Top stories

More news

Marketing & Media

Ads are coming to AI. Does that really have to be such a bad thing?

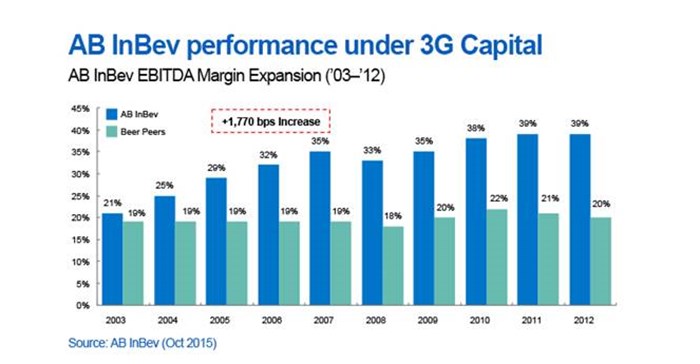

AB InBev's proposal has been the source of much speculation for over two years. With the backing of the 3G founders, the private equity giant AB InBev is a master at corporate deals in the beverage space. Looking back at AB InBev's deal history it is clear this is something AB InBev has done well.

In 2004 Interbrew and AmBev merged and in 2008 InBev and Anheuser-Busch merged. Both mergers were very successful and enabled the business to gear up, extract significant cost synergies - and add significant value to shareholders. Cash extraction has also been exceptional and, combined with the cash generative nature of the industry, has again positioned AB InBev to look further afield as they entered 2015.

SAB has itself become more efficient (it has been paying down debt post the Foster's deal) and is now in a relatively under-geared position. In a world of exceptionally low interest rates it was thus only a matter of time before further consolidation occurred.

While the beer category globally has seen slower growth in relatively mature markets, there is still the benefit of scale. There is also growth in emerging markets. From an investor's point of view the most attractive aspects of SAB's business are three fold: Firstly, SAB is significantly exposed to growth/emerging markets, typically where per capita beer consumption is below 30.

Secondly, SAB has a significant portion of its business in relatively less competitive markets. This allows SAB to shape the development of the market, achieve economies of scale and generally have high margins and high cash conversion. And, thirdly, there is a fair degree of strategic optionality embedded within SAB (the Castel JV in Africa, the Molson Coors JV, CR Enterprise and Anadolu Efes).

SAB's share price prior to the announced deal was also suffering from a series of short-term earnings down-grades, almost exclusively due to significant weakness in emerging market currencies, as SAB reports primarily in dollars. AB InBev is therefore being somewhat opportunistic in the timing of this deal in that the short-term valuation looks stretched. It's the long-term attractiveness of the business that will play into AB InBev's hands once the deal is concluded. There are of course still a number of regulatory hurdles to overcome but we expect these will be managed and compromises made along the way.

Each individual investor has his or her own history as an SAB shareholder. The business has been listed on the JSE since 1898 - so this is not a decision to take lightly. We were comforted by assurances by the AB InBev management that the combined business would seek a secondary listing on the JSE. If one were to sell and deploy the cash elsewhere there could be capital gains tax to pay.

The share option - should investors choose that route for a portion of their shareholding - was priced at an effective SAB price of £39.03 (an effective 12.7% discount to the cash offer). The partial share alternative is in reality only meant for the two strategic shareholders in SAB, the Santo Domingo family and Altria, as both would avoid capital gains and benefit from the integration, while potentially still having board representation. This is probably the best option for shareholders with a long-term mind set.

The unfortunate situation is that AB InBev needs to fund the deal predominantly with debt, as this is likely to be at relatively low interest rates, while the equity portion is relatively much more expensive. Once the equity proportion becomes too large the deal becomes less attractive and less likely to generate AB InBev's required returns.

The share alternative is in the form of an unlisted structure for five years, which will preclude many investors from going the equity route. With the equity component limited to 41% and largely designed for the two strategic SAB shareholders, any further equity uptake by other shareholders is likely to be cut back.

While the initial cash offer is priced at a premium, the reality is that this could very well be at a discount to the alternative share offer. That is because there is a fair amount of time to pass before the deal will be concluded. AB InBev will provide more information to its shareholders on the relative merits of the deal - and the operating environment, as well as the outlook for emerging markets, could improve over the next 6 to 12 months.

Our preference at Sanlam Investment Management would be to take the alternative share offer. You do face the risk of the deal not going through, but we think on balance the deal will go ahead. AB InBev has an exceptional track record and you benefit from the joint business and growth characteristics of the combined group. This would require you to remain invested for a minimum of five years, but in a world of lower returns and stretched valuations that might not be a bad thing.