Top stories

AutomotiveHilux Custom Builds offers purpose-built solutions for your business

Toyota South Africa Motors 16 Feb 2026

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

New vehicle sales in January 2016 were sitting at 34,936 units, reflecting a decline in sales of 2,272 cars (6.1%) when compared to the 37,208 new cars sold in January 2015.

The car rental industry accounted for 24.6% of new car sales during this period, a substantial contribution to overall new sales figures for kick starting 2016. This large amount of new vehicle purchases could owe to the fact that car rental companies are needing to upgrade their fleet and discard older vehicle models, or a boom in business where they need additional cars to meet the demand of passengers travelling around the country.

Domestically, a number of key indicators, including the Purchasing Managers’ Index (PMI) and the Reserve Banks’ leading indicator, suggested that the South African economy would experience a difficult year.

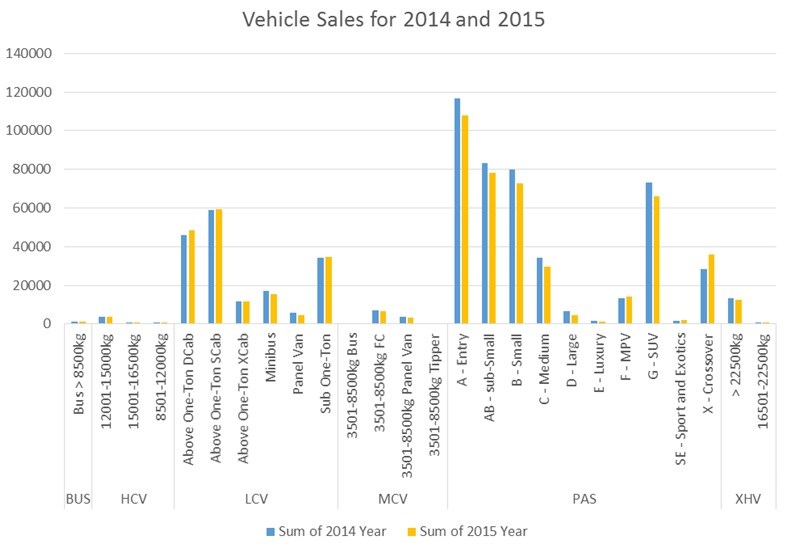

When looking at domestic sales of new vehicles between 2014 and 2015, the data shows an increase in sales of double cab and single cab LCVs; a decline in sales of minibuses and panel vans; a substantial decline in the sale of SUVs; and a substantial increase in the sale of sport and exotic vehicles.

In light of poor economic growth prospects with GDP growth estimated at 0.5% at best and given the likelihood of well above inflation new vehicle price increases as well as prospects of further interest rate hikes - the outlook for 2016 in terms of domestic new vehicle sales had deteriorated and had been reviewed downwards.

At this stage the consumer demand sensitive new car market is anticipated to decline by around 9% in volume terms to about 375,000 units in 2016, down from the 412,826 new cars sold in 2015. New commercial vehicle sales were expected to perform slightly better with declines of between 3% and 5% expected in volume terms.

When it comes to export sales of new motor vehicles, we have seen a major year on year decline owing to logistics and shipment capacity constraints. The January 2016 export sales of 13,057 units reflected an unexpectedly large decline of 3,652 vehicles (21.9%) compared to the 16,709 vehicles exported in January last year.

That said, the industry expects a substantial increase in new vehicle exports to materialise from March 2016 onwards, and at this stage industry projections for exports during 2016 show an improvement of around 40,000 vehicles (or 12%) to an anticipated 375,000 export units - which is some kind of a light at the end of the tunnel.