Top stories

Marketing & MediaAds are coming to AI. Does that really have to be such a bad thing?

Ilayaraja Subramanian 20 hours

More news

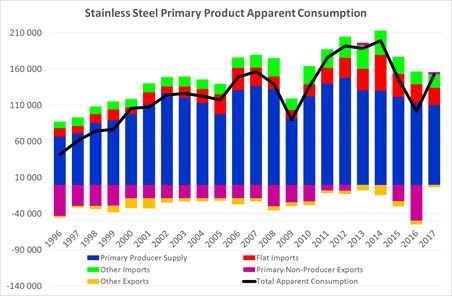

This has been caused by a flood of Asian imports, mainly from China, a drop in exports of finished products and the resultant huge decrease in the conversion of primary to finished products, he said. “Our declining apparent consumption is a concern. Prior to 2015, our figures mirrored what was going on in the rest of the world, whereas now we’re deviating from the global trend.”

Looking at the value and output of the local market, Tarboton explained that apparent consumption last year was just over 130,000 tonnes in terms of primary product which represents a value of R4.6bn if you assume an average cost of $35,000 a tonne. The conversion of that product - costed at twice that of primary product value - equals an additional R9.2bn, which results in the total value of the local stainless industry of close to R15bn.

In terms of physical output, the national average is currently four tonnes per worker a year, which based on apparent consumption figures, means approximately 32,000 people are employed in the conversion of stainless steel primary products to finished products.

Overall, the statistics show that the stainless steel market continues to contract in 2017. The forecast is showing zero primary, non-producer exports and so apparent consumption may return closer to primary supply into the market. (Primary supply minus primary exports equals apparent consumption.) At present, the forecast shows similar primary supply for 2017 as 2016.

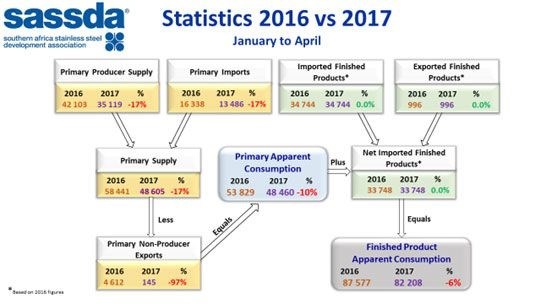

Looking at the first four months of this year compared to last year (January - April 2016 vs. January - April 2017), the primary supply of stainless steel is down by 17%, leading to apparent consumption having declined by 10%. Tarboton explained that, “The reasons for the supply of product into the market declining is due to a lack of demand in the local market, reflecting our current grindingly tough economic conditions.”

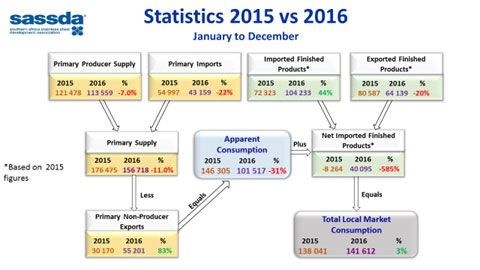

A longer term comparison of 2015 vs. 2016 reveals that primary supply (produced locally + imports) which includes: sheet, coil and plate stainless steel - dropped by 11% in 2016 or 20,000 tonnes and unfortunately, the apparent consumption figure - which is the amount of stainless steel expected to be converted to a finished product - declined by 31% in 2016, probably due to destocking of primary products and the reversal of finished products trade balance.

Imported finished products surged with an increase of 44%. This is supported by anecdotal evidence and feedback from the sassda member survey and is largely due to a flood of imported product, primarily Chinese. In comparison, the export of finished products dropped by 20%, which is the opposite of previous years. Stated Tarboton: “So, whereas in 2015 we were a net exporter of stainless steel finished products and exported 8,000 tonnes more than we imported, we now import 40,000 tonnes of stainless steel finished products more than we exported and therefore run a trade deficit on stainless steel finished products.”

Tarboton also reported back at the sassda AGM on his recent attendance at the annual International Stainless Steel Forum AGM and associated meetings in Tokyo. “The general view was that the economic climate has resulted in an improved outlook for stainless steel. This is because since late 2016, the commodity crisis may have reached its worst point and may have turned a corner, which means we could start to see an improvement, particularly in mining investments, something that our market is seeing glimpses of.”

For 2016, the ISSF reported that the global growth rate of the stainless steel market was at just over 10%. Virtually all that growth occurred in China which in 2001 had virtually zero share of global production as compared to 2016, where it now commands 54%. “I had hoped that after 2014 that that would start plateauing to just over 50%, but it has started to increase again towards the 60% level, so this is a concern to our stainless steel industry,” commented Tarboton.

He added: “Fortunately, forecasts for the rest of the world are looking better. Our region is predicted to grow at 1.2% in 2017 and 1.6% in 2018, which represents a more optimistic outlook than has been the case for the last nine years.”