Top stories

ESG & Sustainability#BudgetSpeech2026: SRD grant unchanged, other Sassa social grants see hike

10 hours

More news

ESG & Sustainability

South Africa’s carbon tax should stay: climate scientists explain why

Strong competition between banks for home loans continued in Q2 2022, with homebuyers benefiting from more accessible home loan finance at attractive interest rate discounts.

Rhys Dyer, CEO of ooba says “Continued low interest rates relative to historic trends and the banks’ continued willingness to lend at high loan-to-value ratios has principally supported home buying activity in Q2 2022.”

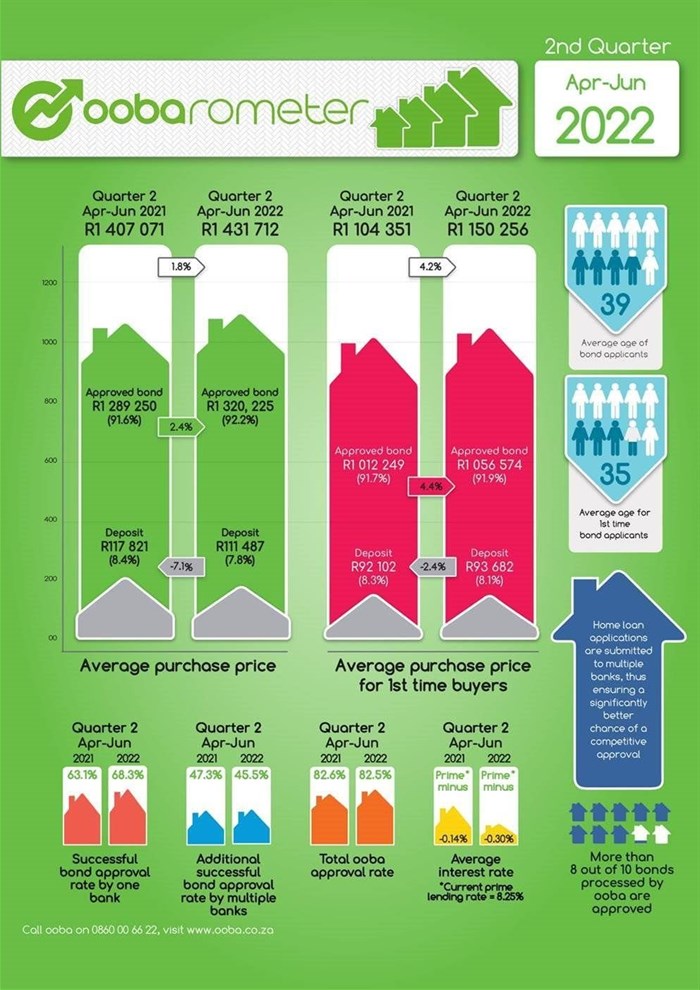

ooba’s average purchase price of R1,431,712 in Q2 2022 showed a lower than inflation rate growth of 1.8% on Q2 2021’s R1,407,071. Similarly showing lower than inflation growth, the first-time buyer’s average purchase price of R1,150,256 in Q2 2022 was 4.2% higher than Q2 2021’s average purchase price of R1,104,351. “This slowing in the growth of the average purchase price reflects consumers adjusting their buying patterns to the current interest rates and economic challenges.”

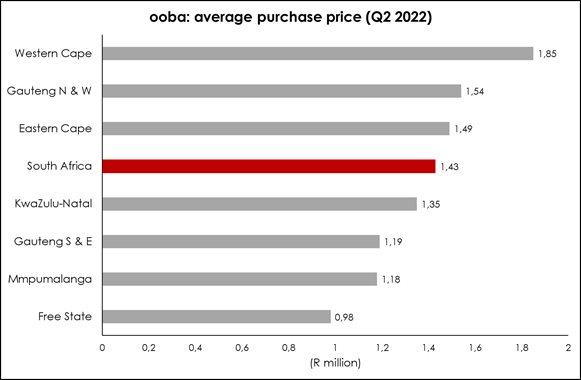

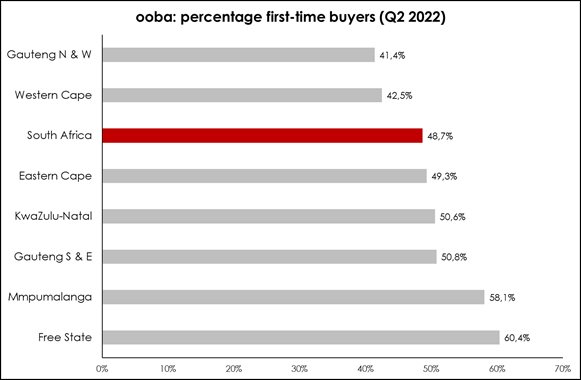

Across the regions, the Western Cape showed the highest average purchase price in the country at R1,851,740 in Q2 2022 (R420,028 higher than the national average purchase price), followed by Gauteng North and the West Rand (R1,535,848). The Free State reported the lowest average purchase price in the country at R981,493.

