Related

#MiningIndaba: Harmony Gold's copper venture may take 2 years

Nqobile Dludla and Olivia Kumwenda-Mtambo 10 Feb 2026

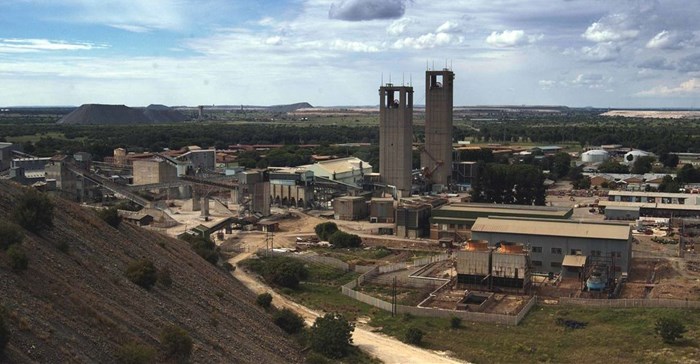

Harmony Gold diversifies with $1.75bn Australian copper project

Nqobile Dludla 25 Nov 2025

Patrice Motsepe announces Harmony Gold's "huge investment"

Colleen Goko and Nqobile Dludla 20 Nov 2025

Top stories

Marketing & MediaMoshoeshoe Monare appointed group head of Corporate Affairs at Primedia

Primedia Broadcasting 10 hours

Marketing & Media#BehindtheSelfie: Spitfire's Ying-Poi De Lacy on directing with purpose

Karabo Ledwaba 9 hours

AutomotiveFoton breaks into South Africa’s top commercial vehicle ranks in just over a year

Foton 2 days

More news

ESG & Sustainability

Innovations from Uganda and Tanzania selected for H&M’s Global Change Award 2026

ESG & Sustainability

In photos: How Cape Town is converting waste into electricity

Construction & Engineering

#BizTrends2026 | CESA's Chris Campbell: Reigniting progress in SA's infrastructure journey

Construction & Engineering

#BizTrends2026 | TPN Credit Bureau's Waldo Marcus: Resilience over expansion wins the day