Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

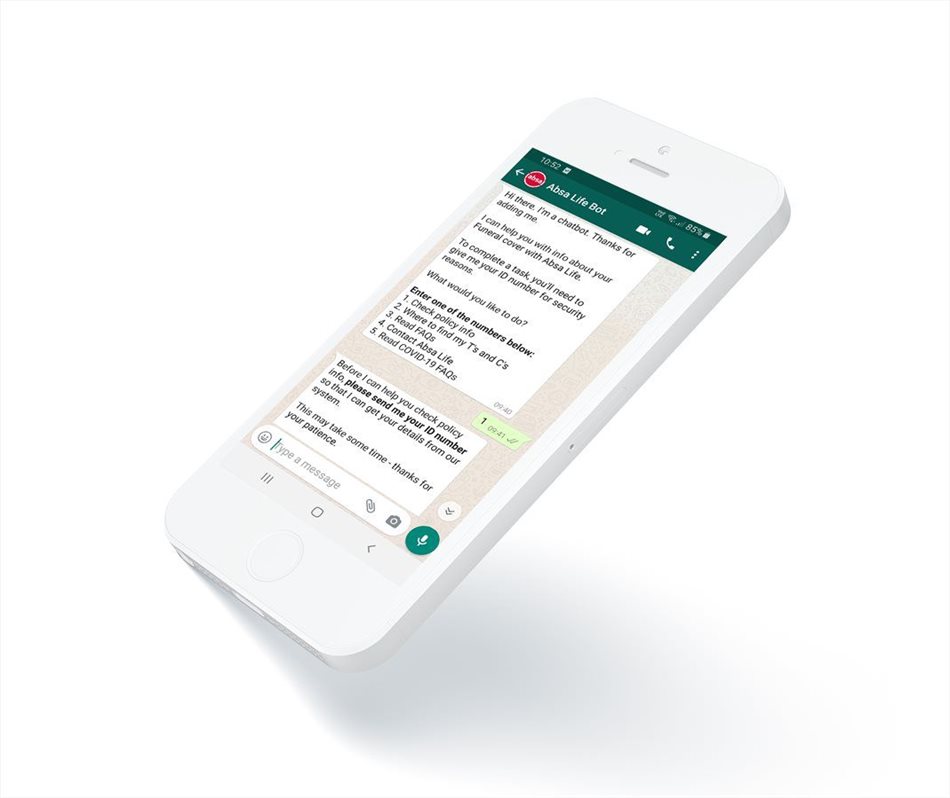

With the help of a WhatsApp chatbot, policyholders can now access basic policy information at any time of the day or night. Previously, in order to obtain information on an insurance policy, policyholders had no option but to contact call centres and talk to agents. Now, those agents are able to focus on cases that need the human touch, such as customers who are affected by the global pandemic or dealing with the traumatic experiences attached to funeral policies.

“In our constantly evolving industry, we need solutions that are dynamic and versatile yet relatable and cost effective for our broad client base. This bot achieves that. Our customers can access basic information such as their policy status, policy number and check debit order dates. Terms and conditions, answers to frequently asked questions and Covid-19 information are available via the platform too,” says Dushen Naidoo, managing executive for insurance at Absa Retail and Business Bank said.

A soft launch to customers took place in April. “Since launching this chatbot we have seen in excess of 16,000 people who have interacted on the platform. The technology is conformable and in future, we may see users applying for new policies on WhatsApp,” he added.

The perimeters of traditional commercial models are continuously tested as society’s foray into the digital age deepens. The latest innovation follows Absa’s trailblazing introduction of banking services via WhatsApp in 2018 as part of a digital banking strategy. This customer-first ethos saw Absa Life emerge with high scores in the South African Customer Satisfaction Index for Life Insurance (2019) published by Consulta recently.

“It is vital that we remain at the cusp of innovation for all our customers,” Naidoo said. In this novel approach to funeral insurance, the protection of customer information remains sacrosanct. User information is cross-checked when a customer launches the chatbot. No new software, apps or membership is required to access it.

Naidoo says: “There are no shortcuts in the digital era and as a bank embracing innovation, we turned to Praekelt, a company with a proven technology and innovation track record to partner with us.”

With over thousands of unique users within the first few days of launching, it is easy to see why WhatsApp has become such a popular platform for customer service. Not only is WhatsApp affordable and easy to access, but it is also already used by nine out of 10 South Africans.

The service is backed by Praekelt’s Feersum Engine, an AI-powered conversational platform that builds Intelligent Assistants with the ability to chat to millions of users in multiple local languages.

“In our line of business, we usually help either our clients’ customers or their employees,” says senior project manager at Praekelt, Maryna Ellis. “It’s very rare to find a solution that does both, and Absa Life’s WhatsApp bot has managed to do just that.”

While the first release of this service solves the most basic user needs, the future could see users applying for new policies with the click of an icon on their phones.

Praekelt’s Feersum Engine is an AI-powered conversational platform that builds Intelligent Assistants with the ability to chat to millions of users in multiple local languages. praekelt.com