Top stories

Marketing & MediaAds are coming to AI. Does that really have to be such a bad thing?

Ilayaraja Subramanian 12 hours

More news

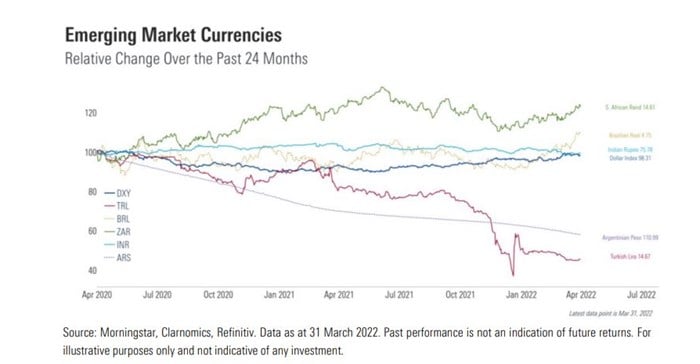

On the South African front, the local equity market and the rand have been incredibly resilient.

The FTSE/JSE All Share Index is up around +2% year-to-date (as at 28 March 2022) and the rand has strengthened by roughly 9% against the US dollar since the start of 2022.

Across the globe, inflation and interest rates are heading one way and that is up. With ongoing global uncertainty and volatility, South African investors are left wondering what the implication of this global turmoil could be on their investments locally.

While it is too early to say with certainty how Russia's invasion of Ukraine will impact the South African market in the long term, certain short-term economic factors are evident.

Russia is a key global oil and gas producer. Potential energy-supply disruptions in Russia and Ukraine (due to the current conflict), combined with sanctions and boycotts against Russia have caused the price of energy and commodities (namely oil and gas) to soar. The price of crude has increased by close to 30% in the past month alone (albeit including a lot of volatility along the way).

Russia and Ukraine are two of the world's biggest exporters of wheat and with shipments from these big growing areas coming to a virtual standstill (creating supply and demand mismatches), it has led to wheat prices increasing by close to 50% over the past month and reaching its highest level in 14 years. Let’s not forget that Russia is also a key supplier of metals.

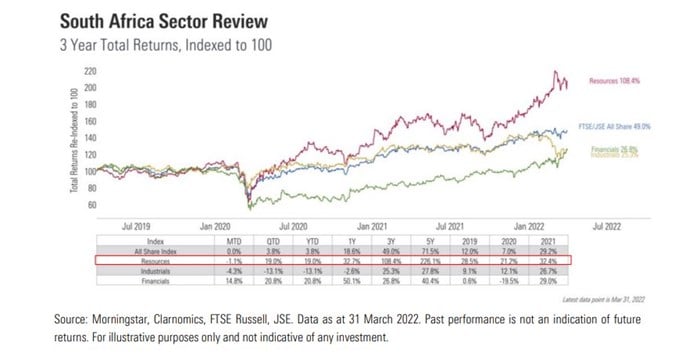

The rise in commodity prices has impacted our local commodity counters and the SA Resources sector has been a beneficiary of these higher prices. As can be seen in the below table, the Resources sector is up by +19% on a year-to-date basis.

The negative impact that the war in Ukraine is having on global supply chains, food production and fuel prices will inevitably put upward pressure on inflation in many countries, including South Africa. Given that adjusting the repo rate is one of the only mechanisms the South African Reserve Bank (SARB) has to curb inflation, we could continue to see an increase in interest rates in the near term.

Favourable terms of trade have been the main reason why the rand has been so strong, and a large part of the volatility of our currency is a result of commodity price volatility. Over the past few weeks, we have seen a sharp rise in commodity prices of which South Africa has been a beneficiary. It is, however, important to note that soaring prices for the commodities that South Africa exports (coal, platinum and palladium) will be weighed against the surge in the price of oil, which is imported.

With a rise in oil and food prices, and the potential for more interest-rate hikes in the near term given higher inflation, there is a downside risk for the consumer.

As we have seen recently, the Reserve Bank’s Monetary Policy Committee (MPC) will look at hiking interest rates when inflation expectations breach the upper end of the inflation target band. How aggressively they hike interest rates will be dependent on the inflation drivers and economic growth prospects.

The yield on money market funds will increase in line with the hikes. We could see some negative returns in the bond market as yields increase to accommodate the expected hikes and inflation increases. Long duration bonds will be affected more than short-duration assets due to their higher interest-rate sensitivity.

There is no guarantee that a rate hike will negatively impact equity markets, however, historically the less expensive/value areas of the market tend to outperform the growth areas of the market in a rising interest-rate environment. Typically, rising interest rates occur during periods of economic strength. In this scenario, increased rates often coincide with a bull market.

With other borrowing, like home loans, credit cards, personal loans or car loans, the interest rate on these debts may rise too, which will impact the consumer. This could lead to lower disposable income growth coupled with a lower capacity to spend by consumers which, in turn, could put downward pressure on the overall GDP growth of South Africa.

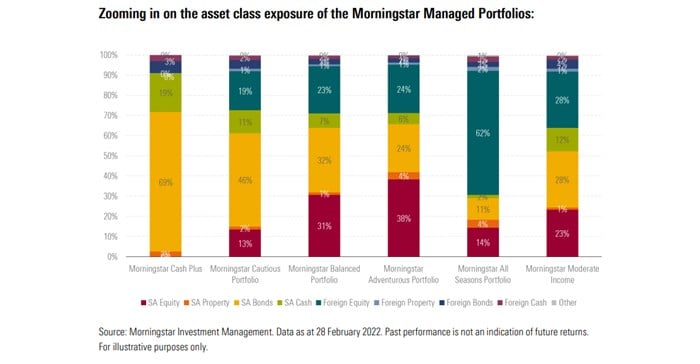

Given the current market backdrop, there is a lot of uncertainty that investors face both in local and global markets. The most powerful protection against market volatility and uncertainty is diversification within portfolios. The Morningstar Managed Portfolios have been constructed to ensure exposure to areas of high conviction while maintaining diversification across different regions, sectors and asset classes.

When constructing portfolios, it is important to understand the risks of each asset type and create a portfolio of uncorrelated investments that have different return drivers. The next important course of action is to “press on regardless”.

Over decades of evidence and through the investment literature there is one golden thread – time in the market remains superior to timing the market.