%) is firmly back in the spotlight – the higher rates of stamp duty for overseas buyers are no longer considered draconian, rather a trade-off for stable politics and a secure currency in a city-state that applies no capital gains tax or estate duties.

Sydney leads the five Australian markets tracked by PIRI with price growth of 3.7% - constrained supply and cheaper finance are underpinning prices. Mounting challenges, both economic, political and climatic, are curtailing prime price growth for our African cities. Prime sales in Cape Town held up but prices dipped (-1.5%) as longstanding vendors proved more flexible on price.

Dubai’s hosting of Expo 2020, the first to be held in the GCC region, along with an overhaul of investment visas - as well as greater powers for Dubai’s Real Estate and Regulation Authority (RERA), which empowers it to oversee the strategy for all future real estate projects - are together adding some optimism to the market. The annual rate of decline slowed to -0.7% in 2019.

Monaco remains the world’s most expensive city.

Says Everett-Allen: “Monaco continues to be the most expensive city in which to buy luxury residential property. $1m buys just 16.4 square metres of accommodation here - the equivalent of a bedroom. This is followed by Hong Kong and London. New York slipped to fourth place in 2019 although the gap between London and New York is small with currency shifts also proving influential.”