How to value a social media company - PwC Valuation Index

The quarterly index focuses on recent valuation trends in the technology sector and asks if we are in the middle of another technology bubble as very high valuation multiples are being reported in the US for social media websites as they go through the IPO process.

In talks

In September 2006 Yahoo! was reportedly in talks to buy Facebook for US$1 billion*. In August 2010 reports suggested Facebook had a valuation of US$34 billion. This increased to US$50 billion in January 2011 following an investment from Goldman Sachs. More recently, some investors have mooted that the price should be as high as US$80 billion. LinkedIn launched its IPO on 19 May at an enterprise value of US$4.1 billion, which had risen to US$9 billion at the end of the first day of trading. It is perhaps unsurprising that some commentators have seen these rapidly growing valuations of social media sites as indicators of a bubble developing in the sub sector, but the evidence from listed technology companies does not support this.

At the height of the tech boom in 2000 Price/Earnings (PE) ratios for UK listed technology companies peaked at close to 90x, compared to a wider multiple of around 25x for the market as a whole. Today the PE ratio for listed technology companies of 16x is only slightly higher than for the overall market multiple of 15x, with a similar picture in the US. Therefore, a bubble does not seem to be forming for the technology sector as a whole, certainly for quoted businesses.

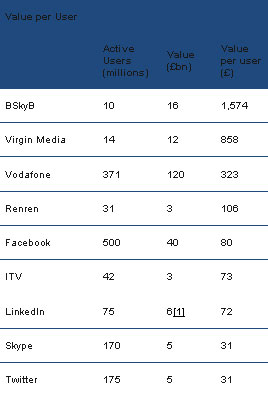

For social media companies, the valuation picture is different. In many cases, traditional metrics like PE ratios are not valid as such enterprises regularly prioritise growth over earnings and, with no earnings, PE ratios become an inappropriate valuation tool. On the presumption that subscriber bases can eventually be monetised, an alternative valuation approach of 'value per user' can be used to compare social media valuations to more established telecom operators and broadcasters. See Figure 2 attached.

Figure 2: Value per user for selected companies

Ian Coleman, partner, PwC said: "When you look at value per user metrics, the valuations for some of these businesses begin to make more sense. The LinkedIn share price increased sharply on IPO, taking its enterprise value to US$9 billion. This represents value per active user of around US$120, which compares to Skype's value per active user of US$50 (based on the Microsoft transaction), implying that investors believe it may be easier for LinkedIn to monetise its customers. Certainly, the Skype benchmark is based on a hard cash deal and therefore provides some support for other social media valuations recently inferred."

'No bubble' forming

Simon Harris, technology valuation specialist at PwC, commented: "There does not appear to be a bubble forming for the technology sector as a whole, and there also appears to be some support for the valuations of social media sites. Google was trading on very high multiples after its IPO and is now a hugely successful company, so high PE multiples should not necessarily be taken as an indicator of a business being overvalued."

"The ability of social media sites to innovate in the long term, and to retain and monetise their subscribers, will be the true test of whether such valuations are merited."

This is backed up by the evidence that of the 100 companies in the Techmark Focus Index in 2000, 43 are still around today while the majority of others were bought out. Only three went out of business. The average PE ratio of those companies still listed since 2000 is 26.5, compared to an average ratio of all companies in the Techmark index of 15.8.

*Exchange rate at time of posting: US$1=R6.94

Source: PricewaterhouseCoopers

PwC firms provide industry-focused assurance, tax and advisory services to enhance value for their clients. More than 161 000 people in 154 countries in firms across the PwC network share their thinking, experience and solutions to develop fresh perspectives and practical advice.

Go to: http://www.pwc.com