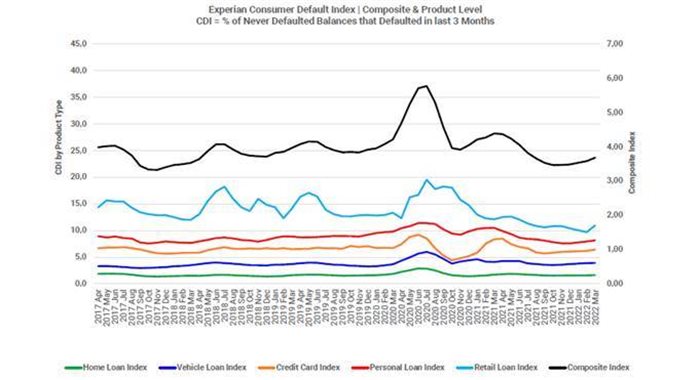

The rate people defaulted on their loans for the first time increased in the first quarter of 2022, according to Experian South Africa's Consumer Default Index (CDI).

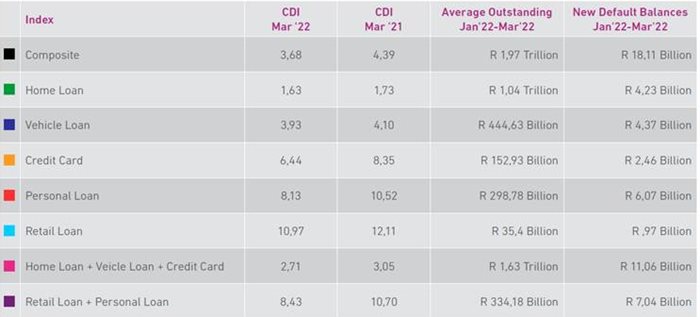

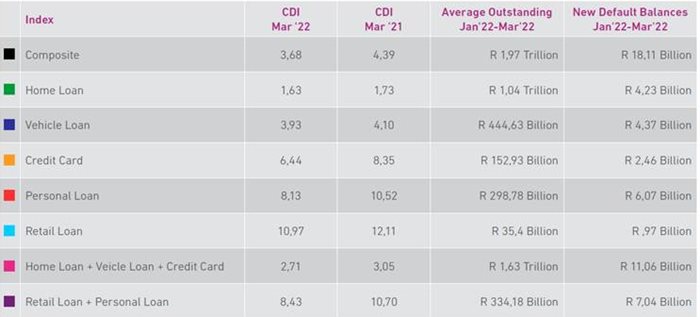

The CDI increased quarter-on-quarter, moving from 3.49 in 2021 Q4 to 3.68 in 2022 Q1. Year-on-year, however, an improvement was observed, moving from 4.39 in 2021 Q1 down to 3.68 in 2022 Q1.

The year-on-year improvement was observed across all products, with the most significant improvement for unsecured credit products.

Relatively speaking, the improvements observed for credit card and personal loans were the most significant, with both of these products showing a relative improvement in CDI of almost 23%.

However, consumers are cautioned against reading too much into the year-on-year improvements which can be attributed to the tail end of reduced credit lending by credit providers and spend by consumers due to the impact of Covid lockdowns experienced in 2021.

What is of concern is the quarter-on-quarter increase observed across all products, predominantly caused by the turmoil in Ukraine. The impact of the rapidly rising fuel-, gas- and grain costs, which are significant contributors to the global rise in inflation, is starting to have a direct impact on consumers across all products.

For the first time in almost 18 months, the Retail CDI saw a deterioration on a quarter-on-quarter basis, moving from 10.41 in Q4 2021 to 10.97 in Q1 2022.

Source: Supplied.

The decline in Q1 2022 indicates that consumers are becoming increasingly exposed to the rising cost of living. Additionally, interest rates are expected to increase more rapidly and frequently than before to manage the inflationary pressures. As a result, consumers across all segments of the market will be exposed to higher cost of living and increased instalments on credit – in many cases.

Financial Affluent Segments (FAS) most affected

Source: Supplied.

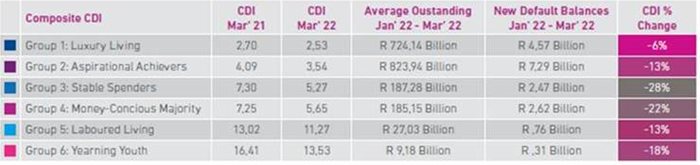

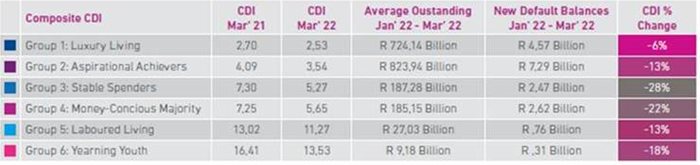

While on a year-on-year basis a similar improving trend in CDI is visible across all consumer segments, the quarter-on-quarter trends are vastly different with early signs of distress clearly visible.

The most affluent consumer group, the luxury living segment, represents the upper crust of South African society which is highly exposed to secured credit and is typically deemed to be the least risky consumer segment.

Consumers in luxury living have a large exposure to secure lending products with an average opening home-loan balance in excess of R1.2m (54% owning one home, and 25% owning multiple properties) and an average opening vehicle-loan balance greater than R450k.

Although this group showed improvement from 2.70 to 2.53 on a year-on-year basis, the relative improvement only came to 6%. On a quarter-on-quarter basis however, the CDI shows a reverse trend with a 12.4% deterioration from 2.25 to 2.53, due to the impact of rising cost of living and interest-rate increases starting to impact consumers in this segment.

Similarly, on the opposite side of the consumer segmentation scale, the relative year-on-year improvement in CDI is more pronounced for less affluent groups like Group 3 – Stable Spenders and Group 4 – Money-Conscious Majority at 28% and 22% respectively.

The Stable Spenders, which make up about 7% of the South African population, saw the greatest relative CDI improvement from 7.30 in 2021 in Q4 to 5.27 in 2022 Q1 (28% relative CDI change).

This group is made up of consumers who are mostly young and middle-aged adults, who live from month-to-month and require credit to make ends meet.

Their exposure to secured credit is very limited, with only about 10% owning a home. Exposure to unsecured credit – particularly pay-day loans and retail loans, is more substantial and is used by these consumers to afford certain necessities.

Again, when looking at the quarter-on-quarter trends for this segment, the opposite can be seen as the higher cost of living has a more pronounced impact on this segment. The quarter-on-quarter CDI shows a deterioration from 5.23 in 2021 in Q4 to 5.27 in Q1, with this trend expected to continue into the coming months.

Source: Supplied.

“It is unfortunate that we are not able to reap the rewards of the improved consumer debt performance observed over the past two years on the back of a more stringent lending and spending environment predominantly caused by Covid.

Just as the South African consumer came out the Covid lockdown phase with new capacity to spend on the back of better credit standing and more liberal lending practices reintroduced by credit providers, the turmoil in Ukraine and consequential global inflationary effect thereof again applies pressures on consumers across all financial affluence segments.

We expect the CDI trend to continue deteriorating as interest-rate increases take effect and advise consumers to manage their budgets carefully through this challenging time,” concludes van Jaarsveldt.