The future looks bleak. EPA

Oil consumption in Venezuela fell 37% in five years up to 2017, a reminder that the country was struggling under the Maduro administration long before the latest sanctions, which came after opposition leader Juan Guaidó announced himself the country’s rightful president in January. Unfortunately, the oil decline is not an environmental achievement but a worrying symptom of Venezuela’s economic conditions – GDP is expected to have fallen 50% between 2015 and 2019.

In a country where economic data is scarce, different oil products can be used as proxies for different kinds of economic activity. Venezuela’s oil and fuel oil export numbers give insights into the country’s incoming cash flow from abroad, for instance, while diesel consumption is a partial indicator for transport, industry and the power sector. Gasoline is a proxy for transport activity as well.

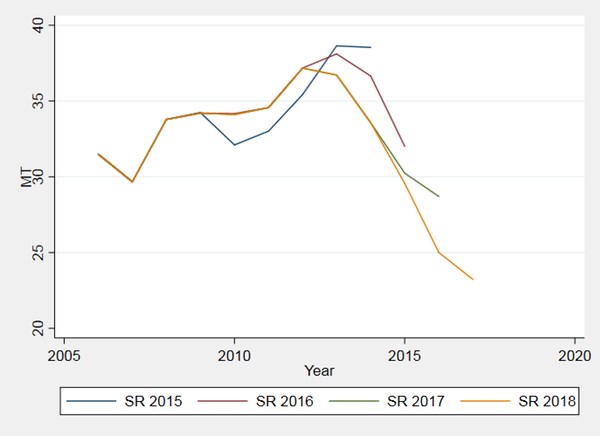

Diesel consumption declined by 11% on average each year in 2013-17, and gasoline shows a similar pattern with an average annual decline of 7% or by 27% over the same five-year period. Together, the two fuels account for approximately 70% of total oil demand in the country. From the graphic below, you can see that the collapse in oil consumption and GDP are staggeringly similar.

ppp = purchasing power parity; MT = millions of tonnes; GDP from IMF. BP Statistical Review 2018

This is not to say that the oil consumption estimates from the likes of BP are anywhere near perfect. Multiple Venezuelan official energy statistics ceased to be published between 2012 and 2015, leaving experts to build the best possible estimates from multiple sources.

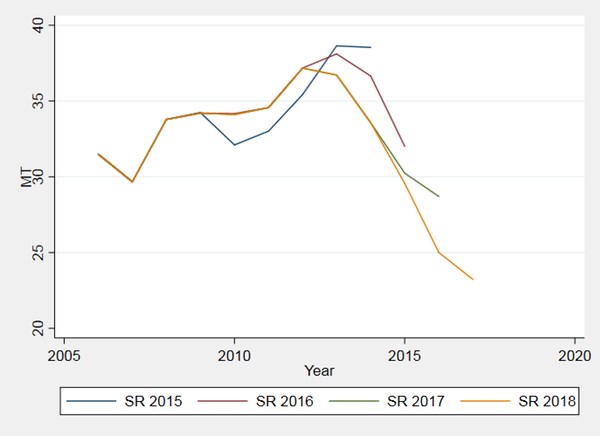

BP figures for total oil consumption have been consistently revised downwards every year in recent history, as reality always punches below expectations. You can see this in the following graph, where each coloured line represents a different year of the BP Statistical Review and the estimates included for Venezuelan oil consumption: the yellow line represents the 2018 edition, whose numbers are mostly lower than the estimates in previous years’ editions.

SR = BP Statistical Review of World Energy; MT = millions of tonnes. BP Statistical Reviews 2015-18

The view from the ground

People are not driving around anymore in Venezuela. To make things worse, 90% of buses were reportedly out of action by mid-2018. This is a society that just doesn’t go out for work or travel. Businesses are also using less transportation, since they produce fewer goods than they used to – including food. The last implication is terrifying, and can easily be missed when solely looking at numbers. It is possible to survive without a car, but not without food. A litre of milk can now easily cost a tenth of a monthly salary.

Energy prices have been severely distorted by a combination of explosive inflation and heavy fuel subsidies. By mid-2018, you could buy 3.5m litres of gasoline for a single US dollar, but could barely buy any basic food item. Yet even if you have enough money to fill up your tank, it is increasingly difficult to find fuel – and the cost of spare parts is exorbitant.

The future of oil output looks equally bleak. Production is quickly collapsing, with refineries only running at an incredibly low 22% of capacity. The power system is actually taking a double hit: the part that depends on fossil fuels in the form of natural gas, diesel and some fuel oil is crumbling while the part driven by hydropower is being undermined by very low rainfall caused by changing climate patterns. The net result has been thousands of power failures. A dry year could aggravate things further, requiring extra fossil fuels that the country is incapable of producing or affording.

Read more:Venezuela: US sanctions hurt, but the economic crisis is home grownAs the sanctions continue to bite and hyperinflation rages on, Venezuela’s oil consumption decline looks set to reach levels last seen in the 1990s. The country began rationing gasoline in February, and is now in the awkward position of importing refined fuels from Russia, India and Spain at “horrifying” premiums, according to an executive of PDVSA. One consequence of the sanctions is that they have affected Venezuela’s ability to transport heavy oil from its own oil fields, since this is made easier by adding diluting agents that are often imported from the

The perfect storm of sanctions, inflation, production problems and climate change risks to power supply leaves us wondering how long it might take before the energy system comes to a total halt. As new oil statistics are published in the coming months, everyone from energy analysts to Washington policy hawks will be poring over them to try and understand where the country goes from here.

This article is republished from The Conversation under a Creative Commons license. Read the original article.