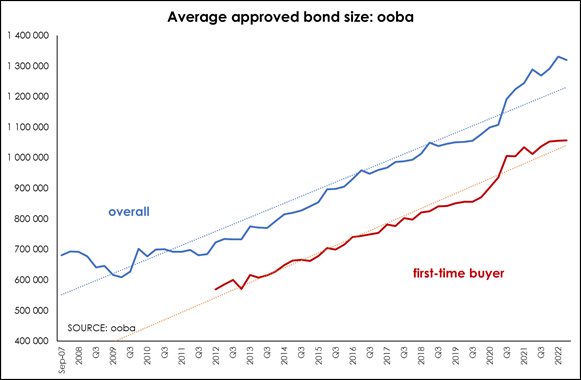

ooba’s Q2 2022 statistics show that the average approved bond size of R1,320,225 (up by 2.4% from Q2 2021), grew at a higher rate than that of the average purchase price, indicative of sturdy lending confidence. The average approved bond size for first-time buyers grew by 4.4% from R1,012,249 in Q2 2021 to R 1,056,574 in Q2 2022. The growth in the approved bond size dovetails with the trend in lower deposits.

Dyer adds that banks continue to respond well to zero deposit and cost-inclusive lending, particularly in the first-time homebuyer market segment. “Our Q2 2022 statistics show that 60% of our first-time homebuyer applications processed in Q2 2022 were from buyers who had no access to a deposit. The approval rate on these zero deposit applications in Q2 2022 was 80% - only marginally lower than Q2 2021’s approval rate of 81%.”

According to ooba’s latest statistics, the average deposit for Q2 2022 came in at 7.8% of the total purchase price - down from 8.4% in the same period for the previous year, however up from the 6.7% average deposit that was recorded in Q1 2022, potentially indicating a bottoming out of the historically low average deposit trend.

ooba achieved an approval rate of 82.5% on applications processed during Q2 2022, similar to Q2 2021’s 82.6%, indicating that banks’ approval rates remain steady. “Banks competing for home loan business is evident in the high ratio of applications declined by one lender but approved by another. 45.5% of applications initially rejected by one bank in Q2 2022 were subsequently approved by another bank,” says Dyer.

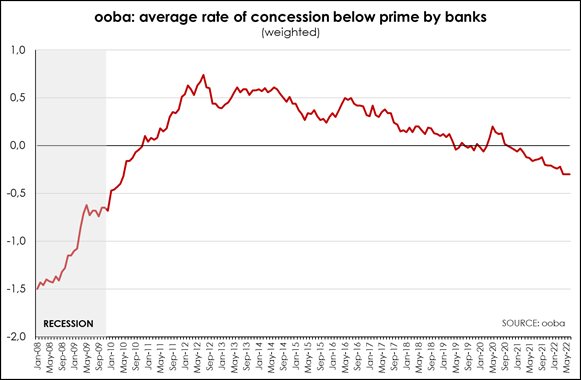

Banks are also continuing to compete on rates to attract new home loan business. Q2 2022’s statistics show that ooba achieved an average interest rate discount of prime less 0.30% - 16 basis points lower than Q2 2021’s prime less 0.14%.

Interest rate hikes during the quarter may not have decreased banks’ appetites for lending but they have had an impact on buyer behaviour – particularly among the first-time buyer demographic, who are sensitive to interest rate fluctuations. One of the ways in which banks are helping to ensure that home ownership remains affordable to a broad range of first-time homebuyers at a time of rising interest rates is the availability of 30-year mortgages. According to ooba, 26% of first-time buyers applied for a 30-year home loan in Q2 2022, compared to just 16% of first-time buyers in the same quarter a year earlier. “The easier repayment terms of a 30-year mortgage helps to cushion borrowers against higher instalment repayments in the current rising interest rate environment.”

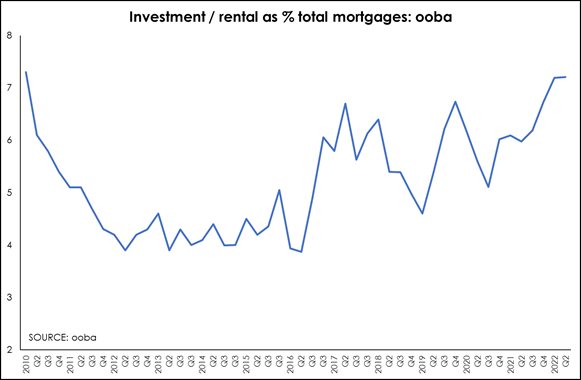

While the vast majority of bond applications processed by ooba in Q2 2022 were for a property that would serve as a main residence, there has been a marked increase in bond applications for investment and rental properties in recent months. “Overall, investment properties accounted for 7.21% of ooba’s applications in Q2 2022 – the highest percentage recorded since 2010,” adds Dyer.

17.6% of bond applications in the Western Cape in June 2022 were for investment properties - up from 16.5% in June 2021. In Gauteng North and West Rand, 10% of all applications in June and May were for investment properties, doubling the 5% achieved in April 2022. “The higher level of activity in the rental market and the still relatively low cost of borrowing is favouring the investor market segment where buy-to-let properties are being acquired at relatively less expensive prices.”

“Despite changing market conditions, we anticipate steady activity in the home buying market, largely driven by ongoing competition between the banks. Lending and pricing decisions can differ vastly from bank to bank, making it more important than ever to use a free home loan comparison service like ooba to shop around for the best deal on a home loan,” concludes Dyer.