South Africa's economic fate now lies in its own hands after Standard & Poor's (S&P) left the country's investment largely unchanged last week.

Together with Moody's and Fitch, these decisions must therefore be seen as friendly warnings, rather than as reprieves, about what South Africa is seen to be doing and implementing over the next few months. Although the S&P assessment also recognises the changes and improvements made so far in certain areas of policy, the reality is that the economy remains on the cusp of junk status. South Africa is still at only one notch above junk in both S&P and Fitch assessments. The country needs to break this mould sooner, rather than later, by implementing polices which put it on a much higher growth trajectory.

Source: NWU

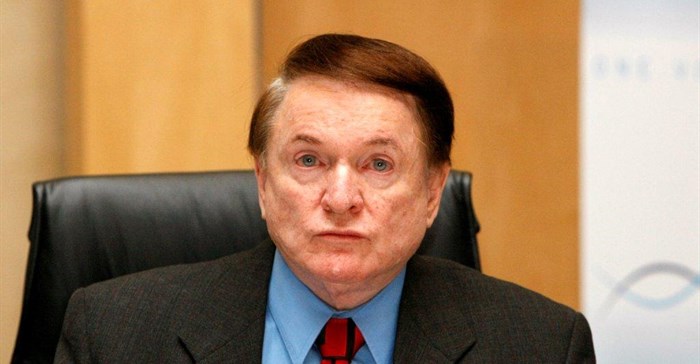

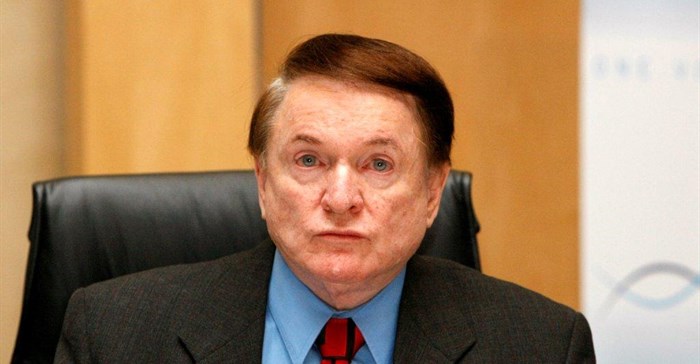

“The good news from S&P’s latest decision on South Africa’s investment rating clinches the extra period now granted for us to get our house in order by all three the Credit rating agencies... But this time must be used wisely”, says North-West University’s school,of business and governance economist, Professor Raymond Parsons.

Although S&P lowered the local currency rating, it still remains above junk status. But the underlying strong and converging messages of the three rating agencies should still be taken very seriously by decision makers in both the public and private sectors. The three rating agencies now all reflect negative outlooks.

In the next few months the burgeoning collaboration between government, business and labour must therefore begin yield further tangible results which are aimed at improving growth prospects, as well as staving off future investor downgrades.

Investor confidence remains a key requirement to underpin growth and job creation, and to avoid a low-growth trap. “SA now has the opportunity to make 2017 a crucial year in which turn the economy around and to push the growth rate above 1% in 2017, and perhaps even to 2% by 2018,” Parsons says.

To unlock its true economic potential, South Africa must boost long-term investor confidence by progressively building on its strengths and urgently addressing or eliminating its persistent weaknesses. The invasive and corrosive political and policy uncertainty which presently adversely affects economic performance must be reduced to the point at which South Africa will welcome, rather than fear, future credit rating economic assessments, he concludes.