Despite the decrease in Covid-19-related claims, Momentum Retail Life Insurance paid R6.18bn in 2022 claims, with a 31% decrease from the previous year.

One notable trend is the significant reduction in Covid-19 related death claims. In 2021, such claims accounted for 42% of total death claims, but in 2022 they dropped to 12%.

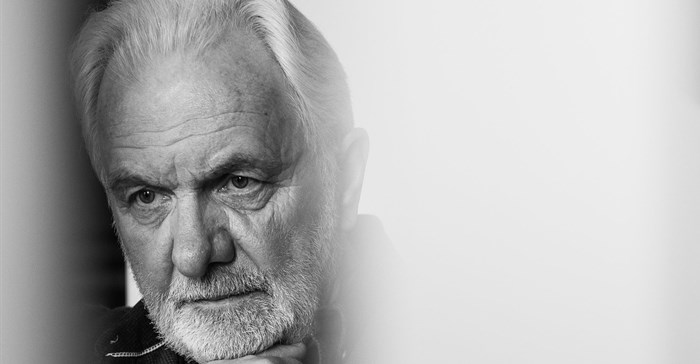

While Covid-19 death claims are declining, George Kolbe, head of Momentum Life Insurance marketing expressed concern over the rise in unnatural death claims.

Unnatural deaths, including motor-vehicle accidents, murder, suicide, and surgery-related deaths, increased by 11% compared to the previous year. Specifically, motor vehicle accident-related deaths increased by 17%, murder by 72% and deaths due to surgery by 63%. However, suicides decreased by 7%.

Notably, among claimants under the age of 30 years, 67% of unnatural deaths were attributed to motor vehicle accidents.

“Such a big increase in murder claims is concerning,” says Kolbe. “This could be a symptom of the unacceptably high murder rates in South Africa and, while our numbers come off a relatively low base, the increase is significant. Combine this with the high motor vehicle accident-related deaths and we see a great need for South Africans to become more vigilant and aware of their surroundings, for their own safety.”

In terms of overall death claims, cardiovascular events topped the list accounting for 31% of claims, followed by cancer at 23%. Covid-19 ranked as the third most common cause at 12%, followed by unnatural deaths at 11% and respiratory issues at 10%. Notably, Momentum found that 68% of death claims in 2022 were for men who also had a higher rate of unnatural deaths.

Persistent cancer claims prevail

Cancer was a leading cause for death, critical illness, disability and income-protection claims.

“Cancer continues to form the bulk of claims, so it is important to understand that nobody is immune to this disease. Prevention is the best cure, so statistics like these serve as an important reminder that we should take care of ourselves and adopt healthy lifestyles while young for the best possible outcomes.

Cardiovascular events and cancer consistently ranked among the top three causes of death claims making them significant contributors to mortality statistics. It was disappointing to see that for 70% of death claims caused by a critical illness, the insured lives had no critical-illness cover in place with Momentum. If only they had critical illness cover in place, it could have benefitted the claimants during their lifetime and may even have delayed or prevented their death because they could possibly have afforded superior care,” explained Kolbe.

Musculoskeletal claims also featured strongly across income protection, disability and critical illness claims. It was the most common cause for income protection claims at 24%, the second most common cause of lump sum disability claims at 18% and fourth for critical illness accounting for 7% of all claims. These claims typically involved severe and chronic neck and back pain, typically resulting from accidents causing physical harm to the body.

In terms of gender distribution across all benefit types, men accounted for the majority of claims, representing 62% of all claims.

A solid record of claims payment

Momentum Retail Life Insurance has a strong record of claim payments with 92.98% of claims submitted for all life-insurance benefits paid out in 2022. The remaining 7.02% of claims were denied due to exclusions, non-disclosure, suicide within the first two years, or failure to meet the definition of a valid claim. For mortality benefits only, claim payouts are in excess of 99%.

“We have a solid reputation of always looking for reasons to pay valid claims,” emphasised Kolbe. “We know that every claim represents a family that has lost a loved one or experienced the impact of illness or disability, and we are committed to doing everything we can to ease their financial burden during this difficult time.”

Kolbe said one thing remains certain, “Getting the right insurance cover in place is possibly the best thing anyone can do to protect their family’s financial future. Life is unpredictable but there is lots we can do from a health and safety perspective to tilt the odds in our favour.”