Top stories

LifestyleWhen to stop Googling and call the vet: Expert advice on pet allergies from dotsure.co.za

dotsure.co.za 2 days

More news

Estimates from the South African Sugar Association (SASA) also indicate that the revenue lost since the implementation of the sugar tax is approximately R1.3bn. The 5.2% increase in the sugar tax announced in February 2019 is expected to further exacerbate this problem.

While it is difficult to quantify the impact of imports and the sugar tax on employment, the South African Cane Growers Association estimates that the sugar tax is likely to lead to approximately 10 000 people losing their jobs in the primary level of the sugar value chain. This figure is conservative as it does not include the impact on job losses in the milling and beverage industries. It is worth noting that the sugar industry employs approximately 350 000 people.

Recent monthly trade data from the South African Revenue Services (SARS) indicate that sugar imports from India have increased substantially in recent months. The Indian government offers its sugar producers a USD150/tonne rebate or subsidy on sugar exports. This unfair practice or dumping, makes the Indian sugar competitive in the global market thus depressing global prices. This unfair practice has prompted Brazil (the world’s largest sugar producer) and Australia to bring a formal dispute complaint against India at the World Trade Organisation (WTO).

The adoption of the sugar tax is also affecting the profitability of the local industry and industry sources indicate that the implementation of the sugar tax in April 2018 has led to local food manufacturers using less sugar. Data from South African Sugar Association (SASA) indicate that domestic sales of sugar decreased by 83.5% to 293 397 tonnes in the 2018/19 season from 538 354 tonnes the previous season as beverage manufacturers opted for chemical sweeteners as a result of sugar tax-induced a rise in domestic sugar prices.

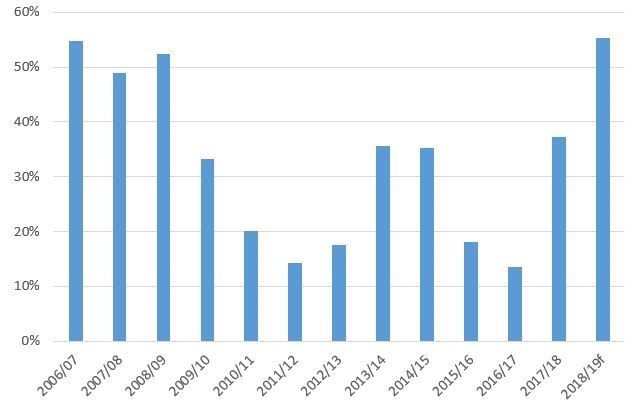

A closer look at South Africa’s export data shows that in the 2017/18 season sugar exports increased by 54.5% to 1.2 million tonnes. As shown in Figure 1 below, the proportion of South Africa’s exports to domestic production increased from 13.6% in the 2016/17 season to 37.3% in the 2017/18 season.

Should the South African government not take further steps to protect the local market; the domestic market will come under renewed pressure from sugar imports from India. The industry has called for the tariff to be increased from R4 500/tonne to approximately R7,000/tonne.

The increasing imports and the sugar tax are the main downside risks for the profitability of the sector in the short to medium term. These risks can be mitigated by adequate protection through tariffs and investing on alternative uses of sugarcane such as ethanol production. The global sugar market is distorted by production and export subsidies which create an oversupply of sugar. In addition, almost all countries have tariff protection which protects their domestic sugar industries.